Presented By: GPARENCY

GPARENCY’s Live Listing Directory is Rapidly Expanding

GPARENCY is a premier commercial mortgage brokerage taking borrowers from term sheet through close, and offering its clients added value through tools like their Live Listings Directory over an interactive map. Find out more on gparency.com.

GPARENCY, a premier commercial mortgage brokerage firm, has seen rapid growth in the eight months since launch, closing hundreds of millions of dollars in deals. GPARENCY has gained growing popularity for their ability to allow mortgage brokers to close financing deals at their cost of $11,000. Partner Insights spoke with Ben Schweitzer, GPARENCY’s chief product officer and co-founder, about how the firm is reinventing the value a mortgage broker can bring to the table.

Commercial Observer: Tell me about the Live Listing Page GPARENCY is preparing to introduce.

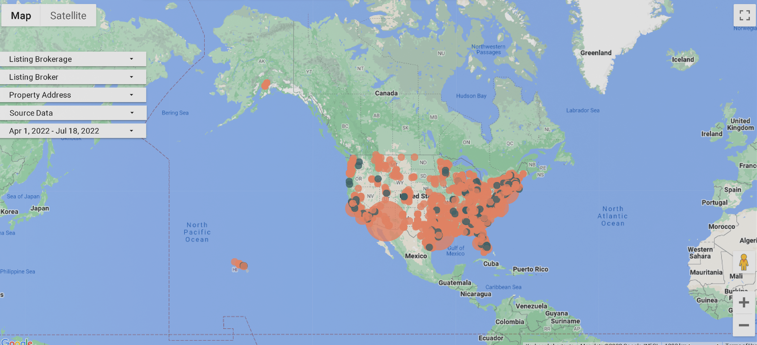

Ben Schweitzer: We are offering a map-centric view to all commercial real estate listings for free. Certain companies in the market — LoopNet and Crexi, most notably — provide some of this technology. We are not looking to replace these companies, we’re looking to be the central source — the first mile for the commercial real estate owner. So, let’s say you own commercial real estate. You have properties that need financing and you’re looking to acquire new ones. This map will show you the properties you own in relation to new properties you might want to acquire. We then give the owner access to the listing brokers and provide the financing associated with it, which is really our sweet spot — matching commercial real estate owners with capital sources. The listing product is just a means to centralize that process for commercial real estate owners through best-in-class map technology. The beta version of this is accessible on our website now, and by the end of the third quarter, we’ll have a significant enhancement to the mapping technology. We’re building features that will make these searches a lot more powerful.

Given the nature of these products and how quickly they’re evolving, what do you expect your service to look like a year from now?

I expect that every commercial real estate owner will start their day checking out GPARENCY for the latest information on those properties instead of going to Google Maps — especially properties they might want to acquire, or their own properties. We will become the search engine of commercial real estate.

Tell me about the team at GPARENCY.

I used to run innovation and data strategy at Freddie Mac, and part of my job was to interact and partner with all the financial technology companies in the market. So I’m very familiar with a lot of the CRE tech industry. What makes us unique is that we have a mix of commercial real estate transactional professionals, including a new Large Loan division, plus originators, brokers, processors and underwriters, and a growing technology team. A lot of companies have one or the other, but having that mix of both is incredibly important. We are building a best-in-class technology team that includes our CTO and product teams.

Is there anything else you think is important for people to know regarding what you’re working on right now?

Given the pending recession, we’re always dealing with the challenges inherent in securing financing and looking for cost-effective ways to find transactions and obtain capital. That’s our focus. For your readers who share these concerns, they should check us out, because that’s the space we’re playing in.

How did a novel approach to lender relationships help establish GPARENCY?

I look to examples in adjacent spaces like LendingTree on the residential side: “When banks compete, you win.” That’s similar to what we’re doing on the commercial real estate side with lenders. What really makes us novel, for commercial real estate, is that our co-founder, Ira Zlotowitz, was the co-founder of a Top 10 mortgage brokerage that did over $5 billion annually of transactions with commercial real estate owners on one side and lenders on the other. He had those relationships. Then I came from the technology side and the lending side, building lending programs. That technology pedigree allows us to provide even more value to borrowers.

Exactly how does GPARENCY’s approach to lending relationships help borrowers close deals at better rates?

We have profiles on over 3,000 lenders across the nation, so no matter where the property is, we can narrow down the list and have our team reach out. No other brokerage firm or lending intermediary has collected the depth of data we have on lenders and their offerings. We’ve already closed with over 200 of those lenders in the last 12 to 18 months, so our numbers are based on actual activity, not just what they tell us — it’s not about what you say, it’s about what you do. We are validating our profile data with transactional data.

We also offer free services on our website to any current or aspiring commercial real estate owner. They enter their acquisition preferences, and we’ll match them to the optimal lender. That’s really unique. This is the transparency element of GPARENCY that we offer to the public — comprehensive information on 3,000 lenders — and it’s only going to evolve. Let’s say you transact in Omaha, Neb. We know how many lenders are transacting in Omaha, and how many took a quote and were able to close that quote in that market. This is one of our unique values to borrowers — the openness of that data. Equitable access for everyone.

To sum up, why should general partners turn to GPARENCY over your competitors?

Two reasons. One, we’ll get you the most optimal structure for commercial real estate capital. And two, we’ll save you transactional costs via our low-cost subscription model. We have the ability to tap into 3,000 lenders and get you the best deal. We can do that to see what’s out there in terms of offers, or we can take you all the way to close.