CO’s 25 Under 35: The Top Young Debt and Equity Professionals of 2019

By The Editors October 1, 2019 9:00 am

reprints

Sorry everyone: They’re (mostly) taken.

As if making major strides in the world of commercial real estate finance wasn’t enough, 2019 has also been a busy year for nuptials among our latest class of the real estate industry’s top young debt and equity professionals. Between helping CBRE’s small but high-flying debt team broker some of the country’s biggest real estate debt deals, Ethan Gottlieb found a free day to tie the knot in California. Michael Payton, an originator of growing renown at ACORE Capital, said his vows over the summer. For Jean Liu, on the other hand, the big day is just around the corner: She’ll be walking down the aisle later this month.

So if you were aiming to use these pages as a bachelor’s or bachelorette’s guide to some of the country’s most eligible, you may want to head back to the newsstand.

On the other hand, if you’re here to make your first acquaintance with some of the faces that will be shaping U.S. real estate finance deals for decades to come, read on. In fact, they already hard at work doing just that. One enterprising debt broker helped move the market when her team wrangled the financing for Related Companies’ $2.2 billion sale-leaseback deal at 30 Hudson Yards. Another up-and-coming superstar was on hand to help broker the debt for 10 Jay Street on the Brooklyn waterfront, where the $205 million loan he worked on will fund the conversion of a former industrial plant into a 21st-century mixed-use office-and-retail development. Names you’ll see in the pages to follow also helped mastermind debt deals for sites like Terminal Stores and Essex Crossing in New York City, as well as some marquee projects elsewhere in the country.

If you plan on following where commercial real estate goes next, plan on seeing a lot more of these 25 stellar youngsters.

Is there anyone here who objects?—Cathy Cunningham, Mack Burke, Matt Grossman and Tom Acitelli

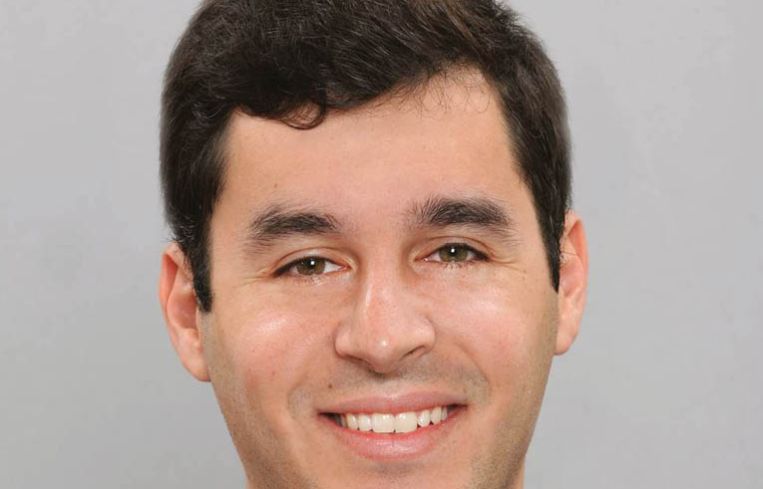

Tobi Abereoje, 32

Vice President, Basis Investment Group

At 32, Tobi Abereoje has already worked at a series of some of the industry’s biggest institutional lenders, including stints at J.P. Morgan Chase, KeyBank and Santander. But the best fit of his career to date has come at his current position as a vice president at New York City-based Basis Investment Group, where he’s hit his stride as a generalist in a big way.

“I wanted to find a platform that allows me to cover more of the country and work on a variety of loan products,” Abereoje said of the job’s appeal. “The No. 1 strength of Basis is that we’re a one-stop shop for deals. We certainly punch above our weight class.”

Born in Nigeria, Abereoje moved to the Big Apple as a 7-year-old and describes himself as a “local kid” through and through. His first inkling of a finance career came from the Academy of Finance program, an extracurricular workshop that teaches high school students business concepts and then sets them up with corporate internships, an experience that Abereoje said was invaluable.

“While some of your friends are working at McDonald’s, you’re working at a bank for eight weeks, earning a pretty decent paycheck,” he explained. “I had internships going back to my sophomore and junior years of high school.”

His next stop was Morehouse College in Atlanta, after which he took a job with KeyBank in Cleveland — just as the Great Recession was hitting its nadir. Abereoje hung on though, and his next big career move actually came courtesy of Commercial Observer, in which he read about the career of Chad Tredway, head of real estate banking at J.P. Morgan Chase. Reaching out to Tredway on a whim, they met for lunch and Tredway hired Abereoje on the spot.

“Chase put me in charge as a portfolio manager of all its legacy Washington Mutual loans. There were about $500 million of loans I was managing,” Abereoje said.

And though Basis rarely tackles the same gigantic financings that Chase does, Abereoje has thrived there in a role with even greater responsibility. Last year, he led the lender’s Freddie Mac originations team with $30 million of production — all the while continuing to tackle CMBS loans, mezzanine pieces and bridge debt in the background.—M.G.

