Presented By: VTS

VTS Survey: 85% of Landlords Uncertain About Tenant Needs for Office Return

VTS, the commercial real estate industry’s leading leasing, marketing and asset management platform, has released a global survey of office landlords showing that while landlords are working hard to bring tenants back to the office in a COVID-safe environment, there is mass uncertainty about exactly which measures will best accomplish this and which are most desired by tenants.

For the “2021 VTS Global Office Landlord Report,” the company partnered with an independent market research firm to survey senior leaders, all with budgetary authority, at 154 office landlords representing 5.3 billion square feet of commercial assets.

The survey found that only 6 percent of landlords trust their data sources due to lagging indicators, and that 85 percent don’t feel confident they fully understand the investments or features needed to bring tenants back to the office with a secure feeling of safety.

The key for landlords to solve this issue, from VTS’ perspective, is better information across the board, as well as making the right investments in tech, marketing and data.

“Our industry is grappling with the biggest recession and public health crisis in our generation, and we don’t expect those challenges to disappear anytime soon. It’s never been more important for industry leaders to share information and best practices for the greater good of the industry,” said Nick Romito, CEO of VTS.

“This new research indicates that, for the foreseeable future, commercial office landlords will need to proactively manage their business recovery, continue to focus on and even reinvent tenant relationships, and modernize their operations if they are to emerge from COVID in the best position possible,” he added. “Ultimately, the landlords with the right technology, data, and marketing investments will be the ones best positioned to win during the pandemic and beyond.”

While continuing to navigate the pandemic, the main priorities of landlords include maintaining tenancy across their portfolios and mitigating COVID’s financial impacts, and 77 percent of landlords agree that technology is critical to meeting these goals. Eighty-six percent believe they do a good job of engaging and communicating with their tenants currently, and 64 percent have technology in place to track those relationships and interactions.

Yet, despite this, only 20 percent of landlords feel they have full clarity into exposure to tenants at risk of economic failure, and just 15 percent are sure they have adequate visibility into what investments or features tenants require in order to safely return to work during COVID-19.

That said, landlords are making the investments they feel will be most likely to enable the safe return of their tenants. The most common investments made by landlords throughout the pandemic have included air filtration systems, touchless building entry, and building management systems. In addition, 65 percent of landlords anticipate lease terms for new tenants will be shortened in 2021, while 64 percent say lease terms for tenant renewals will also be shortened, and 68 percent say that providing flexible leasing options will become a more important part of their leasing strategy this year and beyond.

In addition, 45 percent of landlords surveyed say tenants’ space requirements will decrease overall, despite 49 percent believing that space-per-employee requirements will increase this year due to social distancing measures brought on by the pandemic.

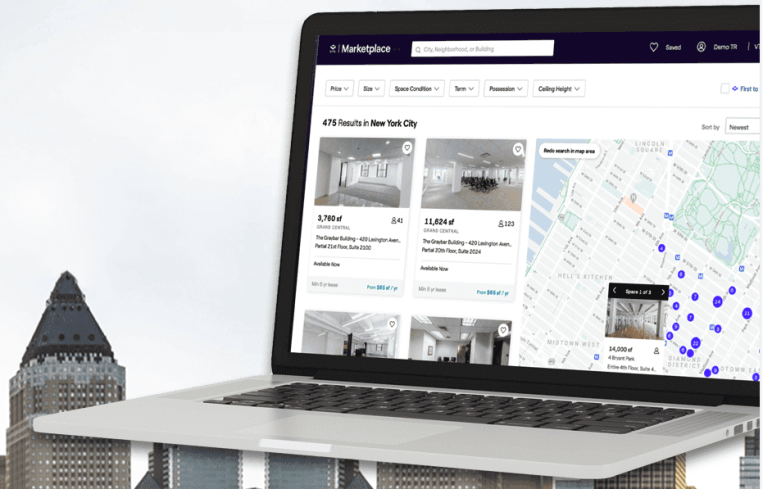

The survey also highlighted the need to meet tenants online when marketing spaces, with 73 percent of landlords believing that digital marketing will be crucial post-COVID, and 60 percent saying that tenants expect to virtually tour a space before committing to look in person.

The adoption of proptech is perceived to be so essential for office landlords that it has far eclipsed new hiring as a priority, with only 32 percent of landlords seeing hiring — with an emphasis on leasing managers, asset managers, and analytics/data and research professionals — as a business need for 2021.

Other significant anticipated investments for the year among office landlords include data and analytics software, asset management software, property management tools (including tenant experience and smart building technologies), virtual tour technology, online marketing technology, and digital photography and video content.

In another sign of a shifting commercial landscape, the percentage of landlords who expect to dedicate more than 10 to 20 percent of their portfolios to flexible space in 2021 has more than doubled since 2020, jumping from 19 percent last year to 48 percent now. Around 70 percent of landlords, meanwhile, believe that flexible space options will be a more important part of their leasing strategy post-COVID, and anticipate dedicating greater proportions of their portfolios to it.

“What this report makes clear is that one of the many impacts of COVID-19 on commercial real estate has been an acceleration of trends that were already unfolding within the industry,” Romito said. “Evolving tenant expectations, growing technology adoption, and the rise in digital marketing are a few key examples. We’ve seen more technology adoption since the start of this crisis than in the past three years, signaling that this pandemic has been a significant catalyst of change.”

Romito believes the findings of the survey, the company’s second in what will be an annual occurrence, can help set the stage for the sorts of progress and transparency industry leaders will need to strive for while emerging from the current crisis.

“As we navigate an environment that none of us has experienced, it’s never been more critical to share information and best practices for the greater good of the industry,” Romito said. “We’ll continue to do this research annually, so we can benchmark changes over time and offer these key insights to help CRE professionals understand how they compare to their peers.”