CMBS Special Servicing Rate Improved in June, Manhattan Led New Wave of Troubled Loans: Trepp

By The Editors July 16, 2021 12:44 pm

reprints

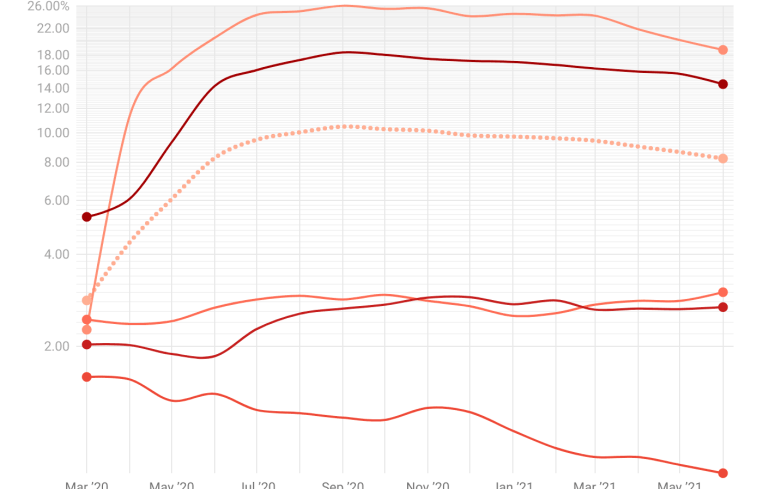

“The Trepp commercial mortgage-backed securities (CMBS) special servicing rate maintained its strong downward movement in June, helped by the U.S. economy continuing to make progress toward a full reopening. The overall reading dropped by 41 basis points to 8.24 percent last month, making it the ninth consecutive monthly decrease. With firms reevaluating their need for office space and finalizing plans to bring employees back to work, there appears to be a notable pickup in special servicing transfers for office and mixed-use loans, especially those in major gateway cities,” wrote Catherine Liu, an associate manager at research firm Trepp.

“By property type, the reduction was the most pronounced for the hardest hit lodging and retail sectors, which posted a month-over-month reduction of 143 basis points and 116 basis points, respectively. About 18.68 percent of lodging loans and 14.43 percent of retail loans were in special servicing according to June remittance data.

“The percentage of loans on the servicer watchlist climbed to 27.48 percent in June, a rise of 97 basis points from May’s tally. The watchlist rate has now increased for six consecutive months as loans removed from special servicing were later added to the servicer watchlist for continued surveillance. Lodging (+1.66 percent to 65.66 percent), office (+1.75 percent to 16.74 percent), and retail (+1.66 percent to 25.13 percent) represented the largest monthly declines, while the industrial watchlist rate fell 3.15 percent to 11.23 precent.

“Roughly $1.28 billion in CMBS debt across 36 notes were transferred to special servicing in June. CMBS loans backed by Manhattan office, lodging and mixed-use properties comprised nearly 50 percent of last month’s transfer balance.

“The $220 million 850 Third Avenue loan (whole loan balance) — which is backed by a 600,000-square-foot office in the Midtown East section of Manhattan — was the largest loan sent to special servicing last month. The property backs the single-asset NCMS 2017-850T deal. The floating-rate loan is slated to mature next month but has embedded extension options that could push the maturity out to 2023. Year-end 2020 financials on the loan showed occupancy at 57 percent after top tenant Discovery Communications vacated the collateral after its lease expired in May 2020.

“Other noteworthy transfers for June include the $205.5 million loan backed by the 1.3 million-square-foot Tucson Mall in Arizona (BBUBS 2012-TFT); the $170 million loan secured by the Empire Hotel in Manhattan (GSMS 2013-GC10); the $160.3 million loan on the Town East Mall in Mesquite, Texas (BBUBS 2012-TFT); and the $124 million collateralized by the Gansevoort Park Avenue hotel in Manhattan’s Meatpacking District (CGCMT 2012-GC8 and GSMS 2012-GCJ9).”

Access Trepp's full report here.