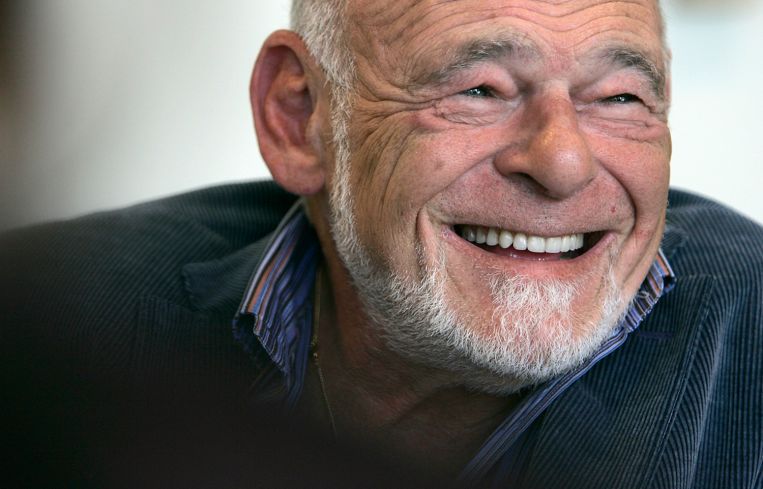

Sam Zell, Real Estate Billionaire, Dead at 81

By Mark Hallum May 18, 2023 11:34 am

reprints

Sam Zell, a son of World War II refugees who became founder and chairman of Equity Residential, and whose skill and instincts in real estate made him a billionaire, died Thursday at age 81, according to the company.

His death was caused by “complications from a recent illness,” according to ABC7.

Zell began his real estate career in the 1960s, starting what would become Equity Residential while still a student at the University of Michigan and turning it into a $31 billion business after taking the company public in 1993, according to the firm.

Following Zell’s death, the board of trustees appointed David Neithercut, 67, who served as Equity Residential’s CEO from 2006 to 2018, as chairman of the board.

“The world has lost one of its greatest investors and entrepreneurs,” Mark Parrell, Equity Residential’s current CEO, said in a statement. “Sam’s insatiable intellectual curiosity and passion for deal-making created some of the most dynamic companies in the public real estate industry. He was a generous philanthropist and an incredible mentor and friend and will be missed by all who were lucky enough to be part of his extraordinary world. We extend our deepest condolences to Sam’s family and loved ones.”

Sam Chandan, founder of the Chen Institute for Global Real Estate Finance, remembered Zell for the mentorship he provided to students at New York University and at the Samuel Zell & Robert Lurie Real Estate Center at the University of Pennsylvania’s Wharton School.

“Sam was a tireless supporter of academic institutions and students the world over. I first met him when I was an undergraduate student at Wharton, where the center was named for him and Robert Lurie [Zell’s first employee], then as a faculty member at Wharton and later at NYU,” Chandan said in a statement. “His incredible generosity, in meeting with, advocating for, and mentoring students often went unseen, but it shaped a generation of leaders.”

Barry Sternlicht, CEO of Starwood Capital Group, worked with Zell since the early 1990s, closing a $5.4 billion deal as recently as 2016 when Zell sold Sternlicht 23,000 suburban rental units. The two also had a very public bidding war in 2021 for industrial real estate investment trust (REIT) Monmouth Real Estate Investment Corporation, both eventually losing out to Industrial Logistics Properties Trust.

Strenlicht remembered Zell as a loyal friend who maybe didn’t take himself as seriously as one may think a billionaire would.

“I was on the board for a while, and the board meetings were hilarious. Sam would start every meeting with jokes, and he loved his jokes,” Sternlicht told CO. “Sam wore sweaters when no one else was dressed like that, and they weren’t even good-looking sweaters. Sam didn’t care. If he liked them, they were fine to him. He had a collection of some of the ugliest sweaters I’ve ever seen.”

Zell was born in 1941 in Chicago to Polish refugee parents Bernard and Rochelle Zielonka, four months after their escape from the German invasion.

One of Zell’s first enterprises, which he outlined in interviews and in his memoir Am I Being Too Subtle: Straight Talk From a Business Rebel, was being a 12-year-old in Chicago reselling Playboy magazines, which he obtained for 50 cents from vendors who sold under the L trains.

“I bought it and I read it all the way home and I showed it to a friend of mine. He said, ‘Whoa, that’s really hot. Can I buy it?’ ” Zell said in a May 2017 interview. “I was confronted for the first time in my life with the relevance of supply and demand. I also learned margins. So I said, ‘Three bucks.’ He said, ‘Great.’ ”

Zell started his real estate career while at the University of Michigan managing student housing with Lurie, a fraternity brother. In 1968, Zell founded Equity Group Investments, with Lurie joining a year later, according to the firm. Zell started the REIT Equity Residential in 1990, shortly after Lurie died.

By the fourth quarter of 2022, Equity Residential reported that it owned 80,000 residential units in more than 300 properties in coastal urban markets where the real estate investment trust was cashing in on high rents and a difficult market for home buying among young professionals. Commercial Observer recently ranked Zell and Parrell No. 11 on the 2023 Power 100 list.

“The board, executive leadership and all the employees of Equity Residential are committed to honoring Sam’s legacy through a continued focus on value creation for our shareholders,” Neithercut said in a statement.

Equity eventually grew to own multifamily, hotels, mobile homes and logistic properties. Zell largely exited the office market in 2007 when Blackstone cast the winning bid for Equity Office Properties for $55.50 a share, or $39 billion, which the New York Times called the “fiercest buyout battle” since RJR Nabisco was bought out by KKR in 1988 for $30 billion. Zell was said to have driven up the price of the office portfolio — which included the Verizon Building in Manhattan — by up to $3 billion, a masterstroke by some accounts.

Equity Office Properties, better known today as EQ Office, was the biggest office landlord in the United States at the time of the deal and currently owns 80 office properties encompassing 40 million square feet.

Life wasn’t all wine and roses for Zell, however.

His ownership of Tribune Co. and the ensuing financial fallout that left the company $13 billion in debt while bankrupting the Chicago Tribune and the Los Angeles Times was hardly forgotten by those publications, the latter of which put that fact in the headline reporting Zell’s death.

Tribune Co. in the late 2000s, much like Zell’s other investments, was a distressed asset which he was accustomed to reviving. He didn’t dub himself the “grave dancer” for nothing.

But his powers failed when the conglomerate he bought for $8.2 billion, along with $315 million of his own money, went down the drain within a year and sent about 4,000 employees into unemployment. It would cause himself and other former Tribune executives to pay $200 million from a later lawsuit as well.

Still, Sam Zell could often be found on media outlets like CNBC pontificating about the state of the real estate market, and he gave advice to other real estate professionals on how to work with the press. An avid motorcyclist, Zell once told Blackstone Jonathan Gray to also buy a ride for himself.

“You have to take up motorcycles or something,” Mr. Zell told him, a person present previously told Observer. “I ride motorcycles, so they start every story with me riding a motorcycle. You need to find a hook.”

Zell is survived by his wife Helen; sisters Julie Baskes and Leah Zell; children Kellie, Matthew and JoAnn; along with nine grandchildren.

Mark Hallum can be reached at mhallum@commercialobserver.com.