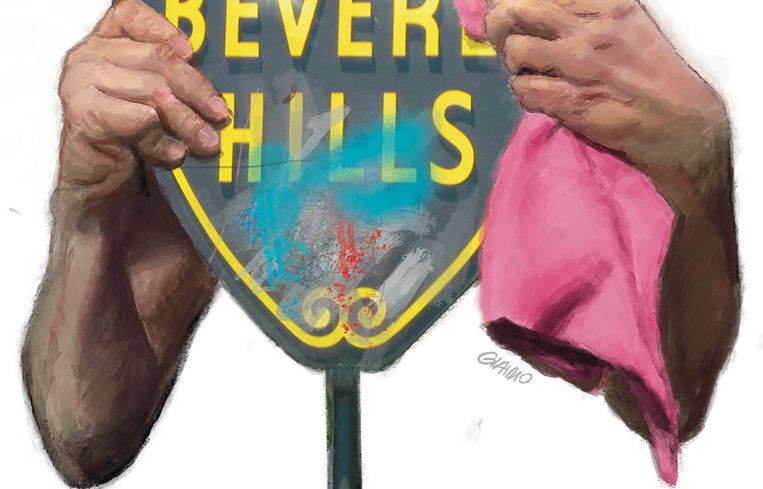

Beverly Hills Retail Rolls Out of the Pandemic Behind Luxury Brands

New projects, including expansions, are also driving the good fortunes of the tony L.A. County enclave

By Greg Cornfield April 24, 2023 6:59 am

reprints

What pandemic?

Whether it’s the bustling restaurants, the shoppers and tourists lining the streets, or the construction crews working to grow buildings for some of the nation’s richest companies, Beverly Hills makes it easy to forget that not long ago, a global health scare seemed to threaten the existence of brick-and-mortar retail. Instead, the world’s top luxury brands and the highest-end retailers are still all in on brick and mortar in 90210, probably more so than ever before.

The flagship stores along Rodeo Drive and throughout the coveted Golden Triangle escaped the depths of the pandemic — when tourists disappeared and retail shopping was restricted — and have moved into a new era of significant growth and expansion.

“I don’t know if I’ve ever seen Beverly Hills stronger than it is today,” Andrew Turf, a senior vice president at CBRE, said. “Across all streets, not just Rodeo. Beverly, Cannon — they’re all doing extremely well.”

JLL retail brokers said Beverly Hills’ Golden Triangle, with Rodeo Drive at the heart, has overtaken any area in New York City as the country’s top retail destination because of the active tenant base that includes the likes of Saint Laurent, Gucci and Versace. These companies aren’t just occupying space to wave their flag and call it a day; they’re putting big money behind expansion projects.

“To have some of these international brands that could go anywhere in the world invest in our area, it goes a long way,” Newmark’s Jay Luchs said. “It means something. Probably more than we know. They really believe in it. They’re clearly doing well, and they believe that Rodeo Drive and Beverly Hills is a place that they need to invest a lot of their own money into. Because they continuously put money into renovating.”

The landlords and owners are also thriving, with average asking rents just as eye-popping as the price tag on some diamonds at Tiffany & Co. For reference, the national average retail asking rent is under $2 per square foot, and L.A. County’s is under $3, according to a first-quarter market report from Colliers.

“So whether it’s Rodeo Drive or not, neighboring streets like North Beverly Drive, which is more affordable luxury, the vacancies have dropped by 75 percent and rents are at an all-time high, trading between $15 to $17 per square foot now,” Houman Mahboubi, JLL’s executive vice president of retail brokerage in L.A., said. “There’s a list of companies and brands that are trying to get onto Rodeo Drive. Rents are $80 to $100 per square foot now per month, triple net.”

Indeed, Cushman & Wakefield’s Carter Magnin said Beverly Drive is seeing $12-$13 per square foot rents, “and we were seeing $9 and $10 rents for a long time.”

“Canon Drive — which was typically more service retail and hair salons, restaurants, daily needs — rents on that street were historically $6-$7 per square foot, and we’re seeing a handful of deals now that are pushing $10,” he said. “Really strong rent growth, especially for these types of uses.”

L.A. County’s retail market vacancy rate was at 6.1 percent after the first quarter this year, while the national vacancy rate was 5.6 percent, which was the lowest it has been in the U.S. since at least 2007. The vacancy at Beverly Hills’ Golden Triangle is even lower, under 5 percent. On Rodeo Drive, it’s 0.

“There’s so much demand from all types of retailers — restaurants, wellness, fitness, art galleries, destination retail, salon services,” Mahboubi said. “There’s so much demand and not enough supply.”

Roll down the window

A lot of attention is on HBC, which owns Saks Fifth Avenue and Hudson’s Bay stores. Last summer, the company announced a five-year plan to restore its property at 9600 Wilshire Boulevard near Rodeo Drive and add office and multifamily space, as well as new retail and restaurant space, a membership club and more.

“With the Saks Fifth development, people are waiting,” Turf said. “There’s a lot of talk in the city and in the market of what that’s going to eventually look like. … More types of tenants will want to come once the market understands what’s going into the Saks building.”

The new post-pandemic era of growth is tied to the reign of Bernard Arnault and Louis Vuitton Moët Hennessy (LVMH), one of the most valuable companies in the world. It also happens to own several other landmark tenants on Rodeo Drive.