Joshua Berman, 34

Senior Vice President, Meridian Capital Group

The two biggest deals that Josh Berman has orchestrated so far in his financing career happen to be in the hometowns of his two alma maters.

In 2018, he arranged $163 million in financing for 1300 Fairmount Avenue — a major mixed-used development along Philly’s North Broad Street corridor, which links Center City and the Temple University area. Berman helped arrange a senior construction loan and a preferred equity contribution for the 471-unit project.

Then, last year, Berman worked on a deal for a $175 million floating-rate loan to refinance 21 India Street, the apartment component of Brooklyn’s Greenpoint project on the waterfront of the similarly named neighborhood. The refinancing allowed the sponsor of the project — which includes 368 luxury apartments and 43,000 square feet of retail — to replace its construction debt and finish enough work to lease the apartment portion.

Before joining Meridian Capital in January 2016, the northern New Jersey native, who now lives in Westchester County after a decade on the Upper West Side, worked at Silverpeak Real Estate Finance, a privately owned commercial real estate lender specializing in CMBS financing, and as a senior real estate appraiser at the Leitner Group (now the Burger Butler Group), a New York commercial appraisal firm.

He got that first job after answering a posting from a Penn alum. At the time, Berman, a political science and history major, had seemed destined for law school, but he said that ultimately did not appeal to him. Real estate did.

“I was immediately thrown into the deep end, appraising properties within my first few weeks,” he said of that Leitner job. “Immediately, my interest was piqued, and the rest is history.”—T.A.

Peter Cabrera, 26

Associate, B6 Real Estate Advisors

Peter Cabrera grew up in real estate. His grandfather owned an appraisal business in Washington, D.C., his father is an investor and developer in Connecticut’s Fairfield County, and his uncle is a vice chairman at CBRE.

He worked summers for his father on a variety of projects and said he “always loved the tangible aspect of real estate as well as the competitive aspect of the industry.”

So, Cabrera gravitated to it even before his graduation from Franklin and Marshall College in southeastern Pennsylvania, where he majored in business with a concentration in finance. While there, he interned for a leasing team at JLL, and after graduation he split for Washington, D.C., to work full time for the brokerage’s public institutions group. He spent two years evaluating public-private development proposals — including for universities, local and state governments and pro sports teams — that ultimately totaled more than $1 billion.

Last year, the Greenwich, Conn., native, who now lives in Midtown South, joined the capital advisory side of B6 Real Estate Advisors, which Paul Massey started in early 2018. There, Cabrera works under Steven Sperandio, a partner and senior managing director in charge of the firm’s debt and equity capital work.

His responsibilities at B6 include sizing debt and equity opportunities, preparing offering memorandums and executing deals. The biggest deal Cabrera’s worked on to date was a $52.5 million senior construction loan in 2018 for the development of a 300-unit Class A multifamily building in Indianapolis’ central business district.—T.A.

Jack Cortese, 29

Vice President, Capital Markets, D2 Organization

Jack Cortese grew up in Los Angeles, America’s second largest city, and works about half the time in the nation’s largest metropolis, New York City. But he’s most proud of the deals he’s cut and helped cut in smaller locales as co-leader of the debt and equity placement group at D2 Capital Advisors, a firm he joined about two and a half years ago.

“A lot of brokers can get big deals done in gateway markets,” Cortese said. “I get big, challenging deals done in secondary and tertiary markets.”

These deals include a complex $70 million bridge loan executed in late 2018 for developer EB Realty Management Corp.’s mixed-use plans along Philadelphia’s North Broad Street corridor.

As of September, he was also working on similarly large financing deals in Pittsburgh and Allentown, Pa., and worked on a $56 million loan to redevelop Philadelphia’s Metropolitan Opera House.

In total, Cortese has arranged more than $200 million in financing over the past two years, working on underwriting each deal, creating loan request packages for lenders, distributing those packages, fielding questions from lenders, obtaining and negotiating term sheets, and facilitating requests (and demands) from third parties. He also works with the development team at the umbrella D2 Organization on its own internal financing needs.

It’s a lot of moving parts. But that’s the allure for Cortese, who said commercial real estate’s capacity for deal-making drew him to the profession. The Philadelphia resident always liked the negotiating aspect of pretty much any business, so real estate was a perfect fit.— T.A.

Matthew Dzbanek, 30

Director, Capital Services, Ariel Property Advisors

Matthew Dzbanek, a director in capital services at Ariel Property Advisors, is only 30 years old, but he’s been on construction sites since before he could walk. Born on the Upper West Side to parents who were both architects, Dzbanek’s first site visit came when he was just weeks old — and playtime for him often took place at any toddler’s ultimate dream sandbox.

“When I went to visit my dad ‘at the office,’ I was playing with wrecking balls and backhoes and driving the elevators up and down,” Dzbanek said. “Take your son to work day was a little different for me than the other kids.”

