Hines Secures $160M to Acquire 258 Acres in Virginia for Single-Family Homes

The D.C. metro area submarket is severely undersupplied and will require 26,000 units per year through 2030

By Brian Pascus July 30, 2024 9:00 am

reprints

Hines is growing its residential footprint in the Washington, D.C., metropolitan area.

The global real estate investment firm, together with several partners, has secured $142 million in acquisition financing to buy 245 acres of land in Virginia’s Loudoun County to build more than 1,000 single-family homes, Commercial Observer has learned.

Kennedy Lewis provided the acquisition loan for the larger Loudoun County project, which will be known as Village at Clear Springs and sit in Leesburg, Va., just 40 miles outside of Downtown Washington, D.C.

Hines secured an additional $18.4 million from Western Alliance Bank to acquire 13 acres in Manassas, Va., to build 162 single-family homes and townhomes for residents of Prince William County.

Hines bought the land in Loudon County from Clear Springs Development, with Trez Capital, DRB Group and Estein USA serving as partners on the project.

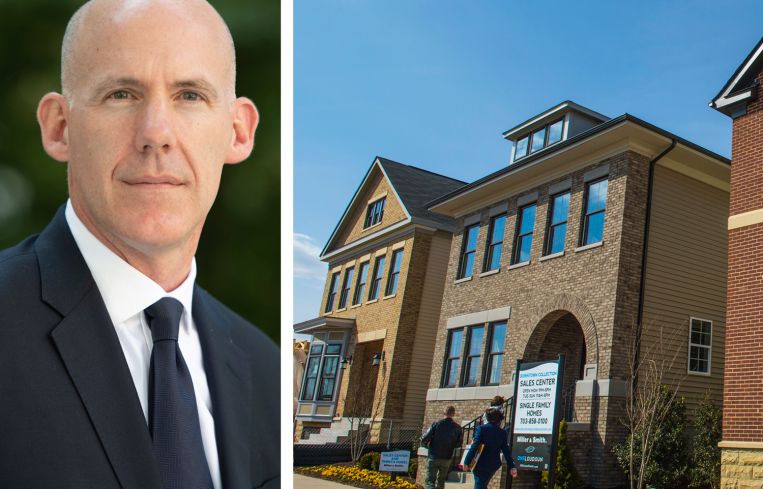

Andrew McGeorge, senior managing director and city head of the D.C. office at Hines, told CO that the housing market of the nation’s capital is “severely undersupplied,” and that his firm plans to leverage its experience in the area to address the shortage.

“We see tremendous opportunity with the acquisitions of these sites to build master-planned communities that offer a high-quality and diversified product to help address this housing shortage,” said McGeorge. “We have experience in these markets and are expecting to see continued success in developing these communities.”

The lots for Village at Clear Springs in Loudoun County have already been pre-sold to DRB Group and NVR. Construction is expected to require three phases, the first of which will begin in 2025 and the last completed in 2030.

The development will feature 1,077 units: 230 single-family homes, 667 townhomes, and 180 affordable units.

The development will also feature a 19-acre indoor-outdoor tennis and pickleball complex owned and operated by the United States Tennis Association.

“We look forward to the positive impact these new communities will have, spurring economic growth and providing much-needed housing options,” said McGeorge in a statement.

Located just a short walk from the Manassas Battlefield Museum (site of the famous Battle of Bull Run that opened the Civil War in July 1861), the smaller Parkridge West development will supply 162 units of single-family homes and townhouses in the Northern Virginia town.

Hines acquired the site from Willard Retail/Buchanan Partners, and has already pre-sold all lots on the site to NVR.

Parkridge West is expected to open in 2027, following the start of construction next year.

“We are pleased to partner with Hines once again, further strengthening our strategic relationship with joint-venture equity investments that support housing needs in the Washington, D.C., metropolitan statistical area,” said Sam Salloway, senior managing director and head of equity investments at Trez Capital, in a statement.

McGeorge’s statements noted that Prince William County carries favorable demographic trends for residential assets and an undersupply of housing stock.

Moody’s predicts the D.C. metro area will require 26,000 single-family homes per year through 2030, while the Northern Virginia Association of Realtors found that the average home price in Northern Virginia increased 10 percent in May 2024 compared to May 2023.

Correction: An earlier version of this article characterized the Hines acquisition as a multifamily community of single-family rentals, when it is for single-family homes for sale.

Brian Pascus can be reached at bpascus@commercialobserver.com