Presented By: Ariel Property Advisors

Making Sense of the 2023 New York City Multifamily Market

Future Of Capital Markets brought to you by Ariel Property Advisors

By Ariel Property Advisors May 22, 2023 8:00 am

reprints

Q&A With Michael Tortorici

Michael Tortorici, a Founding Partner at Ariel Property Advisors, originates and executes the sale of commercial real estate transactions throughout New York City’s five boroughs, with a specific focus on Manhattan. Recent successes include the sale of three multifamily and mixed-use buildings in Lower Manhattan that sold for just under $30 million.

Tortorici discussed the challenges facing the New York City housing market and some of the creative policies that could increase supply.

What trends are you seeing in New York City’s multifamily market?

The post-Covid world left us with a slew of macro-economic challenges that the market continues to wrestle with, but the broader economic growth right now is serving as a powerful counterforce to all those obstacles.

Over the last year, the City has generated over 186,000 new jobs. Even if many of those jobs follow a hybrid-model of working, rising rents–especially those we’re seeing in prime areas of Manhattan–suggest more and more people are choosing to pay a premium to live here versus less expensive options immediately outside of the City or beyond.

Average rents for free market apartments in Manhattan rose to $5,115 in March, 10.3% above the year before, as demand for housing continued to push rents upward and the vacancy rate below 3%, according to Douglas Elliman. We’re also seeing many renters postponing buying apartments because mortgage rates more than doubled in the last year, which is putting additional pressure on rental inventory.

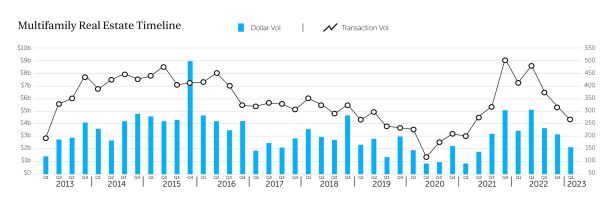

At the same time, the multifamily market is currently undergoing a price adjustment as buyers and sellers look to reconcile the long-term outlook for interest rates and inflation, as well as the challenging regulatory environment. Multifamily transactions declined 35% from 1Q 2022 to 1Q 2023 to 268 transactions, and the dollar volume of those trades fell 39% over the same period to $2.11 billion, Ariel’s Multifamily Quarter in Review shows.

We expected a drop in the first quarter because it reflects the uncertainty experienced during the previous two quarters. By the fourth quarter of 2022, the optimism of the summer months had disappeared as investors realized inflation would persist and interest rates would be higher for longer than the market anticipated. Owners were reaching out to us for evaluations so that they could prepare to market their properties or figure out other options such as refinancing or finding additional capital to stay in for the long haul.

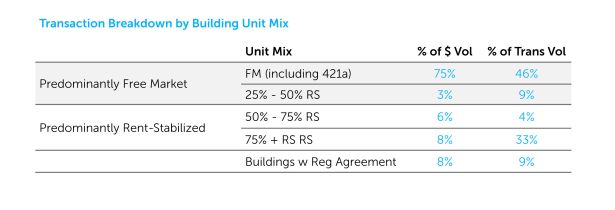

Notably, the vast majority of multifamily buildings that are selling today have at least 50% of their units as free market apartments. In fact, predominantly free-market buildings accounted for 78% of the total dollar volume and 55% of the total transaction volume in the first quarter. Small multifamily buildings (MF-MU under six units) also performed well, especially in Brooklyn where volume totaled $181 million across 80 transactions.

At Ariel, we arranged the following sales in the first quarter in Manhattan that exemplify the buyer appetite for buildings with free market units:

• A six-story, 22,500-square-foot multifamily elevator building at 153 Norfolk Street sold for $16 million, or $711 per square foot.

• A six-story, 16,812-square-foot, mixed-use walk-up building at 109 Ludlow Street between Delancey Street and Rivington Street sold for $8.8 million, or $523 per square foot, a price that was somewhat weighed down by a challenging retail situation.

• A 4,708-square-foot, four-story, mixed-use building at 32 Avenue A traded for $3.78 million, or $803 per square foot. Of the four units, three are free market floor through apartments and one is a commercial space on the ground floor.