After college at Washington University in St. Louis and stints in investment sales at a family office and in acquisitions at The Lightstone Group, Dzbanek now wears a suit — not a hard hat — to his job at Ariel. But he has still managed to get his hands dirty, at least figuratively, with some fascinating Big Apple projects. This year, Dzbanek led the analysis on a unique $300 million financing: a deal led by Janus Property Company that will transform the Taystee Building in West Harlem into a top-flight life sciences facility.

“Our play was that Columbia was spending $3 billion or $4 billion to develop a new life-sciences campus,” Dzbanek said. “We leveraged that information to find an equity partner for our client’s project.” Even the young debt advisor’s more routine projects are nothing to scoff at. Another recent deal saw Dzbanek find a lender for a $41 million financing package on a set of 23 cross-collateralized retail assets in 15 states. And he’s currently at work finding a $90 million loan for a residential development in Westchester County.

Though work sometimes takes him outside the five boroughs, Dzbanek sees little need to get away from the city on weekends: “I live on the Upper West Side, and I love taking my bike out along the Hudson River in the mornings,” Dzbanek said. “If there’s something fun or interesting to see around the city, I’m there. My fiancée and I do whatever we can do to stay active and outside.”—M.G.

Ethan Gottlieb, 26

Associate, CBRE

Ethan Gottlieb’s fifth grade yearbook stated his aspirations to be a journalist for The New York Times, but a growing fascination with real estate soon took him down a different path. (“I would sit in my room and build paper-mâché buildings,” he said.)

His father, Scott Gottlieb, is a vice chairman at CBRE — representing both tenants and landlords in leasing transactions — but even though a career in real estate was always written in the stars, Gottlieb couldn’t have imagined he’d end up working in the very same building as his father. “He’s been a mentor throughout my career,” he said. “It’s really cool to come into work and see him every day.”

Gottlieb joined CBRE in 2016 from Goldman Sachs. While he remembers Goldman as a “fantastic place to learn,” the prospect of joining ex-Deutsche Bank alums Tom Traynor and James Millon as they spearheaded a new large loan business at CBRE was “something I couldn’t pass up,” he said. “It seemed like a great fit both culturally and professionally, and it’s been a fantastic experience.”

The first deal Gottlieb worked on at CBRE was the $1.75 billion acquisition financing for HNA’s $2.2 billion purchase of 245 Park Avenue. Not too shabby an industry debut, eh?

“It was definitely eye-opening for me,” Gottlieb said of the mammoth deal. “I hadn’t worked in the industry before and all of a sudden we’re working with Darcy [Stacom] and Bill [Shanahan] on this huge acquisition financing. It was great to observe the process.”

In terms of recent deals, another jewel in his team’s crown was the $647 million acquisition and pre-development financing they arranged for L&L Holding Company, Normandy Real Estate Partners, and J.P. Morgan’s $880 million purchase of Terminal Stores (Blackstone Mortgage Trust was the lender).

“The deals I love working on are the value-add, construction and redevelopment plays where you feel like you’re really making an impact on a community,” he said. “To work on such a cool project, from the historical nature of the building to how they’re redeveloping it into what will be one of the best projects in the city, was a really unique opportunity.”

Gottlieb also tied the knot this summer. He and his wife, Ilana, went to Japan for their honeymoon and he’s now taking Japanese language classes. With a busy year-end pipeline ahead of the CBRE team, he best take every chance he gets for some downtime.

“It’s going to be a really strong fourth quarter for us, and the industry,” he said.—C.C.

Daniel Grobman, 34

Associate, Rosenberg & Estis

The tangibility of commercial real estate is one of the industry’s greatest appeals to Daniel Grobman, a rising young New York-based lawyer at Rosenberg & Estis who had previously worked in more esoteric fields of law.

“I love being able to walk around the city and see the fruits of your labor,” Grobman said. That wasn’t possible in his first job as a lawyer at Clifford Chance, which saw him negotiating purchase contracts for commercial airliners that may have been sitting on the tarmac overseas. “I realized my heart was more set on real estate.”

The Nassau County native first got a taste for the field from his parents, who were involved with a small-scale local real estate business. After college at Washington University in St. Louis and a degree from Yeshiva University’s Cardozo School of Law in Manhattan, Grobman found a way back to the industry he grew up around. Five and a half years into his time at Rosenberg, he’s building an impressive resume.

His biggest project to date was work on a $1 billion loan from Citigroup to fund a refinancing of five Durst Organization buildings in Midtown, and more recently, he had a hand in negotiating a $75 million TD Bank debt package for a Quinlan Development Group mixed-use building in Brooklyn.

Outside of finance, he also spends plenty of time working on retail leases around the city — and “plenty of time” is right, given how complex real estate deals have become.

