Whoever Wins the Presidential Election, It Won’t Upend Commercial Real Estate Returns

By Tom Acitelli October 20, 2020 11:01 am

reprints

Whoever wins the presidential election next month, the outcome won’t affect the longterm returns on commercial real estate investment.

That’s according to a new Cushman & Wakefield report, which dives back to the late 1970s to show that returns on investment for institutional investors in commercial real estate tend to do well under both Republican and Democratic administrations.

The report worked off data from the National Council of Real Estate Investment Fiduciaries Property Index (NCREIF NPI), which institutional investors in the U.S. use to gauge the performance of commercial estate. Think of it as a guide for deciding what will be a good investment and what won’t. It turns out that the NPI does pretty well whoever’s in the White House.

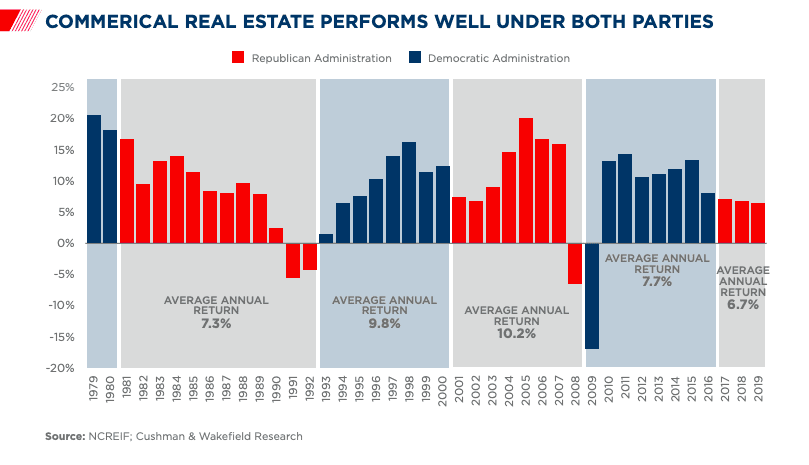

“Property has performed well under both parties,” the Cushman & Wakefield report, which in-house economists Kenneth McCarthy and Kevin Thorpe authored, said. “Since 1979, NCREIF property index returns have averaged better than 8.5 percent annually under various Democratic and Republican administrations.”

In fact, if you look at the chart below, you’ll see that the downturns in commercial real estate investment performance have come during recessions, including the one at the start of the 1990s (under Republican George H.W. Bush) and during the financial crisis of 2008-2009 (under Republican George W. Bush and Democrat Barack Obama).

To be clear, it could matter very much who’s president when it comes to how and whether to invest in commercial real estate at all, whatever the returns. Former Vice President Joe Biden has said he would tweak existing 1031 exchange rules, for instance, and he differs with President Donald Trump on the efficacy of the opportunity zones program that the 2017 federal tax overhaul created. Numerous investors have seized on the OZ program to park money in various developments to defer certain taxes.

As far as return on investment, though, the election’s outcome doesn’t matter as much as other factors—though who’s president can certainly play a role in how these factors unfold.

“Rather than elections,” the Cushman & Wakefield report said, “the real estate cycle, the economy, interest rates, COVID-19, geopolitical events, and long-term growth drivers (like demographics and technological change) are the areas to focus on in determining leasing fundamentals and property values.”