Brooklyn Investment Sales Poised for Bull Run, Numbers Suggest

It could be a few months, but trends are aligning for brisk activity.

By Andrew Coen September 14, 2023 8:00 am

reprints

Brooklyn’s investment sales activity has been barreling ahead in 2023 despite myriad market forces in its path.

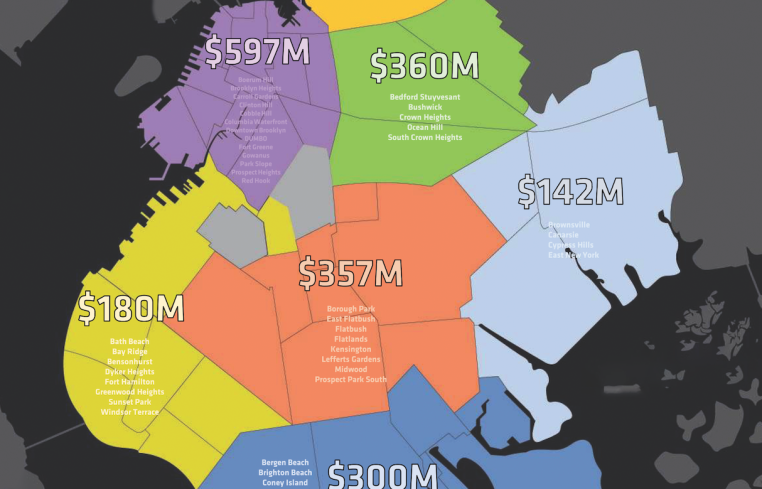

New York City’s most populous borough saw a 35 percent increase in the dollar volume of investment sales — $1.49 billion from 281 deals — in the second quarter compared to the first three months of the year, according to data from brokerage TerraCRG. While the first-half volume of $2.6 billion was way down from $5.28 billion during the same period in 2022, Ofer Cohen, TerraCRG’s founder and CEO, noted that Brooklyn investment sales conditions are back to pre-pandemic levels with potential for further growth.

“It’s obviously a big drop from the peak, but the reason I like this market is there are always transactions,” said Cohen, who noted third-quarter investment sales volume so far has continued the momentum seen in the spring. “There are a lot of different players in the market.”

The decline in Brooklyn investment sales compared to 2022 has been driven largely by rising interest rates creating higher borrowing costs, coupled with owners reluctant to sell due to uncertainty on how increased cap rates will impact valuations. This year’s Brooklyn investment sales climate is also in stark contrast to early last year, when there was a flurry of commercial real estate trading activity in multifamily properties as investors sought to deploy capital ahead of the June 2022 expiration of the 421a tax abatement for multifamily development.

The collapse of New York City-based Signature Bank in March as part of a wider regional banking crisis created even more headwinds for Brooklyn investment sales, but alternative lenders have kept the market moving, according to Cohen, particularly with construction and bridge loans. Many smaller Brooklyn deals in the $2 million to $3 million range have been funded with all cash.

While there is plenty of dry powder on the sidelines ready to pounce on commercial real estate in Brooklyn, a number of owners are reluctant to sell properties until there’s more clarity on where interest rates will settle, according to Timothy King, managing partner of SVN CPEX Real Estate. King said he expects transaction activity with multifamily properties to pick up once interest rates return to steadier levels, but he does not foresee this occurring until at least the summer of 2024.

Another barrier holding back investments in Brooklyn, according to King, is over-regulation on multifamily developments, including requirements on how many units need to be designated as affordable housing. He added that restrictions on what can be developed at industrial sites and where hotels can be constructed has also limited Brooklyn’s real estate from truly taking off.

“’The fact that every week seems to bring some new regulatory notion that may or may not be implemented gives people pause,” King said. “The goal posts keep getting moved.”

Despite many unknowns confronting commercial real estate, there have been plenty of sizable Brooklyn investment sales in 2023. The biggest so far involved Saint Francis College selling its campus at 180 Remsen Street in Brooklyn Heights to affiliates of Rockrose Development for $160 million in April.

Properties that TerraCRG classified as “special-use assets” such as school buildings, nursing facilities and hotels have played an integral role in helping to scale deal flow this year. Sales of these assets were up 686 percent in the second quarter compared to the first quarter.

Six Brooklyn investment sales were above $60 million in the first half of 2023, with three exceeding $100 million. Cohen said the size of individual deals has drastically changed in the last decade as more institutional players target the Brooklyn market.

“That trend of larger and larger deals and institutions selling and buying in Brooklyn is going to continue,” Cohen said. “We’re seeing that from the pipeline of deals that we are working on now.”

Cohen added that the next 12 months could be shaping up to be “the biggest opportunity in New York City since 2009 and 2010” with Brooklyn poised to benefit as investors seek discount buying opportunities in the Big Apple. Another factor that could spur Brooklyn investment sales velocity is the Federal Deposit Insurance Corporation’s unloading of roughly $60 billion in Signature Bank loans. The loan sales, facilitated through Newmark, include a large chunk of rent-stabilized or rent-controlled assets throughout the borough.

“Either these loans are going to be sold to a fund or that fund is going to continue to sell,” Cohen said. “In 2024 something is going to happen, and that could really change the market because it’s billions of dollars in a market that’s $5 to $10 billion depending on the year.”

Andrew Coen can be reached at acoen@commercialobserver.com