Incentive Hunters: New Proptech Platform Uncovers Hidden CRE Funding

REDIST launches in September and will uncover hidden government tax incentives

By Cathy Cunningham July 14, 2021 12:26 pm

reprints

Among the most archaic, opaque, convoluted and labor-intensive processes in development is finding real estate incentives.

It involves knowing byzantine laws and regulations; it involves expensive lawyers and understanding politics on various governmental levels. In short, it’s extremely difficult. And extremely ripe for a proptech fix.

REDIST — founded by entrepreneurs Atif Qadir and Jonathan Kuo — launches in September, and aims to help developers and investors find available incentives for a property’s specific address at any point in the deal’s lifecycle, regardless of asset class.

Those incentives, though widely available, are often as difficult to locate as a truffle in a Norwegian forest, hidden deep below layers of city, state, and federal cloaks and daggers. REDIST simplifies, clarifies and digitizes the process — removing the significant leg work that normally goes into the hunt.

And, the opportunity is significant.

In the U.S. alone, public funding in the form of real estate incentives is available to the tune of around $100 billion per year — yes, you read that correctly — much of which goes to waste as it’s never utilized. Within the 18 geographies that REDIST currently covers — with more being added all the time — Kuo and Qadir have already uncovered 2,100 incentive programs for real estate industry use, including for new construction or rehabilitating existing buildings.

The problem, now being addressed by REDIST, is you don’t know what you don’t know.

“Developers can be really tenured in a specific area and know the existing programs around, say, opportunity zones or energy rebates, but if they’re new to an area doing due diligence, there’s no clear or single source to find that information,” said Karen Hollinger, senior vice president of strategic initiatives at Avalon Bay, an apartment real estate investment trust. “While some of the bigger programs are better known, the hyper-local programs are far from transparent.”

Real estate guys

REDIST’s founders have deep histories in real estate development and finance, and are keenly aware that they’re now taking the road less traveled with the platform’s launch.

“So much of the innovation in our industry, in terms of proptech, is driven by outsiders — people that worked at Google or some other company,” Kuo said. “There is rarely an internal motivation in someone who’s an analyst, associate, or principal to take a detour in their career and start a business. That’s not the norm. The path is: You become a partner, you get the golden handcuffs, you get your house in the Hamptons, your apartment on the Upper East Side, and you never leave. And that path is fine, but there’s one problem: It doesn’t drive our industry to change.”

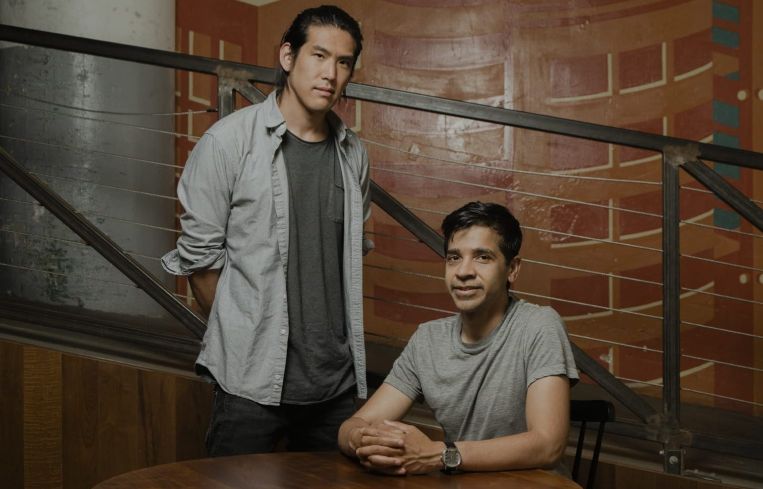

“We’re not tech bros, even though we wore t-shirts for this photoshoot,” Qadir said. “We’re real estate guys — and our industry needs to get with the times. We can’t continue to outsource innovation to someone outside.”

Qadir is an architect turned developer. After studying at MIT and Columbia Business School, he got his start as an intern at Rafael Viñoly Architects, before taking roles at Gwathmey Siegel Kaufman Architects, Turner Construction and Extell Development. In 2017, he founded development firm Amanat Properties, and was also appointed a city planning commissioner in Hoboken, N.J.

“Those last three experiences were the impetus in identifying a gap and realizing that public financing for real estate incentives was a huge problem — but a huge opportunity as well,” Qadir said.

Kuo attended the University of Pennsylvania, with a dual degree in finance and computer science. He initially pursued a more traditional Wall Street route, graduating from The Wharton School and landing at Goldman Sachs. He then hopped around a few hedge funds, focusing on long and short equity positions, primarily in the internet and media sectors.

In 2014, he started a company focused on bringing more efficiency to New York City’s property leasing process, before returning to the private investment side and becoming one of the first investors in Qadir’s development activities.

