Presented By: CREXi

How Advancing CREtech Elevates the Entire Industry

When COVID rocked the commercial real estate to its core in late March, the subsequent isolation and uncertainty introduced with it an unintended benefit: the accelerated, widespread embrace of CREtech.

While CRE as an industry has hitherto been slow on technological adoption, professionals in the sector are seeing more clearly than ever how it enhances all aspects of the transaction process. The wave was already coming and, thanks to COVID-19’s pressure on transaction activity along with the inability to do business in person, CREtech’s value has proven all the more apparent. CREtech’s increasing adoption leads to a virtuous circle of technological advancements, all designed to help brokers, buyers, sellers and tenants transact on more properties with more facility and agility than ever.

The post-COVID rush of tech adoption

The massive reach of tech adoption post-COVID is by no means unique to commercial real estate. Every digital marketplace has witnessed an accelerated adoption in the last six months that would’ve taken five to 10 years to occur naturally.

McKinsey and other research firms have reported we collectively vaulted five years ahead of schedule in both business and digital consumer adoption in the first eight weeks of the pandemic. This rapid adoption is also likely to continue: In the same survey, 75 percent of users using digital channels for the first time said they would continue using these virtual tools when things “return to normal.”

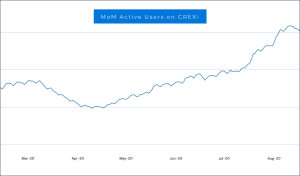

Commercial real estate is no different than other sectors in this way. On CREXi‘s marketplace, the number of active users increased 111 percent from a low point in mid-April to a recent high in mid-August. This surge in site visitors indicates an embrace of the online CRE marketplace: Principals who are currently blocked from in-person interactions turn to CREXi as an alternative method of viewing properties and connecting with brokers

Online commercial real estate tools have become an intermediary between brokers, principals, landlords and tenants to continue transactions despite social distancing. And as CRE professional become more familiar and increase their business success with these tools, they’re unlikely to set them aside once pandemic-induced restrictions are lifted.

The democratization and consumerization of CRE

Successful technology centers around building solutions and delivering them to everyone at scale. The unit cost and the marginal cost of providing functionality is minimal when you use the internet as your distribution. And it is a force that overpowers any inefficiency that stands in its way.

In particular, CRE technology succeeds with the consumerization of the product: in equipping brokers, buyers, tenants and landlords with tools that make buying, selling and acquiring commercial properties accessible to all parties. Therefore, CREtech must combine tool education with ease of use and apparent value.

Advances in machine learning and artificial intelligence come into play with developing these tools and facilitating their adoption. As CREtech develops further, buyers can, for example, more easily surface properties most relevant to their parameters and needs. In-office visits are no longer necessary when consumers can easily show interest by sending a message to a broker or a seller, or even clicking a “Learn More” button.

And, as time goes on, CREtech will provide the most accurate data without requiring thousands of researchers and manual hours of work. It’ll instead happen as a side effect of having a robust online marketplace. Buyers will be able to incorporate a vast amount of market and economy data into their investment decisions. While CREtech hasn’t fully applied the potential of machine learning to risk assessment and property valuation, these applications aren’t outside the realm of possibility.

Empowering the middleman lifts everyone

Equipping brokers with CREtech tools has contributed significantly to successfully bringing the entire marketplace into the digital world and accelerating business

Current CREtech connects brokers to buyers and tenants faster than ever, putting listings in front of hundreds of thousands of eyeballs with a few clicks. A property becomes even more attractive with easily obtained drone photos and virtual tours. Brokers can easily manage their online listings, while empowered clients — who’ve done their homework — approach a broker much further down the pipeline than before.

This hyper-targeted, late-phase connection with buyers enables brokers to truly leverage their expertise. By the time a buyer has reached out, brokers know their listing is on that buyer’s shortlist, boosting their closing chances.

Brokers’ worlds will be completely transformed a few years from now with the proliferation of CREtech. They’ll work with a much greater reach than before the internet, using technologies to manage inventory, market, access data, offer services and reach clients with increased relevance. CREtech gets your offerings in front of people who LIKE your stuff, rather than disseminating to everyone, hoping someone will bite. Even on CREXi, brokers see a 60 percent increased likelihood of closing using the platform’s complete toolset.

Together, these advancements help the CRE industry collectively trend toward democratization. Through machine learning and aggregation, CREtech is chipping away traditional barriers to entry around existing data or networking opportunities, raising liquidity higher (as properties achieve better value), and speeding transactions through simplified processes, communication and discovery.

A rising tide lifts all boats, and, despite COVID-related pauses in activity, commercial real estate is poised to thrive as CREtech transforms the way professionals conduct business.

*The below is a sample set of listings available on CREXi.com