“Many law students don’t really quite understand what transactional law is all about — myself included, when I was a student,” Grobman said. “Your apartment lease is five pages, so you don’t realize that negotiating a commercial loan agreement is a 100-page document full of nuanced issues that can take months and months of back-and-forth.”

As a result, he’s learned that one of the profession’s most important skills is not missing the forest for the trees.

“You can get really distracted arguing with another lawyer about a bankruptcy provision,” Grobman said. “But it might not be enforceable anyway, and your client may not even care.”—M.G.

Eric Hynek, 33

Managing Director, Metropolis Capital Advisors

Eric Hynek just wanted a job in business. The field didn’t really matter. But as soon as the economics grad from the University of Colorado at Boulder discovered real estate, his future was sealed. As he explained it, “the excitement of transactions and just the day-to-day quickly became more than just a job to me, but a way of life. If you’re ever having a dull day in this business, it’s probably because you aren’t working hard enough.”

In his more than seven years at Maryland-based Metropolis Capital Advisors, Hynek has worked on numerous financing deals. His responsibilities at the firm include sourcing capital for transactions involving all commercial real estate assets.

His most prominent deal so far was probably a $27.48 million bridge financing for a large retail property in Manassas, Va., which a Home Depot anchored. The presence of a big-box retailer could’ve spooked some capital sources, but Hynek was able to help identify several banks that saw the potential in the property. The end result in late 2018 included a much tighter spread than a debt fund might have provided.

Before joining Metropolis, Hynek worked at Easter Union’s Washington, D.C., office, focusing on originations in excess of $100 million. And, before that, the Bethesda, Md., native and current resident worked at a real estate law firm doing accounting and other support functions for attorneys.—T.A.

Dylan Kane, 27

Director, Newmark Knight Frank

Dylan Kane was brought on to Newmark Knight Frank’s overhauled debt and structured finance team in October 2017, when co-heads Dustin Stolly and Jordan Roeschlaub were building out their group.

Kane joined via an introduction to the group by NKF managing director Nick Scribani. They haven’t looked back since.

Kane and the team tallied $11.8 billion in deal volume last year and they’re on track to arrange $17 billion to $20 billion in 2019, Kane said. “Once you’ve earned [Stolly and Roeschlaub’s] trust, they fully give you the reins to run the transaction soup to nuts,” he said.

In 2014, the Port Washington, N.Y., native earned a bachelor’s in economics from Middlebury College in Vermont, where he was also recruited to pitch for the college’s baseball program.

He’d never considered commercial real estate finance. His first taste of it was at 747 Capital, where he worked as a summer analyst in 2012, while he was still in school. The following summer, he took the same role but this time within Bank of America Merrill Lynch’s summer program, where he worked in structured finance origination. That gig led to a full-time structured finance job at BoA following his graduation in 2014.

Kane went on to spend just over three years at BoA before being recruited to the brokerage side at NKF.

“I really liked the CMBS group [at BoA],” Kane said. “It was my first taste of real estate. It’s tangible; it’s cool; you can touch it and there’s always a story to tell with it. It was the subjective side that made it appealing. The lending side is a great place to start but … as a broker, it’s very entrepreneurial, and that aspect was super attractive to me. You can go out and have a great year; it’s all hustle.”

Fast forward to what his NKF team sees as a potential $20 billion a year, Kane is riding high.

He alone ran the closing of a $205 million refinance from Natixis on Glacier Global Partners and Triangle Assets’ 10 Jay Street in Brooklyn, a 10-story mixed-use office and retail waterfront development in Dumbo, Brooklyn, that was originally constructed as a sugar factory in 1898. The new debt refinanced a $150 million bridge loan provided by ACORE Capital in 2017.

“[Our team at NKF has] found a niche in transitional office deals where clients are, say, halfway through their business plan and have materially de-risked the deal through significant completion of the redevelopment or newly executed leasing, but are still 12 to 18 months away from stabilization or disposition,” Kane said. “We’ve arranged refinance solutions that allow our clients to boost their returns via repatriating equity capital ahead of schedule, reducing the cost of debt capital through the remaining duration of the business plan, and funding any additional future costs or overruns with debt as opposed to injecting additional equity.”—M.B.

Marko Kazanjian, 30

Vice President, JLL Capital Markets

It was by happenstance that JLL’s Marko Kazanjian wound up in commercial real estate finance.

He had friends and family who were close to the commercial real estate industry and pushed him to go that route, but his interest was in sports management and representation — think “Jerry Maguire.”

The Massachusetts native and former college golf walk-on at Rollins College in Winter Park, Fla. — where he received a bachelor’s in international relations and international business — got his first gig out of school at The Acushnet Company, the parent company of top golf brands Titleist and FootJoy. He stayed there for two years and “thought it was a great stepping stone, but I wanted to eat what I killed and do more,” he said.

What better place to do that than at Meridian Capital Group? After being referred to the brokerage house by an acquaintance, he had his first interview with a recruiter at Meridian, and at the end, he was asked if he had any questions. He replied, “When is my next interview?”