Over time, the two got to know each other and identified a major gap in development financing.

“Atif had had a lot of experience with incentives through the tall stack of experiences that he’d worked through,” Kuo said. “But, even with his level of sophistication, it wasn’t easy to identify and utilize the incentives that would give us a little bit of juice to get a deal done. So, in many ways, the genesis of all this was a desire to accomplish what we were trying to do a little bit more efficiently.”

Conversations with peers in the development space underscored that they weren’t alone — others were facing similar difficulties. Incentives were undeniably hard to uncover, regardless of a company’s size or scale — although smaller developers, with less manpower, struggled the most.

And, the REDIST business plan was officially validated: to use a combination of human capital and artificial intelligence to find, translate and organize non-traditional data sets — in other words, data types for which there’s no common industry standard collection or processing procedures — for available real estate incentives.

While data on city, state and federal incentives can be scraped to some extent, “non-traditional data sets are ones that are not scrapeable,” Kuo said. “It’s a huge, human capital lift to gather and process this information in a way that is useful, searchable, filterable and estimable.”

REDIST aggregates all relevant incentive information for a specific property address, curating and sizing an incentive bundle within one search, and its process is repetitive — meaning that the software reviews and refines data constantly, with any given incentive being reviewed and updated as needed roughly once per month.

The platform attracted 30 investors in its pre-seed round, the majority of which are in the real estate industry — including private equity firm Clear Mountain Capital — plus seven additional investors in the seed round, including housing-focused venture capital firm Hometeam Ventures and hedge fund Park West Asset Management.

REDIST’s team of seven operates out of the Columbia Startup Lab at 175 Varick Street.

“For so long, the focus of venture capital in real estate has been on [the] shared economy,” Qadir said. “It’s like, ‘God, do we have to hear about WeWork again? Do we have to hear about Airbnb and Sonder again?’ But, the two areas that have been most under-financed, from a venture capital perspective, in our industry are design and construction and finance. And it’s high time that changed.”

The most common incentives are property tax abatements, federal income tax deductions and low-interest financing for affordable housing. But, the funding is not just government driven; it can also be pseudo-public-private, such as a utility incentive, or funding from a private party that really wants a firm to invest and develop properties in his or her town. Affordable housing and energy-efficiency incentives are the cornerstone of the REDIST platform, however.

“The only thing that’s common amongst all of it is nobody has any fucking clue how to find [incentives],” Qadir said.

Testing tech

“I was introduced to the team by a partner of mine who works at Empire State Development,” Johanna Anderson, executive director of nonprofit developer Ithaca Neighborhood Housing Services, said. “She said, ‘I heard about this new group, and they’re wonderful entrepreneurs.’ So, we sat down virtually and they gave me a 15-minute demo of the platform. It was extraordinary — I’d never seen anything like it.”

She’s now representing nonprofit developers in REDIST’s beta testing, and one aspect that appeals is the removal of the grunt work in incentive hunting. When you click on an incentive, a screen automatically pops up with an email address to contact, the regulation that made it possible and the links to apply.

“The reason that I find it really groundbreaking — no pun intended — is that organizations, whether nonprofit or for-profit, are relying on a human to find funding and put deals together,” Anderson said. “Some humans are really good at searching, and some humans are not so good. And, some organizations just like to use the same old chunks of funding sources, rather than spending hours finding others. Something like [REDIST] can level the playing field for all developers, because it becomes a matter of, ‘Okay, this is available, and this is what I need to go apply for now.’”

Anderson also believes that the platform could encourage more interesting projects: “You could find a $50,000 incentive for including a particular component into a development that you may not even have considered before.”

Avalon Bay’s Hollinger gave the simpler example of an electric vehicle charger, which “there are a ton of programs for that few know about.”

Of course, knowing what funding is available and whether your project qualifies for an incentive should be as easy as going to a website. But, even the largest developers have to hunt and have somebody, such as an analyst, manually traversing the incentive matrix in each city and state. Smaller firms often don’t have the luxury of that analyst.

“I think there’s always a sense that you’re missing something, and that you forgot to look in that one place to find it,” Anderson said. “With affordable housing, we are always filling gaps, and when we can’t find an incentive or some sort of subsidy, well, then it’s just our own cash that goes into the deal.”

The problem, Kuo said, is there’s no legal or financial motivation for agencies that offer incentives to actually coordinate with each other and make things more transparent. Second, the way government officials approach the incentive process has a lot to do with the generation they’re part of, he said. Those who work in economic development are primarily baby boomers, while 40 percent of the U.S. workforce and an increasing number of decision makers in the real estate industry are millennials and Gen Z — who approach the collection, identification and analysis of information a little differently.

