Presented By: Ariel Property Advisors

Q&A with Victor Sozio: Latest Trends in Rapidly Changing New York City Multifamily Market

Future of Capital Markets brought to you by Ariel Property Advisors

By Ariel Property Advisors November 14, 2022 10:58 am

reprints

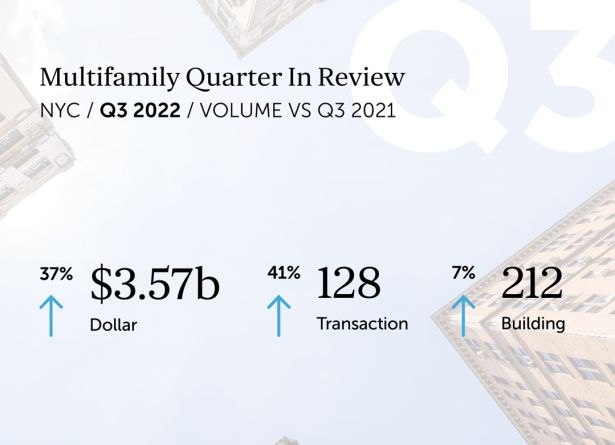

New York City multifamily sales totaled $3.57 billion in Q3 2022, a 37% increase year-over-year, and 71% higher than the five-year quarterly average of $2.085 billion, Ariel Property Advisors’ Q3 Multifamily Quarter in Review shows. There were 128 transactions across 212 buildings, a year-over-year increase of 41% and 7%, respectively, during the third quarter. However, quarter-over-quarter dollar volume declined by 17%, transaction volume fell by 20% and building volume dropped by 11%.

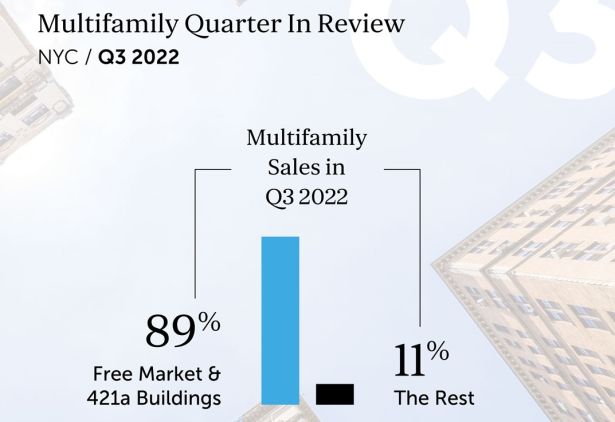

Free market buildings continued to appeal to buyers in the third quarter, capturing 89% of the dollar volume. Brooklyn and Manhattan (below 96th Street) accounted for approximately 89% of the total multifamily dollar volume citywide.

Victor Sozio, Founding Partner at Ariel Property Advisors, originates and executes the sale of commercial real estate transactions throughout the five boroughs of New York City. In recent years, Mr. Sozio has been one of the most active multifamily brokers in New York City, arranging transactions such as the sale of Dawnay Day portfolio for $357.5 million; Bronx 2K portfolio for $350 million; Savoy Park portfolio for $340 million; and a 13-building portfolio across Manhattan, the Bronx and Brooklyn for over $200 million in 1Q2022. He is currently marketing multifamily properties throughout the city with a cumulative total of over 3,000 units.

Sozio discussed recent trends in New York City’s multifamily market and what to expect in 2023.

CO: How are free market buildings performing?

Sozio: Free market buildings in good locations have been on a roller coaster in recent years. During the Covid-19 pandemic, we saw unprecedented apartment vacancies, rent declines and attractive concessions. However, as residents returned to New York City, there was a rapid resurgence and rents rebounded to above and beyond their 2019 levels. In September 2022 compared to the previous year, average Manhattan rents rose 22.3% to $5,287, average Brooklyn rents rose 18.3% to $3,802, and average rents in Northwest Queens rose 15.2% to $3,386, according to the Elliman Report.

Institutional investors have retooled their investment strategies and are targeting free market buildings, which serve as a hedge against inflation and higher interest rates. Their business plans include increasing any remaining Covid-era rents to new market levels. Properties without significant retail exposure in supply constrained markets seem to hold the most appeal as evidenced by several recent transactions such as the Blackstone Group’s $930 million purchase of the residential condo portion of 8 Spruce, Black Spruce’s $837 million purchase of the American Copper Buildings in the second quarter as well as A&E Real Estate’s purchase of 160 Riverside Boulevard on the Upper West Side for $415 million in the third quarter. While it remains a top target for active buckets of capital, this product-type has not been insulated from the rapid rise in interest rates and more data is emerging on rent increases beginning to level off throughout the city.

How has the market for rent stabilized buildings evolved in recent years?