Not long after, Kazanjian was in California when Meridian reached out and invited him back. He joined the firm as an associate in January 2014. He spent two years there, “dialing for dollars,” he said. “It was a great way to cut my teeth in the business.” He moved to JLL in January 2016 and has been there for nearly four years.

In August, Kazanjian, together with JLL’s Max Herzog, arranged a $320 million recapitalization of 20 Broad Street, a 29-story, 533-unit rental building, for Metroloft. He and his team expect to close around $1.5 billion combined this year.—M.B.

Alex Lapidus Okin, 27

Director, Cushman & Wakefield

When you’ve closed $3 billion in capital transactions over the past 12 months, it’s pretty safe to say that you’re a rising star in the industry. In her six years at Cushman & Wakefield, Alex Lapidus Okin has been involved in more than 60 closed transactions, amounting to more than $12 billion in capital raised on behalf of clients.

Lapidus joined C&W, straight after graduating Lehigh University, as an analyst in the brokerage’s equity, debt and structured finance group, reporting to Steve Kohn.

“The idea of working for a big firm with so many different services was very enticing, but the biggest draw for me was the team,” she said. “My interview was funny, it started off as an informal meeting but turned into a three-hour interview and I met half the team.”

While the C&W crew helped entice Lapidus to the firm, the interactive nature of her role with clients is her favorite part of the job today. “We’re not sitting at computers,” she said. “We’re out at meetings and pitches and doing tours or we’re on the phones.”

Lapidus closed the two biggest deals of her career so far this year: the $1.43 billion acquisition financing for 30 Hudson Yards on behalf of The Related Companies (in its $2.2 billion buy and leaseback deal with WarnerMedia) in June and a $900 million financing for One Soho Square on behalf of Stellar Management in May. Both deals were financed with CMBS loans.

“The CMBS market is super competitive,” Lapidus said. “A lot of our clients borrow on balance sheet, but you can’t ignore the tight pricing the CMBS market is providing right now. The closing process is so fast, and large deals can be taken down by one firm. We’re seeing a lot of borrowers who traditionally borrow from a bank or a life company now looking at CMBS. It’s making our job more interesting.”

Lapidus has a busy year-end ahead and is currently in the middle of pitching two very large deals that would close in early 2020. She and her husband Evan have a Cavalier King Charles Spaniel puppy named Jackson who is also keeping them pretty busy in the meantime.

“I think you should be happy doing what you’re doing,” Lapidus said of her impressive career thus far. “I’m excited to go to work every day and work on the deals that I’ve been working on, and I’ve been here long enough to know that I’m very happy in my role.”—C.C.

Jean Liu, 30

Director, Ackman-Ziff Real Estate Group

As impressive young debt and equity professionals go, Jean Liu has more than earned her spot on this list. Since Liu joined Ackman-Ziff five years ago, she has closed approximately $1.1 billion of debt and equity transactions, comprising $550 million of single-family rental portfolio financings and $520 million of multifamily financings.

Further, her current pipeline includes 10 projects totaling $3.5 billion in debt and equity raising assignments.

Liu was born and raised in China. Her father is a local developer there, and her mother is an accountant who also works at a real estate-related firm. Properties were always a talking point around the dinner table growing up. Liu attended Zhongnan University of Economics and Law in Wuhan, China, before getting her master’s in real estate and finance at NYU in 2011. After graduation, a NYU professor recommended she pursue an internship with Ackman-Ziff, and the rest is history.

“Ackman-Ziff is very well known within the NYU master’s program,” Liu said, adding that she enjoyed listening to Ackman-Ziff president Simon Ziff’s guest speaker stints at the school.

Today, Liu tackles the underwriting, structuring and execution of debt and equity financings, with a special focus on residential properties. Her favorite part of the job is “learning something new every day,” she said. “It’s a people business and an industry in which I never feel bored. Every deal is different with different problems to solve. Every day I’m excited to go to work.”

Speaking generally of today’s financing market, Liu said that it’s “still healthy, although a little more volatile right now. That said, people have to continue to do deals and move forward, and a tougher environment is also beneficial to us, [because] clients need our advice.”

The Long Island resident is a “big outdoor person” and enjoys hiking and travel. But her upcoming wedding in October is her main focus — outside of work, of course!—C.C.

Nate Lowy, 32

CEO and Founder, Juniper Capital Group

Nate Lowy named his brokerage company Juniper Capital Group after the biblical story of the prophet Elijah resting under a juniper tree due to exhaustion and desperation.

“A juniper is a special tree that Elijah hid under in a time of need. It protected and took care of him and that embodies the firm’s mission statement, really making sure our clients get what they need,” Lowy said. “It’s been a boutique experience [since inception], and we focus on the [finer] details.”

