Location Data Firm Placer.ai Raises $50M in Series B Round

By Nicholas Rizzi April 27, 2021 8:00 am

reprints

Location data provider Placer.ai raised $50 million in a Series B round to expand its offerings and grow its team, the company announced Tuesday.

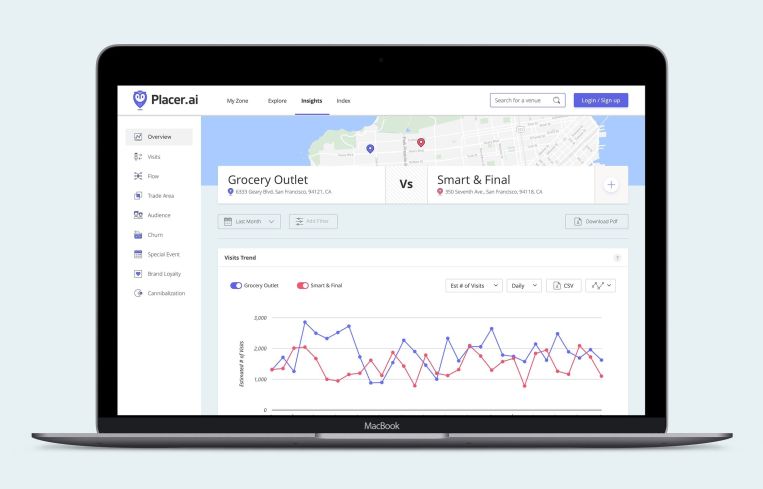

Placer.ai, which compiles foot traffic information for public places, plans to use the funds to invest in research and development to add more data sets and new analytics to its platform, said Noam Ben-Zvi, co-founder and CEO of Placer.ai.

“We always saw mobile location data at the beginning for when our customers have questions on ‘Where should I open the next location?’ or ‘Should I go to the next market?'” Ben-Zvi said. “Now, we can bring on more data sets and more reports: crime, credit card data, weather data … to answer all those same questions.”

The Silicon Valley-based Placer.ai was founded in 2019 and uses data mainly derived from shoppers’ cell phones to understand traffic patterns at public places, including malls and airports. It closed on a $12 million Series A round early last year.

Placer.ai’s main clients have been brokers, landlords and retailers looking to open new outposts, but since the coronavirus pandemic put even further strain on an already reeling retail market, Ben-Zvi expected the startup to suffer as well.

“Initially when the pandemic started, of course, we panicked and froze like everyone else,” he said. “We quickly learned that our data helped people understand the turbulence and the change.”

Ben-Zvi said the company tripled its customer base and started to attract new types of clients, including hedge funds. While the company tries to roll out new features monthly, the new fundraising round will “just help us do it faster,” Ben-Zvi said.

Placer.ai also plans to use the money to hire more sales and marketing staff, and it wants to increase its headcount from 160 employees to 300 within a year, Ben-Zvi said.

The Series B round was led by independent angel investors Josh Buckley, Todd Goldberg and Rahul Vohra. Venture capital firms Fifth Wall, JBV Capital and Aleph VC also participated in the fundraising.