Rockefeller Group Lands $87M Loan for Shovel-Ready Distribution Center in SoCal

Spec development calls for 603,000 square feet of in Southern California’s Inland Empire

By Greg Cornfield November 9, 2023 4:45 pm

reprints

Rockefeller Group has lined up $87 million in construction financing from JPMorgan Chase (JPM) for a large distribution center that will serve the nation’s busiest industrial market: Southern California’s Inland Empire.

The private New York-based real estate company also paid $65.2 million for about 35 acres of land in Riverside, Calif., as well as the entitlements for the 603,100-square-foot Sycamore Hills Distribution Center. Rockefeller plans to lease and sell the property after it’s complete in early 2025.

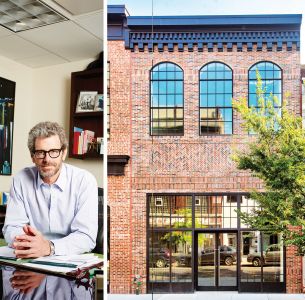

James Camp, senior managing director of Rockefeller Group’s West Coast division, told Commercial Observer that, although the industrial markets have slowed in 2023 in comparison to 2020 to 2022, the firm believes there will be consistent demand for industrial space in the Inland Empire moving forward.

“It’s been a year of what I would call regression to the mean of normalization, and going back to what markets used to be,” Camp said. “Our vacancy rate was 0.5 percent in the Inland Empire, which was just absurdly low. I’ve never seen it hit anything like that in my career. Today, it’s at 3.5 percent. … Over my career, that’s still below average.

“It’s a big change this year, but it’s not like a long-term catastrophe,” Camp continued. “We still have the ports, we still have the freeway system, the infrastructure, the air cargo, and all of that is not changing. They’ll continue to be the largest ports in the world and product will continue to come through there, and it has to end up going through the Inland Empire.”

The plan for Sycamore Hills Distribution Center calls for two buildings spanning 400,000 square feet and 203,100 square feet, respectively, at Alessandro Boulevard and Barton Street, at the southeast corner of the 1,500-acre Sycamore Canyon Wilderness Park. Irvine-based KB Investment Development secured entitlements and sold the project to Rockefeller. Camp said the deal spawned from a personal relationship with Darrell Butler, president and partner at KB Investment Development.

“It was in the entitlement phase for about eight years, which is really an indication of how things are so difficult here to get entitled in California,” Butler said. “Darrell and I have known each other for about 30 years, and it started as a conversation. We were at an event together and we started talking, and that ended up in a meeting, and a meeting ended up in an LOI, and then we ended up in escrow.”

Comparable developments are typically available only for lease, but Rockefeller Group’s “merchant builder” business model strategy is to build, lease and sell the asset as opposed to owning long term, Camp said. The e-commerce boom that drove the market led to more industrial tenants wanting to own the properties they occupy because it’s become more common to spend more money on interior investment than it costs to build the property.

Moving forward, Camp said he expects a significant downturn in future supply over the next few years in the Inland Empire due to higher interest rates.

“It’s very difficult these days to get construction financing and JV equity for most developers,” he said. “That is going to create a huge downward spiral on supply, and that’s going to put pressure on the availability of space. … I think it’s going to become more and more difficult to secure entitlements in California given the anti-warehouse, anti-trucking sentiment that is pervasive in the Inland Empire. And that will make bringing new product to market even harder. So that bodes well for our supply-demand formula.”

Rockefeller Group represented itself on the purchase of the land. Bill Heim, Alex Heim, Michael Chavez, Mario Calvillo and Finn Comer of Lee & Associates will oversee leasing of the project.

Gregory Cornfield can be reached at gcornfield@commercialobserver.com.