NYCB Stock Plunges as Losses and Loan Provisions Pile Up

By Isabelle Durso July 25, 2024 2:24 pm

reprints

The stock price of New York Community Bank (NYCB) dropped 11 percent Thursday morning as losses and loan provisions pile up for one of New York City’s most prominent regional banks.

NYCB reported a second-quarter loss of $327 million, on $413 million in income, and considerable charge-offs on its office and multifamily property loans, according to its earning results Thursday. The bank also announced the sale of its Flagstar unit’s mortgage servicing business to Mr. Cooper Group for $1.4 billion.

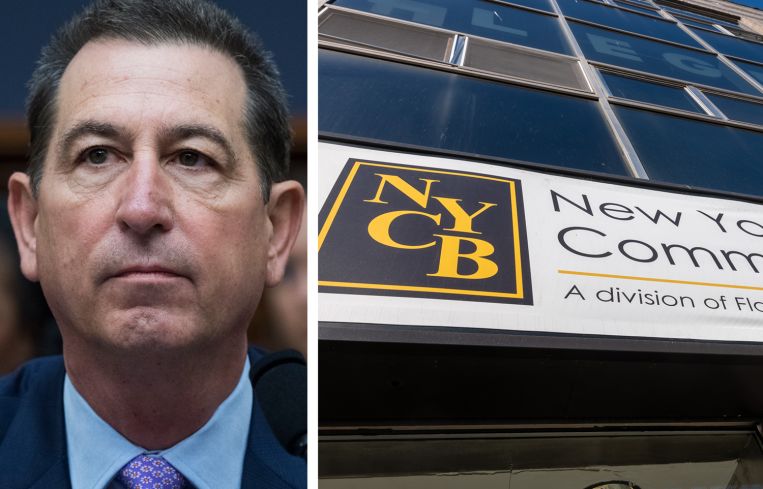

“Our second-quarter performance reflects the ongoing actions management is taking during this transitional year as we reposition the bank for long-term success,” NYCB CEO Joseph Otting, who took the helm of the struggling bank in March, said in the statement.

As of Thursday morning, NYCB’s shares fell 11 percent to $9.70 in New York after tumbling to $9.11 earlier in the day — the steepest intraday drop since March, Bloomberg reported. Its shares recovered to $10.37 as of Thursday afternoon, still below Wednesday’s closing price of $10.94.

The bank’s second-quarter loan provision was $390 million, well above the average estimate of $193 million, according to Bloomberg. In its statement, NYCB said the provision “reflects an increase in charge-offs, principally office loans.”

NYCB said its charge-offs grew to $349 million — up from $81 million in the previous quarter, according to the report. Revenue also fell 44 percent to $671 million, below the annual estimate of $722.5 million, MarketWatch reported.

The bank has been in rough shape since it saw its stock fall 38 percent in one day on Jan. 31, just hours after the bank reported a $252 million loss tied to loans on its office and rent-regulated properties. Since then, NYCB dealt with two shakeups to its CEO position and needed a $1 billion capital infusion from investors tied to former Treasury Secretary Steven Mnuchin.

Since being named CEO in March, Otting has fought concerns from market participants that NYCB’s outsized commercial real estate loan portfolio could exacerbate tighter lending conditions.

“We are focused on transforming the bank into a leading, relationship-focused regional bank,” Otting said in the statement. “Consistent with that strategy, we will continue to provide residential mortgage products to the bank’s retail and private wealth customers.”

Isabelle Durso can be reached at idurso@commercialobserver.com.