Triple Net Lease-Focused Fyxt Secures $4M Series A Funding

Cloud-based proptech startup aims to optimize NNN management operations

By Philip Russo May 24, 2022 9:00 am

reprints

Looking to fix triple net lease tenant operations issues, proptech startup Fyxt announced Tuesday that it has secured $4 million in Series A funding, led by RET Ventures, with participation from U.K.-based real estate billionaire David Reuben.

Founded in 2017, the Venice Beach, Calif-based company is focused on what Fyxt CEO and founder Ryan Botwinick described as the previously unaddressed triple net lease real estate sector.

“We saw a significant void in the market for triple net industrial logistics, what we’re coining as essential assets,” Botwinick said. “Basically, they’re assets that have modified leases, where tenants are responsible to maintain the asset and the space that they’ve leased. We saw a significant increase due to COVID, where digital consumer demand went through the roof. There was a significant increase in tenant demand for these types of assets.”

In the U.S., industrial NNN properties are on track to have a banner year in 2022. As supply chain volatility and online shopping continue to drive demand, industrial real estate is expected to grow by an average of 350 million square feet in each of the next five years, for a total of 1.8 billion square feet of new industrial properties, according to a report by Yardi Matrix.

“Over the past 20 years, triple net industrial, manufacturing and logistics hasn’t quite been at the top of the totem pole,” Botwinick said. “Traditionally, owners and landlords have been okay with underwriting to rip out the guts of a triple net asset after a 10-year lease is up. That’s not the case anymore. Leases are longer, rents are rising up to 20 percent per annum, and the actual amenities, ease of use and the tools that are being provided to these tenants were non-existent over the past decade.

“We focused on triple net quite frankly because the multifamily in the true gross leases, office and whatnot, were saturated, especially in the residential sector. When you have a straightforward gross lease, it’s easy to have a workflow for maintenance [or] a tax event, [but] when you have modifiers that are specific to lease negotiation, that’s where it becomes difficult.”

Botwinick says Fyxt is designed to work with legacy systems that were not built to communicate with additional modules, leading the startup to build its own “platform agnostic, open API, to be able to integrate with these other softwares.”

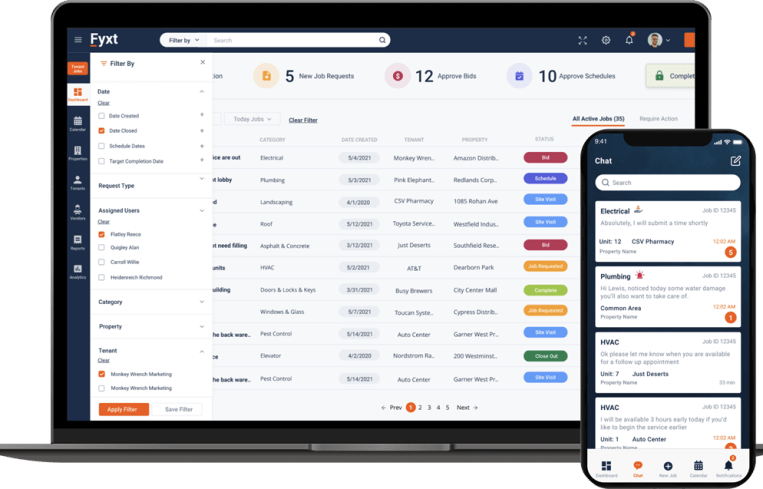

Fyxt has a suite of integrated cloud-based software tailored to the management of essential assets across logistics/industrial, healthcare, retail, and other historically net-lease environments, according to the company. It is most commonly deployed among NNN industrial assets, allowing warehouse, retail, medical and other NNN asset owners and operators to more efficiently run capital cost analyses and manage operations.

To date, Fyxt has “contracted 35 million square feet” of property, Botwinick said. “We’re active in about 15 million square feet of that and rolling out to the rest over the next two quarters.”

The startup already has grown nationally from its west coast roots, Botwinick said, “which actually was surprising. We have a big footprint in the midwest, in the Detroit and Chicago regions, as well as southern California.”

As for what Fyxt will do with its latest funding, Botwinick said: “We’re past the point of proof of concept and we’re growing at a good rate. We want to pour fuel on the fire and be able to build out a sales team. In addition to that, [adding] product managers and engineers into the Fyxt ecosystem, and have a physical presence at conferences, to be able to go out to market appropriately, which is one of the reasons why we decided to go after the venture funding with RET Ventures.”

For its part, RET said Fyxt’s uniqueness was what made it attractive.

“We are consistently hearing about the need for intelligent tools to optimize the operations of NNN properties, and Fyxt is one of the only technology products built specifically for this use,” Christopher Yip, partner at RET Ventures, said “We expect Fyxt to continue to make monumental strides in the industry, streamlining operations, reducing costs and boosting NOIs for owners of NNN properties.”

Philip Russo can be reached at prusso@commercialobserver.com.