CRE Valuations Dropped 42 Percent on Average in 2023

CRED iQ analyzed 556 properties that were reappraised during 2023, since we were interested in the overall valuation impacts by quarter and property type.

The top 25 valuation declines all received an updated appraisal and we dug into that data. The updated valuations offer a rich perspective on the overall market along with trends that can add meaningful dimensions in forecasting. Each of these properties were either delinquent, transferred to the special servicer, or both.

In total, the average decline in value compared to the original valuation at issuance was 42 percent — remaining in the narrow range between 41 percent and 43 percent that prevailed throughout 2023.

Sector perspectives

Not surprisingly, the office sector turned in the largest valuation decline in 2023 at 50 percent. Office valuation declines peaked in the first quarter at 52 percent, with the subsequent three quarters showing reductions of 51 percent, 50 percent and 47 percent.

Retail came in a close second with 49 percent valuation decreases in 2023. Retail also peaked in the first quarter at 57 percent, but saw a choppier pattern for the remaining quarters at 50 percent in Q2, 45 percent in Q3 and 35 percent in Q4.

Multifamily was in third place for 2023 with a 35 percent valuation decline followed by the hotel segment at 30 percent.

The industrial segment also posted a 30 percent decline; however, this is based upon only three properties/loans — which continues a theme that we have seen throughout 2023. When so few cases are involved, it skews the percentages and offers a misleading impression.

Here are the most notable properties that made our Q4 list:

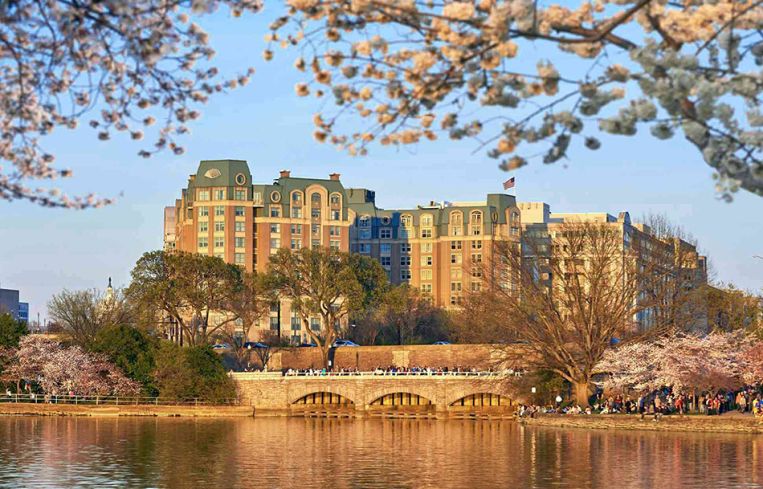

Portals I, Washington, D.C.

The 449,933-square-foot Class A office building and 261,500-square-foot, below-grade parking garage is part of a six-phase, mixed-use development currently containing three office buildings and a Mandarin Oriental hotel. All office tenants have either vacated at the end of their lease term or signed termination agreements. Occupancy is currently 4.67 percent. The property saw a valuation drop from $235 million ($494 a square foot) to $87.6 million ($184 a square foot).

The Brass Professional Center, San Antonio, Texas

This suburban office complex in San Antonio consists of 11 buildings throughout a 35-acre plot that were constructed between 1968 and 1998. The collateral was valued at $79.1 million at underwriting in June 2020, and then dropped to $41.9 million in August 2023, representing a 47 percent decline. The asset became real estate owned in October 2023 and is backed by a $55.6 million loan that is scheduled to mature in August 2030.

While overall valuation losses remained largely flat throughout the year, we saw both retail and office sectors come off their peak decreases from earlier in the year. For office, that may be a favorable trend; however, retail and multifamily seem to be more unpredictable as we move into 2024.

Mike Haas is founder and CEO of CRED iQ