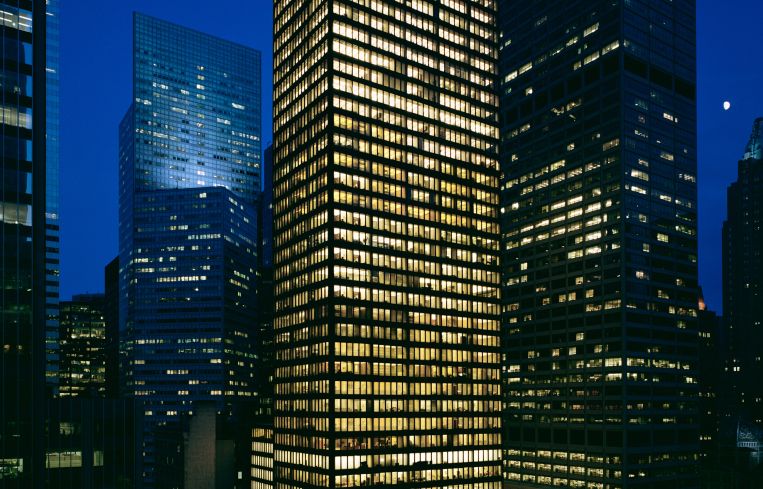

Wealth Management Firm, Financial Consultant Among Wave of Leases at Seagram Building

By Celia Young December 6, 2021 6:18 pm

reprints

Wealth management firm Ehrenkranz Partners and financial consultant Investindustrial inked deals for a total of 27,097 square feet at the Seagram Building in two of the biggest recent expansions and new leases at the RFR Realty property.

Ehrenkranz snagged 17,519 square feet across the entire 21st floor of the approximately 850,000-square-foot building in a 10-year lease. Asking rent was between $160 to $170 per square foot for the wealth manager and Investindustrial, according to a spokesperson for RFR.

Ehrenkranz plans to start building out its space in the 38-story building at 375 Park Avenue on Jan. 1. The firm has occupied space in the Seagram Building for several decades, according to RFR.

“The Seagram Building has been a wonderful home, and we expect a bright future here,” Joel Ehrenkranz, founding partner of Ehrenkranz, said in a statement. “We appreciate that RFR continues to invest in a competitive and desirable building.”

Investindustrial, which has occupied space in the building since 2010, has taken 9,578 on the 26th floor, which will more than double its space at the 375 Park Avenue property. Investindustrial also plans to relocate on Jan. 1, according to RFR. Both deals closed last week.

“The ability to provide employees with amenities that amaze is exceedingly important to high-end office users today,” AJ Camhi, who represented RFR in the deals, along with Paul Milunec, said in a statement.

Camhi added in the statement that the building’s new 34,000-square-foot amenity portion, dubbed “Seagram Playground” helped convince both Ehrenkranz and Investindustrial to stay at the building. The complex includes courts for several sports, a rock climbing wall, a town hall for larger events and smaller multipurpose rooms.

CBRE’s Mary Ann Tighe, Ben Friedland and Tamika Kramer represented Ehrenkranz and CBRE’s Justin Aronson and NYC Realty Advisors‘ Thomas Birnbaum represented Investindustrial. CBRE declined to comment on the deals.

The landlord also signed several new smaller tenants in the building: private equity firm CapVest, which took 3,280 square feet; investment company Decheng Capital, which snagged 2,011 square feet; Pantera Capital, an asset manager specializing in cryptocurrency, which inked a deal for 3,180 square feet; and real estate developer Skyway Equities, which took 2,251 square feet.

Financial planner Brant Point Capital and Ontario Teachers’ Pension Plan both renewed the companies’ spaces, for 5,473 square feet and 2,953 square feet, respectively.

JLL’s Ben Bass and Harrison Potter represented CapVest. Cushman Wakefield’s Brian Weld handled it for Decheng Capital. Colliers’ Jack Senske and Sheena Gohil brokered the deal for Pantera Capital. Prime Manhattan Realty’s Jonathan Anapol represented Skyway Equities.

Together, the recent deals in the Seagram Building totaled around 46,000 square feet.

Update: This story has been updated to include NYC Realty Advisors’ Birnbaum, who represented Investindustrial in the deal.

Celia Young can be reached at cyoung@commercialobserver.com.