We now have more clarity on how investors are responding to the rent stabilized segment of the multifamily market following the New York State Legislature’s passage of the Housing Stability and Tenant Protection Act (HSTPA) in 2019.The active investor profile for rent stabilized buildings has shifted more so to private high net worth individuals and family office investors with patient capital. Institutional investors are shunning rent stabilized assets due to the stringent regulations plus rising interest rates and expenses that can’t be offset by higher rents.

The response is showing up in the numbers. Investor interest in rent stabilized assets fell from 27% of multifamily sales in 1Q 2022 to 11%, or $343 million, in 3Q 2022.

While rent stabilized assets didn’t account for a significant portion of the transactional volume last quarter, we are of the opinion that a deep buyer pool for these properties still exists. However, the price points at which we see that depth in the market have decreased substantially as investors require strong going-in yields and cushion for rising expenses and deferred maintenance.

Where do you see headwinds in the multifamily market?

The Fed is continuing to raise interest rates to fight inflation, which remains high and increased at an annual rate of 7.7% in October. The Federal Open Market Committee (FOMC) at its November meeting voted to approve a rate hike of .75%, raising the range for the benchmark federal funds rate to a target of 3.75% and 4%. In addition to the FOMC’s interest rate policy, the Fed is shrinking its balance sheet by allowing Treasury and Agency securities to mature without reinvestment. The “quantitative tightening” policy also will decrease liquidity and put more upward pressure on interest rates.

Unfortunately, rising interest rates will coincide with pending loan maturities that may have originated before the HSTPA legislation in 2019 and will result in additional equity required for a standard refinance to be a viable option for rent stabilized properties. This could also be exacerbated by DHCR’s most recent proposed amendments to the rent stabilization code, which includes eliminating the ability to set a “first rent” upon substantial reconfiguration of the units amongst other changes.

Rent stabilized property owners are also voicing increased concern about long-term deferred maintenance on our housing stock because HSTPA regulations have hampered a property owner’s ability to recover the cost of renovations. Renovating apartments vacated by long-term tenants can reach up to $100,000 per unit but the low rents allowed for these units typically don’t cover the operating costs, according to the Community Housing Improvement Program (CHIP). As a result, more than 40,000 rent stabilized units remain vacant, which is concerning at a time when it is estimated New York City will need 560,000 new housing units by 2030 to accommodate population growth.

We are also keeping an eye on how owners will address capital expenditures relating to Local Law 97, which requires many properties of over 25,000 square feet to comply with new emission standards, as well as the threat of new legislation such as a new version of the good cause eviction bill that lost momentum in the last legislative session.

Where do you see opportunity in the multifamily market?

Opportunity will exist in cases where increased pressure on owners from lenders, investors and operators will lead to a sale or a recapitalization that meets the current market. Operators that can leverage existing platforms to manage and infuse needed capital should see more opportunity for a pragmatic, structured approach to some of these scenarios. Investors willing to provide equity or debt to fill gaps in the capital stack should also see increased deal-flow.

Some buyers who are willing to take a more long-term approach and have a generally optimistic viewpoint on New York City’s future, can also find opportunity in the rent stabilized space. The adverse effects of the HSTPA legislation on rent stabilized buildings are becoming more visible to the general public and elected officials, which is leading to stronger arguments to revisit or amend various parts of the legislation or introduce new bills to counteract some of its deficiencies.

We expect interest in free market buildings to continue despite reports of leveling rents in New York City and the rest of the country. The mad dash to deploy capital outside of New York City has diminished some as investors are falling back on the staying power and depth of the market that the city provides.

Affordable housing, which has performed well in the past few years, continues to remain attractive due to the downside protection in a property’s tax benefits, attractive financing options and subsidized rents. Effective October 1, HUD raised Fair Market Rents by 10% nationally to offset higher costs. These rents also determine federal Housing Choice Vouchers and rents for many state and local programs.

What is your forecast for 2023?

Market volatility will continue to make it more difficult for owners to achieve full value on a sale or a recapitalization. Those who do not need to sell most likely will not. Those who are driven to transact may look to push values by being more lenient in giving seller financing to combat a fragile lending environment, or replacing existing debt with a new loan that provides as much flexibility as possible over the next five years. For example, many of our relationships have shifted their focus from 10 year debt to 5 year loans or loans that have minimal prepayment penalties.

We are already seeing lenders entertaining pragmatic solutions for distressed properties so we anticipate an increased volume of structured deals due to a combination of HSPTA regulations, inflation and high leverage financing that can’t be replaced. Optimal results for the stakeholders in these scenarios will be achieved when both lenders and borrowers are realistic on value and working pragmatically together to achieve the desired exit.

Based on how quick the turns in our market have been in the last few years, it is hard to predict anything with confidence. The hope is that macroeconomic pressure points will incrementally resolve over the course of 2023 and a more stable environment can be in view by the latter part of the year. It is fair to say that it should be an interesting year.

For more articles on the future of capital markets click here