JLL Facilitates $85M Financing for 12-Building Industrial Acquisition by MDH

By Keith Loria May 2, 2022 3:02 pm

reprints

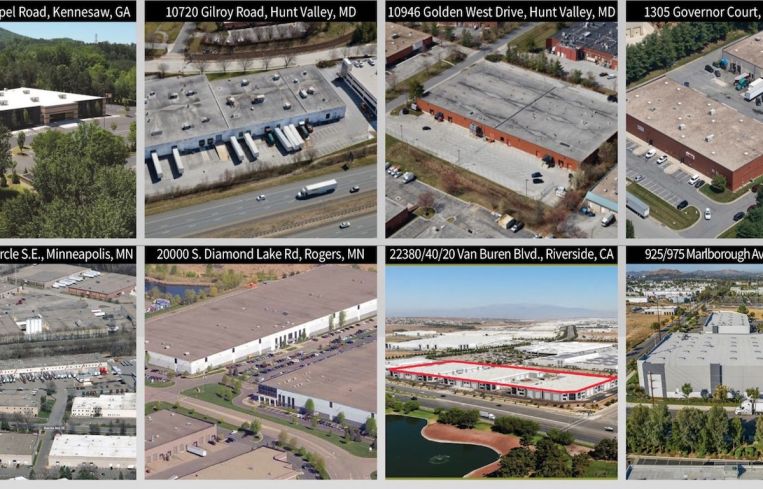

MDH Partners has secured $85 million in acquisition financing to purchase a last-mile industrial portfolio spanning 12 buildings in Maryland, California, Georgia and Minnesota.

The properties were acquired as separate transactions from numerous institutional sellers.

JLL facilitated the loan on the fully leased 814,888-square-foot portfolio, arranging a five-year, floating-rate, interest-only, nonrecourse loan with Truist.

All the properties in the portfolio were built between 1977 and 2019 and are occupied by a total of 20 tenants, with an average leasing term of 10.5 years, according to JLL.

“The geographic diversity was an important factor, it gave the lender the ability to deploy significant capital into the industrial space while taking limited exposure in a single market,” Maxx Carney, a senior director with JLL, told Commercial Observer.

No tenant comprises more than 22 percent of the total portfolio’s base rent.

The four properties in Maryland include 10720 Gilroy Road and 10946 Golden West Drive, both in Hunt Valley, and 1305 Governor Court Buildings A and B in Abingdon.

The Southern California portfolio consists of five buildings in Riverside; the two Minnesota buildings are located at 740-760 Kasota Circle in Minneapolis and 20000 S. Diamond Lake Road in Rogers; and the one Georgia property is at 1875 Greers Chapel Road in Kennesaw.

“MDH Partners is committed to its superior acquisition strategy in key growth markets across the country,” Arun Singh, CFO of MDH Partners, said in a statement. “The closing of this loan strengthens our credit profile by providing access to capital, granting us enhanced flexibility in the dynamic industrial market. We look forward to building our relationship with Truist as we deploy capital to grow our diverse portfolio.”

Carney noted it was a savvy financing opportunity as the buyer aggregates industrial product of multiple profiles as a risk diversification and scaling strategy.

“Further, the composition of this portfolio enabled the buyer to offset such low cap rate transactions such as the Inland Empire portion of the portfolio with (relatively) higher cap rate deals in markets like Minneapolis to create a weighted average yield that got them exposure to uber core markets while still getting a yield premium,” he said.

The loan marks Charlotte, N.C.-based Truist’s third industrial financing with MDH.

Joining Carney on the JLL team were Chris Drew, Jimmy Calvo, Robert Carey, Brock Yaffe and Eric Boucher.

Update: This story originally misattributed source material. This has been corrected. We apologize for the error.

Keith Loria can be reached at Kloria@commercialobserver.com.