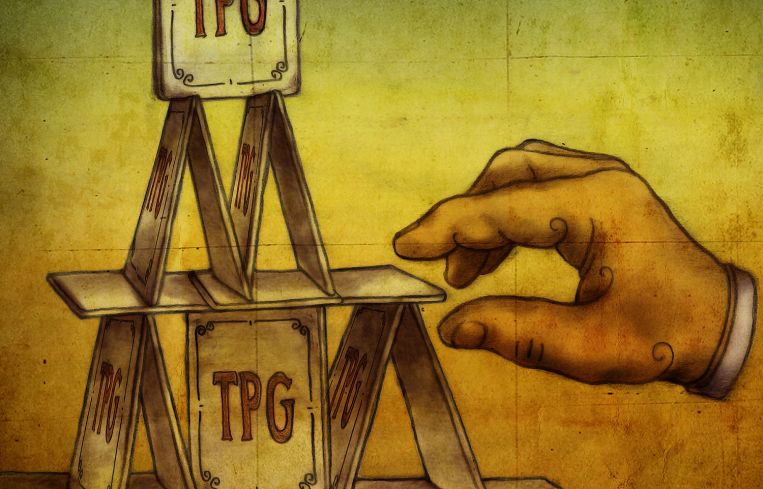

Lawsuit Claims TPG REIT Stopped Funding Loan Last Month Due to Liquidity Issues

By Mack Burke April 29, 2020 6:26 pm

reprints

TPG Real Estate Finance Trust (TRTX) allegedly stopped funding some loan advances about a month and a half ago due to financial pressure and liquidity issues brought on by the COVID-19 dilemma, according to a lawsuit filed against the TPG-affiliated mortgage REIT by one of its borrowers on April 21 in New York’s Southern District Court.

New York-based private equity real estate investor Somera Road claims advances stopped in mid-March on the $60.2 million first mortgage loan it received from TRTX on January 8 last year because the lender was cash-strapped.

The lawsuit is another black eye for a lender who — up until March, when the coronavirus took hold — had been riding high.

Over the last several years, its stock (NYSE: TRTX), which has sported a dividend yield between 6.7 and 9.4 percent since October 2017, has reflected a job well done for the mortgage REIT and has been relatively stable, never dipping below $18 or surpassing $22. But, it cratered in March, dropping by just under 88 percent to $2.52 on April 3, from $20.72 on Feb. 24.

When the effects of COVID-19 seeped into the fabric of the commercial property market, it disrupted securities markets and left some leveraged debt shops like TRTX scrambling for liquidity. Sources who spoke to CO said that TRTX has been operating as “distressed lender 101,” finding every way possible to meet margin calls.

The lawsuit alleges that TRTX breached its contractual obligations under the loan agreement by refusing to fund its share of expenses through loan advances, “by grossly exaggerating a ‘shortfall’ with the intent to use [Somera’s] funds to cover [the lender’s share of the loan]. Thus, [TRTX] deprives [Somera] of the benefits of the loan in bad faith in breach of the parties’ agreement. [TRTX] has acted outside of the loan agreement and without justification for its own personal gain or preservation.”

With its breach of contract claim, Somera is also seeking declaratory and equitable relief.

“We believe the allegations in the lawsuit are without merit and will vigorously contest the litigation. The borrower’s budget is out of balance and the borrower has failed to satisfy its obligations to post equity to satisfy the deficiency,” a spokesperson for TRTX told CO in an emailed statement, stressing that this situation has no connection to the lender’s current liquidity problem. “This is nothing more than a contractual issue that predates the current economic situation. The borrower’s attempts to call into question TRTX’s financial position are not only irrelevant but misguided.”

The loan referenced in the lawsuit included just over $28 million to fund Somera’s purchase of City Center Square, a distressed asset and one of the largest office towers in downtown Kansas City, Mo., as well as nearly $32 million to cover subsequent repositioning efforts to modernize the asset.

According to the lawsuit, the lender and borrower struck an agreement that would give Somera the right to make regular requests for loan advances to fund its repositioning efforts, which includes capital expenditures (cap ex), tenant improvements and leasing commissions, among other costs associated with the work.