“I’ll give you an example,” Kuo said. “One particular municipality that we won’t name requires that you call them, then travel to their City Hall to meet them in person, so they can physically give you the information in paper form on their town’s incentives and their eligibility.”

Kuo and Qadir considered the problem in the context of their own struggles in finding tax incentives for New Jersey and trying to access different grants or financings.

Further, moving quickly in deals today is critical. “So, if your deal can only be done with use of an incentive,” Kuo said, “you can’t have an analyst wading through dozens and dozens of different potential incentives — because, by the time you figure it out, the deal’s done.”

“At first, I had no idea how massive the problem of gaining access to developer incentives was,” Julieta Moradei, a partner at Hometeam Ventures, said.

An investor in REDIST, the Hometeam group realized the magnitude of the problem when they began interviewing top developers across the country in its due diligence of REDIST’s platform.

“One hundred percent of them said this process was a problem, and they either have a team whose full-time responsibility is to find and apply for incentives, or they aren’t large enough to have someone dedicated to this. This causes major conflicts of inequality for small-to-midsize developers,” Moradei said.

Further, when it comes to the affordable housing market, tax incentives are the number one resource for developers to break even on building affordable housing units, Moradei said.

Without them, they’re unable to hit their base margins, leading to a massive lack of supply of developers incentivized to build affordable housing.

“This is one of the many factors causing our housing crisis to accelerate yearly,” she said. “We believe that by enabling access to incentives, existing developers that have affordability as part of their portfolio will be incentivized to scale this vertical in their business, and we will see new entrants in the market of affordable housing — developers who previously weren’t able to break even on these types of projects.”

REDIST first began with the development of a “minimally viable product” in 2019. The initial focus was on the New York area, with Qadir and Kuo looking at properties with a simple question: Would it be possible to put in an address and learn everything that you need to know about available incentives for that property?

“Our hypothesis was, yes — so we went ahead and built it in ‘A Beautiful Mind’ style at a coworking space,” Qadir said. “We showed it to 100 people in 100 days, because the way that we like to build is fast and furious, then we break it and build the next iteration. There’s no use in sitting around for five years, percolating on some ideas.”

Dynamic duo

As far as their working dynamic goes, Qadir is the business-savvy founder with deep industry relationships, while Kuo is the technical founder whose brain is continuously working overtime to level-up its technology, impact and scalability.

As two men of color leading a real estate-focused platform, Qadir and Kuo have noticed some interesting — and unfortunate — trends during REDIST’s fundraising process.

“What we found is that our likelihood of getting money was twice as likely if the decision maker was a person of color, or a woman,” Qadir said. “Think about what that means when 80 to 85 percent of the decision makers of major venture capital firms are white men. The crazy part is that we’ve collected everything that you’re supposed to — a boatload of Ivy League degrees and experiences at fancy New York firms — yet, we’re still in the lobby of the clubhouse.

“So, imagine all of those people that don’t have all of this behind them, who could have the next brilliant idea that changes our industry, but they’re not part of the pattern that decision makers follow.”

Qadir was born in Bahrain and arrived in the U.S. in 1984, his family refugees of the Iran-Iraq War. He has a photograph of his family at Bahrain International Airport (also known as Manama Airport) before they departed, with “three suitcases and $3,000.”

His first day of school in Hackensack, N.J., was Halloween. “Nobody told me ahead of time what this was, and the entire class showed up in costumes and fake blood, so — interesting start,” he recalled.

Kuo’s grandparents fled from the communist revolution of China. His parents were born in Taiwan and moved to Arizona, where he was born before moving to Washington state. “They got here and managed to excel, despite growing up in poverty,” he said. “My parents worked extremely hard and made tremendous sacrifices, so that both my sister and I had a pathway to the best schools.”

Both are driven by their ability to digitize an analogue system that “just doesn’t work or make sense,” Moradei said. “They are both working around the clock to fix a massive problem in our industry.”

Of course, there is a price attached to the solution. Subscription is $5,000 per month, with discounts for customers buying for the year ahead of time. REDIST also has an alternate “per lookup” pricing model for small to mid-size customers.

“But, the way that I look at it is: If I’m hiring a development consultant to do a project, they’re getting about 2 to 3 percent of the total development cost as their fee, and with a $20 million project, that’s a huge chunk of money,” Anderson said. “So, the idea of paying $750 to figure out what’s possible for a deal? That’s very affordable.”

And she hopes the significance of the REDIST platform isn’t lost on its creators.

“I keep wanting to ask them, ‘Do you understand what a big deal this is or what you’ve created? Do you see how this is going to change everything?’” Anderson said. “When I told my own real estate development team about the initial conversations, they were in disbelief, saying, ‘No, it can’t be this easy. It can’t be!’ For us, it kind of feels like a kid in a candy shop.”