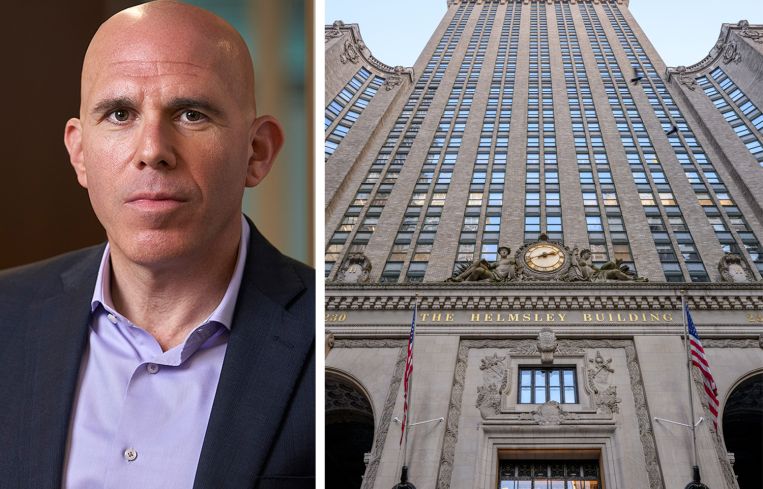

RXR Explores Converting Helmsley Building After Default of $670M Loan

By Andrew Coen July 16, 2024 1:39 pm

reprints

RXR could undertake a conversion play for the iconic Helmsley Building.

The commercial real estate owner led by CEO Scott Rechler is studying the feasibility of conversion options for a portion of the 34-story office tower at 230 Park Avenue, nine months after a $670 million loan backing the property entered special servicing due to “an imminent maturity default,” according to commentary provided by Morningstar.

“Borrower is exploring a change in optimal use for a portion of the building, which could significantly impact value,” the commentary said. “An additional 90-day forbearance to allow further investigation into conversion plausibility has been approved and is being documented.”

The Real Deal was first to report that RXR was examining conversion possibilities for the Helmsley Building. RXR declined to comment on the special servicer report.

The special servicer commentary does not mention specific plans on what RXR would turn the Helmsley Building into, but more than 60 New York City office owners were exploring conversions to residential usage as of May, according to Department of City Planning data.

RXR’s potential conversion comes after New York Gov. Kathy Hochul signed legislation in April to allow 35-year tax abatements for office-to-residential conversions, which could cut 90 percent of the tax bills for conversions for buildings south of 96th Street in Manhattan.

Rechler previously told Commercial Observer that the legislation would help quicken the pace of office-to-residential conversion projects in the city and had RXR considering more.

“The conversion piece hit right in terms of enabling people to do it and do it quickly,” Rechler said. “It gave an incentive to get it done before 2026, so people are moving at a faster pace right now.”

In November, RXR said it was in discussions with lenders about restructuring the floating-rate commercial mortgage-backed securities (CMBS) loan tied to the Helmsley Building.

The RXR loan on the Helmsley Building is part of the Morgan Stanley Capital I Trust 2021-230P single asset, single borrower CMBS deal that totals $795 million. A $670 million portion of the CMBS transaction was secured by RXR’s fee interest in the property while Morgan Stanley Mortgage Capital Holdings originated $125 million in debt.

The 1.39 million-square-foot office tower is 83 percent leased, according to the special servicer commentary. But the 1929-built asset, near Grand Central Terminal, recently lost its third-largest tenant, RELX Inc., when it did not renew its lease in October, CO previously reported.

Andrew Coen can be reached at acoen@commercialobserver.com.