“[TRTX] is in the middle of its own, very public, liquidity crisis and as a result [it] has acted in bad faith by refusing to fund advances to [Somera] under the loan,” the lawsuit reads. “Instead, [TRTX] arbitrarily continues to claim that [Somera] must fund an irrational shortfall, that includes amounts that are not related to any work requested and approved under the loan, or that [TRTX] has otherwise approved.”

TRTX’s business — similar to many other publicly-traded vehicles of the same stripe — relies on having equity in hand to appease shareholders, pay a dividend, meet its obligations to its warehouse lenders and keep its standing in the marketplace intact.

Over the years, lenders such as TRTX have engineered returns by buying securities and financing them via short-term repo warehouse lines. These repo lines that they take on to finance their securities have mark-to-market provisions, and they are full recourse to the parent entity. It’s a revolving door that, when pressured by price drops in securities, could trigger a downward spiral of events.

That pressure comes in the form of margin calls on these warehouse lines. If the securities market comes under stress and financial institutions that provide these warehouse lines of credit then mark-to-market, it drops the value of the underlying collateral backing it, thus triggering these calls that require more equity to be injected to cover losses in value. Somera Road alleges that because TRTX is beholden to third-party warehouse lenders during this period of extreme market volatility, some of its loan funding obligations are going unmet, to the detriment of sponsors.

“We have more than enough equity to complete this project and to fund the entire draw ourselves if we needed to, and by no means is our budget out of balance,” Somera founder and principal Ian Ross told CO. “In fact, we have the equity required to complete the whole project. But we expect the lender to perform under their contract and do what they are obligated to do.”

Ross said that TRTX currently owes his firm around $25 million in future funding and stopped making funding calls 45 days prior to the filing of the lawsuit last week.

At closing of the loan referenced in the lawsuit, Somera supplied $6 million in equity for future cap-ex work and agreed to pay a quarter of all future cap ex costs as well as 14.3 percent of future tenant improvements and leasing commissions expenses; TRTX agreed to fund the remaining 75 percent of cap ex expenses and 85.7 percent of tenant improvements and leasing commissions costs through regular loan advances, as needed, as per details in Somera’s complaint.

Both parties agreed to the initial cap-ex budget and anticipated that Somera would eventually revise the budget as costs came to light. A few months later in May 2019, Somera was still finalizing the expense budget and TRTX agreed to allow for budget modifications at a later date, as per Somera’s complaint.

On Sept. 4 2019, Somera finally provided its revised budget and TRTX approved it on Dec. 4, with a condition that Somera put forth nearly $464,000 into a TRTX-controlled reserve account for work detailed in the new budget; two days later, Somera compiled. Since then, the budget has not been modified and is still in effect, as per the loan agreement.

City Center Square — renamed the Lightwell Building due to sunlight beams that emanate through the base and lower floors of the building — rises 30 stories at 1100 Main Street in Kansas City’s financial district and spans just over 657,000 square feet. It has hosted tenants such as The Kansas City Business Journal, law firm Cooling & Herbers, Alight Analytics and Pinsight Media, among others. They’ve done over 250,000 of new leasing and renewals in just one year, according to Ross.

“Our business plan has been executed phenomenally well and at a swift speed,” Ross said. “We have signed over 250,000 of new leases and renewals in just over a year [since origination], including leases with some of Kansas City’s fastest-growing and exciting tech companies, like Backlot Cars and Payit.”

Ross continued: “The lobby and tenant amenity upgrades [we’ve made] have made this one of the highest quality buildings in downtown Kansas City. We hope our lender’s issues don’t slow us down.”

Somera Road bought the distressed asset — one of only five major office towers in downtown Kansas City and the only one with an occupancy below a mid-90s figure — in an off-market transaction when it’s occupancy was a meager 49 percent, according to information from the firm’s legal complaint against TRTX. As of now, Somera is still in the process of repositioning and renovating areas of the building, and it has leased out around 65 percent of the asset, according to Ross.

TRTX eventually securitized the roughly $28.3 million in acquisition debt in the TRTX 2019-FL3 collateralized loan obligation (CLO) transaction, leveraging the debt at 85 percent, and then it held the remaining $31.8 million in unfunded commitments on its balance sheet.