Lowy is a third-generation real estate professional from Los Angeles. He got his start as a loan analyst at Eastern Union Funding in September 2012 and then, with a partner, “went his own way” nearly two years later, opening Juniper Capital in the summer of 2014.

“I was on the ground floor [at Eastern Union Funding], modeling every deal that came in, working deals for partners,” Lowy said. “[Eastern Union co-founder] Abe Bergman and I parted as very good friends.”

Juniper, currently focusing on the middle markets, hit its stride in 2018 with $250 million in deal volume across 50 properties, and it expects to log $350 million in new loans this year. It’s deal sizes have ranged from $2 million to $100 million, and it offers debt and equity services in bridge, mezzanine and joint venture financing across all asset classes, including multifamily, industrial, retail and construction, both ground-up and redevelopment. They’ve done everything from retail deals in Michigan to industrial deals in Brooklyn to repositionings in Syracuse.

Recently, Juniper arranged a $16 million loan through a life insurance company backed by a 100,000-square-foot industrial property owned by a Williamsburg-based developer.

“We were able to hold the rate for 120 days, as the borrower wasn’t sure about the loan amount,” Lowy said. “That was very advantageous for the borrower, because the Treasury was at an annual low. That was a cool deal, a cash-out refinance.”

His group also arranged a $23.3 million loan for the acquisition of Woodmont Square, a 100-unit residential complex in Bridgewater, N.J.—M.B.

Andrew Marcus, 32

Commercial Loan Originator, Marcus & Millichap

“I feel very lucky to be in the situation I’m in and work with the people I work with,” Andrew Marcus said. He joined Marcus & Millichap (he isn’t related to the founders) in August 2017, having previously worked for Cosmopolitan Capital Funding, a HUD lender.

Some serendipitous networking led him to an interview with Marcus & Millichap first vice president of finance Andrew Dansker. “After one meeting with Andrew, I knew I wanted to hitch my saddle to his wagon,” he said. “He’s always the smartest guy in the room.”

Marcus is now part of Dansker’s team and focused on middle-market multifamily financings in the $1 million to $10 million range throughout New York City. He’s closed 20 deals in the past 12 months. He’s also hard at work on a $55 million multifamily project (the details of which he couldn’t reveal quite yet). The transaction includes a complex mix of refinancing and ground-up financing in Upper Manhattan.

Rent reform has made it an “interesting time to be in our business,” Marcus said. “There’s no way around it; it’s problematic for a lot of people because it has put a firm end to the business plan of deregulation.” His current role may not have been the plan early in his career, but things certainly seem to happen for a reason.

“I never in a million years imagined myself becoming a broker,” Marcus said. “I didn’t become a broker until I was 30, so I was pretty late to the game, but that’s actually been beneficial. I was in more of an analytical role at my previous firm so by the time I joined I already had years of underwriting experience behind me and understood how the numbers worked. It’s made me better at my job now.”

Marcus is an “aspiring golfer” and spends the majority of his free time with his wife, Ashley, and 5-month-old son, Mo.

As for advice for newbies entering the industry today, Marcus said, “Put your head down, work hard, do right and make yourself indispensable in the job you’re in.”—C.C.

Jay Miller, 33

Director, Cooper-Horowitz

Torontonian Jay Miller had a couple of stops on his way to the world of real estate. He moved to the U.S. to play baseball (“After the first two years of college I had a pretty rude awakening that I’d have a different career path,” he said with a laugh) before owning and running a biotech company.

After selling his company, Miller took some time to reflect on what he excelled at. “I realized I loved real estate, I loved doing deals and I wanted to be in a role where I was solely focused on doing deals — not on investors or manufacturing.”

Enter, Cooper-Horowitz. Miller started at the firm in 2017.

While deal execution remains one of his favorite parts of the job, he also enjoys seeing the real estate, meeting clients, and the entrepreneurial side of the business. “I like that we’re helping people execute their business plans,” he said.

One of Miller’s most notable deals to date was a $125 million refinance for Hollywood Circle, a new mixed-use tower in Hollywood, Fla., in June. Miller arranged the bridge debt — which took out construction financing on the asset—with Apollo Global Management. The development was also funded with more than $100 million in EB-5 financing.

“It was a complex deal because of the EB-5 aspect, which meant a couple of hundred investors, and also because the property has three uses; retail, apartments and a hotel,” Miller said. “We needed a lender who would be comfortable with all three. That’s why Apollo was a great fit.”

Today, construction financing is “getting a lot harder to do,” Miller said, although this has only increased the value of Cooper-Horowitz’s role. “A lot of developers who were getting money thrown at them a few years ago are now asking, ‘How do I get this built?’ ”

Miller’s team is busy rolling up its sleeves on the heavier-lift transitional deal and construction projects, but ultimately, “we work on all asset classes and a variety of financings $5 million and up.”

And as real estate itself continues to be an increasingly national (and international business), Miller regularly jumps on planes for some quality face time with “almost all of our business relationships. It’s key.”