LVMH bought the property at 468 Rodeo Drive for $245 million and is planning to build a Cheval Blanc Hotel on Rodeo Drive, which is expected to generate at least $725 million for the city of Beverly Hills over 30 years, according to reports.

LVMH, Chanel, Hermes and Cartier have each bought property on Rodeo Drive over the past several years, as opposed to simply leasing, which Luchs said further signifies their confidence.

Cartier is adding two stories to the building at 370 North Rodeo (next door to Gucci’s expanded 9,000-square-foot store with a 50-seat rooftop restaurant). Dior (which is partly owned by LVMH) also filed plans to build a three-story store with a rooftop restaurant on Rodeo Drive.

Chanel is expanding on Rodeo Drive by combining two properties that it purchased in the last five years for about 100 feet of frontage. That store is supposed to open in July.

“A lot of luxury brands are expanding beyond the typical footprint,” Luchs said. “A typical footprint was always 25 feet wide. Now we have stores that are 50 and 100 feet wide.”

Everybody’s very happy

LVMH is grabbing space like it’s playing Monopoly. The company also paid $200 million in late 2021 for the closed Luxe Rodeo Drive Hotel and its existing high-end retail shops, which include Rolex, Patek Philippe and Ferrari at 360 North Rodeo Drive. LVMH also recently opened a new Bulgari jewelry store at 433 North Rodeo, and will open a Givenchy fashion and perfume spot at 430 North Rodeo in the next few months.

And even as the Federal Reserve raises interest rates and economic headwinds increase, Beverly Hills is a good bet. Earlier this year, developer Probity International secured a $52 million loan to refinance an 8,500-square-foot building at 426-430 North Rodeo Drive from Deutsche Bank.

At the intersection of Wilshire and Santa Monica boulevards, facing the western point of the Golden Triangle, the One Beverly Hills project will be the tallest investment in Beverly Hills. The 17.5-acre, luxury mixed-use project between future Metro Purple Line stops will encompass 1.375 million square feet, and it will integrate with the existing Beverly Hilton and Waldorf Astoria Beverly Hills hotels with three new buildings, two residential towers and a new 10-story, all-suite luxury hotel.

“There’s a tremendous amount of demand and activity on Wilshire,” Mahboubi said. “And with the Purple Line coming up, you can imagine, you’re going to see a lot of future developments from multifamily combined with mixed-use retail. … When Rodeo is fully leased, Wilshire becomes the next destination. … A lot of retailers will be spilling over from Rodeo Drive to Wilshire, especially between Beverly Drive and Camden.”

Turf noted the Two Rodeo shopping plaza on the other end of the Triangle on Wilshire, at the entryway to Rodeo Drive.

“Now with (apparel brand) Kith coming in, it’s changing the landscape of how Two Rodeo has looked,” he said. “Five years ago, you could have had two or three or four units up and down Two Rodeo. Now, for the most part it’s fully leased.”

Don’t let the music stop

Beverly Hills is significantly building on its restaurant scene to complement the retailers. Michelin-starred chef and restaurateur Daniel Boulud earlier this year revealed plans to open his first West Coast restaurant at the 54-unit Mandarin Oriental Residences, the boutique condominium at 9200 Wilshire Boulevard developed by Manhattan-based Shvo.

Steak 48 also opened this year to significant fanfare as the latest big name on the scene.

“I remember, years ago, the Avra space was vacant for years, and no one wanted to be on the west side of the street and no one thought they could make it,” Turf said. “Today, you can’t find a Beverly Hills restaurant space other than one or two.”

He also pointed to Cipriani focusing on Beverly Hills, with a location on North Camden Drive, as another sign of the market’s strength.

“Six years ago, it was like no restaurant wanted to come to Beverly Hills,” Turf said. “There were restaurant spaces that you could have had anywhere. Fast forward to today, I think the demographic has expanded well beyond the 58-year-old Bel Air/Beverly Hills person.”

It’s also set to benefit from the Purple Line Extension, Magnin added.

“Labor was a huge issue (in the wake of the pandemic], and finding and retaining good staff was a real challenge, especially in the restaurant sector, and in retail as well,” he said. “And I think with having reliable transportation, the Purple like will be another positive effect.”

And we was born to ride

New luxury car dealerships have recently come to town to gobble up big space, too. For example, O’Gara Coach — the largest Rolls-Royce dealer in the world — signed a lease in August 2022 for 18,000 square feet on the ground floor at 9460 Wilshire Boulevard for its second showroom in Beverly Hills.

EV developer and manufacturer Faraday Future recently signed a 10,511-square-foot retail lease at 460 North Beverly Drive, too, directly across from the future Cheval Blanc Hotel. Lotus, a British electric vehicle, also signed to take 10,000 square feet at Wilshire and Santa Monica, and Polestar signed a lease at Roxbury and Wilshire.

Newmark’s Luchs said with low vacancies, that Canon Drive and Beverly Drive and all the other surrounding streets are doing as well as they could be right now.

“During COVID, it was scary not knowing what was happening,” he said. “But everything has come back really nicely and been really strong since then.”

Gregory Cornfield can be reached at gcornfield@commercialobserver.com.