Whether it’s a conversion in the East Village, a multifamily building that is 50% free market or an owner-user property, we’ve been impressed with the volume and diversity of interest we’ve been seeing on offerings. Pricing remains cautious, but it’s clear there is a captive, growing audience of local, national and international capital seeking opportunities here.

How has the disruption in the banking sector affected the multifamily market?

Contrary to what many believe, there is still an active pool of lenders for cash flowing multifamily assets. I’m in touch with our Capital Services team every day and they have a healthy pipeline of both acquisition and refinance opportunities, so deals are getting done. Most banks are still pursuing new opportunities in this higher interest rate environment, although some are adopting stricter underwriting standards and/or are looking to establish depository relationships.

That said, there are some specific property types that present challenges for lenders today. Class B and Class C offices are one such product type, a trend that has been widely covered by the media. The other is multifamily properties that have a large proportion of rent regulated units. Without a strong free market component to essentially subsidize lower yielding rent stabilized units that generate less income than operating costs, such buildings will have flat or declining net operating incomes unless major changes are made to the Housing Stability and Tenant Protection Act of 2019 (HSTPA).

How did the development market perform in the first quarter?

If you look at pricing, for well-capitalized investors with a medium- to long -term horizon, it’s the best time in a long time to acquire development opportunities in Manhattan. Sales volume is light, so the sample size is fairly low, but the average price per buildable square foot in Manhattan is hovering around $400, the lowest level since 2012 or 2013.

It seems, however, that this pricing environment is understandably keeping many development site owners from listing their properties, which is negatively impacting sales volume figures. From 1Q 2022 to 1Q 2023, New York City’s development transactions fell by 41% to 69, with dollar volume dropping by 58% to $968 million, Ariel’s research shows, demonstrating that the expiration of the 421a program in June 2022 as well as rising rates and a softer condo market have dampened buyer interest. For example, Manhattan condo sales fell year-over-year by 41% to 979 in the first quarter and co-op sales dropped 35% to 1,263, the Elliman Report shows.

The lackluster development market is evident in the housing pipeline. In February, developers only submitted 22 new multifamily foundation filings to the NYC Department of Buildings, which is the third straight month of fewer than 30 filings citywide compared to 73 filings per month in the first half of 2022, according to the Real Estate Board of New York (REBNY), which tracks applications monthly.

The GDP of our geographically compact New York Metropolitan area is $1.59 trillion, which is slightly bigger than the entire GDP of Mexico and slightly less than South Korea’s entire GDP. Until the City and state enact serious reforms to significantly increase housing supply, our affordable housing crisis will continue to compound as rentals and condominiums appreciate. While perhaps well-intentioned, those who narrowly focus on tenant protections are ultimately offering an ineffective treatment to the symptoms of this reality, not the disease. We must think and act much bigger now.

With that in mind, we believe development sites represent a real buying opportunity today.

What policies would help create more affordable housing?

I was very excited about a number of proposals that Governor Hochul put forth this year, many of which seemed to closely follow a series of recommendations to promote development of affordable housing by NYU’s Furman Center.

Lifting the FAR cap, mandating growth targets, transit-oriented development, ADUs, and tax abatements that incentivize production of rental housing and office conversions must all be in the mix to accommodate New York City’s expected population growth which will require 560,000 additional units of housing by 2030.

Transforming obsolete offices in Midtown to vibrant residential communities is essential for a host of reasons. The Financial District faced a similar challenge back in the 1990s. The government responded with the 421-g tax incentive, which led to 13% of Lower Manhattan’s office buildings being converted to housing. Projects using the 421-g tax incentive added about 13,000 units of new housing and an additional 17,000 units were converted or built in the submarket without the incentive, according to an analysis by the Citizens Budget Commission.

Are you optimistic about the City solving its affordability crisis?

I’m encouraged that it seems like housing is finally at the top of the agenda here in New York. Governor Hochul’s plan was ambitious. Mayor Adams is regularly promoting his “moonshot” goal of producing 500,000 units in ten years. Borough President Levine recently released a report with a plan to create new housing, noting that only 6,000 units of housing were produced annually in Manhattan in the last six years.

New York City is in the midst of reinventing itself once again and, with housing front and center, this is an incredible opportunity for those with the patience and the long-term vision to see it through.

For more articles on the future of capital markets click here