In mid-March, the mortgage REIT reported that it had $296.1 million in cash and available liquidity on hand, according to information from an investor presentation released on March 18. A few days later, on March 23, TRTX announced that it would be delaying its previously authorized first quarter cash dividend payment of 43 cents per common share until July 14 because of the impact COVID-19 has had on real estate securities markets, freeing up a bit of cash. The dividend distribution was originally scheduled for April 24.

As of March 22, right before it delayed its dividend, TRTX was in possession of a debt securities portfolio of around $960 million, $760 million of which is collateral behind daily mark-to-market secured revolving repo facilities (repurchase facilities). The company has had to post cash collateral with its warehouse lenders on these facilities due to market turbulence that has caused shifting credit spreads and fluctuations in the value of the portfolio, according to information from S&P Global published in late March.

In early April, TRTX announced that it had offloaded about $572 million in debt securities, mostly at a loss, in order to satisfy around $429 million in liabilities. Altogether, the firm lost around $179 million.

TRTX recently tapped financial services firm Houlihan Lokey to explore its options and formulate a strategy to alleviate its issues via a recapitalization plan, with Mack Real Estate and Almanac Realty Investors said to be interested in leading the recapitalization.

Contrary to TRTX’s response, Somera’s lawsuit alleges that the lender’s actions with regard to the loan in question are “solely to preserve any limited available cash.”

According to the lawsuit, Somera has requested four advances since December last year, of which only two have been provided.

On March 9, it asked for an advance of just under $2.5 million — the 11th advance since origination — seeking just TRTX’s share of expenses, as Somera claims it was “ready, willing and able” to handle its share of expenses, as per the legal complaint.

Somera claims that TRTX then proceeded to stall from March 17 through March 24, as Ross’ firm continued to try to get information from TRTX about the status of the advance. The lender claimed to be “discussing the effective budget with its agents,” promising a “timely response,” according to Somera. The firm claims TRTX told them on March 19 that they would hear a response the next day but on March 24 said it was still reviewing “and determining the amount of shortfall required to balance the loan.”

In early April, Somera then provided TRTX with bank statements proving it had the funds on hand to “rebalance” the reserve account — willing to deploy up to just over $1 million if it meant the lender would provide the advance. TRTX came back on April 9 and claimed the loan was not “in balance” and demanded nearly $2.5 million from Somera to be deposited in the “rebalance reserve account” as well as an interest reserve account.

A few days later on April 13, Somera appealed to TRTX’s agent Situs Asset Management about the 11th advance. The next day, Situs reaffirmed the need for the $2.5 million commitment from Somera to “bring the loan ‘in balance,’” despite Somera’s explanations that that was incorrect due to previous expense revisions. Somera said it was ready to instead fund $987,777 to the two reserve accounts if TRTX would agree to fund the 11th advance. The 11th advance as well as an unfunded 12th advance total just under $4 million, which represents TRTX’s share of expenses owed to Somera.

Ross told CO that his firm, through bank statements and other documents provided to TRTX and its counterparties, has “shown we have the equity to fund the draw ourselves, to fund the whole construction project if we need to, but that’s not what we signed up for and not what TPG is obligated to do.”

In the wake of government mandates and social distancing measures causing large scale business closures and severely slowed economic activity, most lenders find themselves triaging existing issues on their balance sheets and working with their borrowers to try to keep their businesses afloat and their debt payments current. The collective understanding that there were no bad actors who caused this crisis has resulted in a heightened level of compassion in the marketplace.

But for leveraged loan shops like TRTX, a publicly-traded mortgage real estate investment trust beholden to its financiers as well as it’s shareholders, it’s feeling pressure from multiple sides, and the story isn’t always the same.

There is of course assistance in the form of the federal government, which swiftly responded to the liquidity crisis caused by COVID-19 and has shown flexibility in expanding their reach, via avenues such as the late-March reestablishment of the Term Asset-Backed Securities Loan Facility (TALF) from 2008 to help support and stabilize securities markets.

Lisa Pendergast, the executive director of industry trade group CREFC, told CO in an interview earlier this month that “because of this ridiculous downward spiral, the more you sell, the more the margin calls, so it’s important to have all pockets of liquidity available to help. The one thing I will say with margin calls: there are no villains. They’re doing what they have to do relative to the documents in front of them. We’ve had discussions with government officials to help them understand and realize that we’re sliding down a long hill and that needs to be stopped; it’s not intentional.”