Luzzatto Snags $30M Refinancing in LA’s Booming West Adams

A New York-based life insurance company provided the 10-year, fixed-rate loan

By Greg Cornfield December 12, 2019 12:25 pm

reprints

The Luzzatto Company, who’s been leading the charge in the creative office boom in West Adams, has secured a $30 million refinancing loan for a project that it believes will anchor the 1.5-square-mile Los Angeles enclave.

The 10-year, fixed-rate loan was provided by a New York-based life insurance company, although Luzzatto declined to share the company’s name. JLL helped arrange the loan and announced the deal, but also declined to disclose details about the lender.

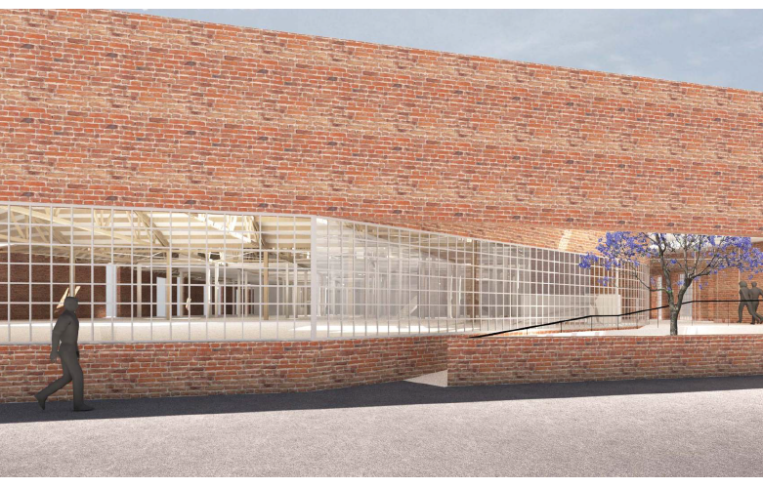

The 56,000-square-foot development, called Exposition 2, is located at 3339 Exposition Place at the intersection of Crenshaw and Exposition Boulevards. Luzzatto completed the renovation this year after securing a pre-lease deal with GOAT, an L.A.-based online sneaker startup that counts Foot Locker among its investors, for the entire space.

Asher Luzzatto, president of Luzzatto Company, told Commercial Observer that GOAT signed the eight-year lease in November 2018 and moved in this October.

“It was the first major creative office deal signed in the West Adams area,” he said. “Other recent leases are 2,000 to 4,000 square feet, so this will be an anchor for the entire area.”

Luzzatto noted that just a few months ago, TheRealReal relocated to the new 30,000-square-foot office next door to Exposition 2 at 3317-3325 Exposition Place.

“That’s two of L.A.’s biggest retail brands right next to each other in West Adams,” he said. “That says a lot about what these venture-backed companies want.”

Luzzatto claims to be the first group to bet on the current wave in West Adams, and the firm currently owns six properties there. The refinancing for Exposition 2 follows $37.2 million in bridge financing that the firm secured to complete the acquisition and redevelopment of Exposition 3, another creative office campus in West Adams. JLL also helped arrange that 30-month, floating-rate loan with TerraCotta Group. It will be used to complete the acquisition, fund construction costs and cover transactions.

That 57,000-square-foot property at 3101 W Exposition Boulevard is pre-leased to Sweetgreen, which is expected to move in after the start of 2020.

West Adams is one of the oldest neighborhoods in the city, located at the northernmost part of South L.A. Its new growth is credited to the Metro Expo Line, which opened three stops in West Adams in 2012. Luzzatto said it helped propel the neighborhood into an alternative to tighter office hubs like Culver City or Century City, and it led to more conversions, lease deals and development.

One major project in the area, the 11-acre Cumulus District development led by Carmel Partners, is scheduled to open later next year adjacent to the La Cienega/Jefferson Expo station. It will include more than 1,200 apartment units and 100,000 square feet of retail space. In August, Commercial Observer reported that Whole Foods signed on to anchor the space at 3321 La Cienega Boulevard with 50,000 square feet.

Luzzatto said they are seeing office lease rates in West Adams that are about 30 to 40 percent less than the averages in Culver City and Century City, with the largest difference at the top end of the market. Properties are trading at more than $500 per built square foot, or more than $400 per square foot of land, he estimated.

Another incentive for investment came from the formation of opportunity zones. Most of West Adams is located within a federally designated zone that stems from the Tax Cuts and Jobs Act in 2017. The designation allows tax breaks for real estate development in lower-income areas.

Luzzatto has seen land prices go up about 33 percent in the past year in the opportunity zoned-areas of West Adams.

CIM Group is also working on developments in West Adams, including more retail and residential properties, as well as a hotel. In September, Curbed reported that the median home price climbed 9 percent in West Adams over the last year to $718,600, above the county’s mark of $618,000.

The JLL team representing Luzzatto was led by senior managing director Paul Brindley, senior director Jeff Sause and associate Spencer Richley.

Luzzatto has a national portfolio that includes retail, office, multifamily, industrial and film production studio assets. The firm focuses on distressed and underdeveloped properties, and has partnered with tenants like Red Bull, Yahoo, NPR, FedEx and Quixote Studios.