Miller lives in Hoboken with his wife, Beth Kushner (an E.R. doctor), and their Corgi, Morty.—C.C.

Michael Payton, 30

Vice President, ACORE Capital

Michael Payton grew up just outside of Toronto and moved to L.A. in the summer of 2015 to start his MBA at UCLA. Little did he know that his career was about to skyrocket, thanks to a ‘day on the job’ experience (a program where students get to see what a single day at a firm is like) at ACORE Capital. The lender had only been in business for around five months at the time and was looking for a full-time intern.

Fortune favors the bold, and Payton jumped at the opportunity to join the new debt fund, reshuffling his studies to work full time while finishing his MBA at night and on weekends. “I looked at the track record of the partners and what they’d accomplished over their careers, and the opportunity to join something so fast-growing and turbo-charged in terms of the lending space was too good to miss.”

Payton started out on the capital raising side of ACORE’s business, before moving over to the originations side in 2018.

“Given the nature of our business, you work with some of the best-in-class sponsors and on so many different projects. You get to see things from cradle to grave, and you’re constantly learning,” Payton said.

The biggest deal Payton worked on over the past 12 months was a $98 million loan to Singerman Real Estate and The Outlet Resource Group for their acquisition of four Tanger Outlets located in Utah, Maryland, North Carolina and Iowa.

“Given the current lending environment around retail, we’re very selective regarding the deals that we do,” Payton said. “This was an off-market transaction where they were looking at the traditional outlet mall space but bringing in nontraditional options to supplement the existing tenant mix, so food-and-beverage tenants and other retailers.”

When he’s not closing deals, you’ll find the Marina del Rey, Calif., resident on a surfboard. He recently got married and credits his “very understanding wife” Samantha for all her support during his career (“especially the MBA-plus-working days!”).

“The biggest thing I’ve learned at ACORE is to take every opportunity you can get, even if it’s outside of your comfort zone, because you don’t know where it will lead,” he said. “At this point in my career I don’t think there’s a better seat to be in.”—C.C.

D. Ross Pemmerl, 34

Vice President of Underwriting, UC Funds

If you run into D. Ross Pemmerl in an airport looking just a tad unstuck in spacetime, you’ll have to forgive him. The originator, a vice president of underwriting at UC Funds, keeps up one of the most demanding travel schedules that Commercial Observer has heard of.

“On Wednesday I was in Savannah [Ga.], yesterday I was in Miami and today I’m back in Chicago,” Pemmerl said one Friday last month, describing another week in the life. “One of the benefits of the job is that you’ll often go to cities and places that you otherwise wouldn’t have gone out to see. It can be a little bit tiring, but I’m still young.”

Indeed he is, hence the 34-year-old’s well-earned spot on the dais this year. It’s yet another milestone on the road Pemmerl has traveled since his childhood in the rural town of Rehoboth, Mass., just east of the Rhode Island state line, where he grew up aspiring for a career like the one his mother (a real estate banker) enjoyed.

“I did and still do idolize her, so the fact that she was in this industry was pretty cool to me,” Pemmerl said.

Eager to jump into the fray, Pemmerl interned at CBRE’s Hartford, Conn., office while still a student at Wesleyan University, arranging his senior-year classes around a two-day-a-week work schedule. Then it was off to Citizens Bank — at the time controlled by the Royal Bank of Scotland — before Pemmerl landed at UC Funds eight years ago.

Among the highlights of his career is a deal Pemmerl pulled off earlier this year, lending $36 million against Detroit’s Fisher Building, a stately Art Deco landmark in the city more than 90 years old. Part of the debt will go to renovations aimed at attracting new tenants when leases roll over.—M.G.

Nick Preston, 32

Director, SunTrust Bank

Getting out of New York is probably not the first thing you’d advise a young Brooklynite to do if he aspires to be a commercial real estate finance executive.

But that’s just what 32-year-old Nick Preston did, and it’s worked out great for him, thank you very much.

The New York City native moved to Atlanta in 2011, where he’s since met his wife, settled down, and embarked on an already dazzling career with SunTrust Bank, which is based there. At SunTrust, the Emory University graduate is responsible for corporate-level relationships with everyone from local developers to major real estate investment trusts, helping match his bank’s debt offerings to landlords’ various needs.

“It’s a pleasure to get in front of clients and talk about our products and solutions,” Preston said. “Our group has national coverage, so anytime [a SunTrust client] has a balance-sheet, corporate-level ask, I’ll probably be attending.”

The role has already led to his having a hand in some eye-catching deals. He was responsible, for instance, for arranging a $475 million bridge facility that enabled the merger of two Carter Validus REITs worth a combined $3.2 billion. His job, he said, is to help clients take advantage of the full suite of products the bank offered, and that loan — which was later partially syndicated, was an apt example of its flexibility.

Though he at one time planned to become a history professor, Preston has no regrets that he landed in finance, and speaks enthusiastically about the people he’s met along the way.

