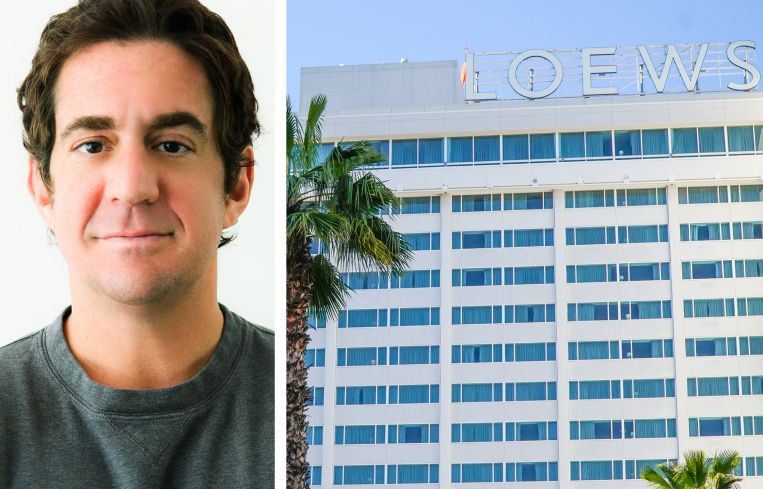

Loews, Metlife List Hollywood Hotel for $40M Discount

By Nick Trombola August 16, 2024 2:35 pm

reprints

Unfortunately, it appears there’s no more room at the Hotel California.

Loews Hotels and MetLife Investment Management have listed the Loews Hollywood Hotel for sale at $125 million, roughly $40 million less what Loews paid for it in 2012.

Loews acquired the 20-story, 625-key hotel, then called the Renaissance Hollywood Hotel, from CIM Group for about $165 million 12 years ago, property records show. Metlife currently has a 50 percent stake in the hotel after forming a joint venture with Loews in late 2012. The JV had planned a $26 million renovation of the hotel, though it’s unclear if any of that project came to fruition.

Loews and Metlife in 2021 snagged a $91 million refinancing package from alternative investment firm Värde Partners, replacing a loan from HSBC, which was later bundled into a collateralized loan obligation agreement, per The Real Deal, which broke the news of the sale listing.

The JV is pitching the hotel listing as either an opportunity for a new brand to take over its operations or as a potential redevelopment project, per TRD. Eastdil Secured is the listing agency.

Representatives for Loews did not immediately respond to requests for comment. A spokesperson for Metlife declined to comment.

The JV is listing the Hollywood hotel for a hefty discount, but deals for other hotels in Southern California lately have gone in the other direction.

Dune Drifter, a new hospitality firm with ties to the Marriott family, earlier this month acquired the Pacific Edge Hotel in Laguna Beach for $80 million, or nearly $23 million more than what sellers Highgate and Morgan Stanley paid for it in 2017.

Meanwhile, the Hilton La Jolla Torrey Pines, about 15 miles north of Downtown San Diego, was picked up by JRK Property Holdings in July for $165 million. Seller Braemar Hotels & Resorts bought the hotel as part of an eight-property portfolio in 2013 for an undisclosed price, but the property was last sold as an individual asset for $106.5 million in 2003.

Nick Trombola can be reached at ntrombola@commercialobserver.com.