“Real estate is more like a family,” Preston said. “Even if you don’t have a direct real estate background, [young people] should consider it, because you can always learn on the job.”

Incredible as it may sound to Commercial Observer’s New York City readers, Preston avers that he has no second thoughts about leaving his hometown — although Georgia life does come with one drawback.

“I really miss the walkability of [New York],” Preston said, “being in Manhattan and being able to walk up and down the island. In Atlanta, you need a car to go everywhere.”

You can always come back, Nick. —M.G.

Vincent Punzi, 34

Senior Director, Multifamily Originator, Capital One

Vincent Punzi entered the commercial property sector at an interesting time.

Having always known that real estate was the route he wanted to go, he studied real estate finance as an undergraduate at San Diego State University, graduating in the depths of the financial crisis in 2008.

Punzi made several stops along the way to joining Capital One, turning into a commercial property virtuoso, of sorts.

“I knew I wanted to get into real estate before I understood the other sectors of the industry. From a macro level, I knew I wanted to do it,” Punzi said.

He got his start in the industry in 2008 at brokerage shop Lee & Associate, working on deals across the country, from San Diego to Manhattan.

In January 2010, he moved on to assist in the creation of a retail-focused REIT called Retail Opportunity Investments Corp. (ROIC), where he helped acquire, lease and manage retail properties located throughout the western U.S., growing it to around $500 million worth of retail assets.

Punzi said, “I transitioned to the equity side and I had the chance to grow a portfolio and see the management side [of things].”

In December 2011, he returned to Lee & Associates for just over a year, this time as the director of its property tax division, and then joined Sabal Financial Group in February 2013, where he remained for almost four years before joining Capital One in September 2016.

At Sabal, he started in acquisitions and development and then became a national account manager, handling multifamily and commercial term debt originations.

“On the equity side, the life cycle was much longer on deals,” Punzi said of how he grew fonder of the debt side of the business. “Being a deal junkie, I get to be on the other side, dealing with smart sponsors, with specialized business plans, and seeing how people do certain things, sometimes better than others. Multifamily performs well through cycles because there’s so much demand. It’s a safe sector, but when you add agency to that you have a lender who’s financing through the entire course of a [business] cycle.”

Recently, Punzi originated a $42 million loan for a 208-unit, garden-style multifamily property in Southern California. Punzi is targeting $200 million in volume for 2019.—M.B.

Max Ralby, 25

Capital Markets Associate, HKS Real Estate Advisors

A little over two years ago, HKS Real Estate Advisors’ Max Ralby was playing for the Israeli National Basketball Association.

Ralby was recruited to play point guard out of New York University, where he received his bachelor’s in finance and accounting from the Stern School of Business. He took a year off to play basketball, and in the summer 2017 off-season, following his first full season playing for Maccabi Ramat Gan, he came back to New York and took an internship with HKS.

By the end of the summer, he had accepted a full-time role with HKS, and made the decision to end his basketball career.

“[Real estate finance] definitely wasn’t the goal,” he said. “At Stern they pushed the corporate banking route. When [my first basketball] season ended in May, I intended to go back for a second year. I came back for the summer and thought I’d do an internship and some friends made the introduction at HKS. I was a week or two from flying back [to Israel] and was offered a full-time job. I liked the timing of the market and thought I’d be a good fit. It was something I thought I could dig my teeth into.”

In September 2018, Ralby arranged a $25 million, stretch-senior construction loan for Propco Holdings through S3 Capital, an affiliate of Spruce Capital Partners, for a 134-unit affordable housing development at 2065-2067 Ryer Avenue in the Bronx.

“[The borrower] came to us with a signed term sheet from a bank at lower leverage and they wanted us to fill that remaining piece with mezzanine or preferred equity,” Ralby said. “It made more sense to restructure rather than deal with two lenders. The project is moving along nicely.”

The Miami native has traversed the country, closing deals in New York, Seattle, New Jersey, Florida and North Carolina. He’s logged $75 million in deal output in his first two years and is on pace to close around $160 million in 2019. Recently, Ralby locked in a $40 million refinance — construction to permanent loan — for a multifamily housing project in a Seattle submarket.—M.B.

Sean Reimer, 33

Principal, Square Mile Capital Management

At a cool 33, Sean Reimer has risen to “rockstar” status at one of the country’s most prominent alternative lending shops, Square Mile Capital Management.

Reimer has logged just over three years in his current role as principal, in which he oversees the sourcing, negotiation and structuring of debt transactions across the Northeast and Midwest.

The University of Michigan alum originated $1.1 billion in loans in 2018, and he said his team is on pace to close around $2 billion this year.

Last year, Reimer and his team closed a $260 million construction loan on a $350 million mixed-use project at 202 Broome Street within the Essex Crossing development on the Lower East Side. The loan was on a building currently under construction on Site 3 of Essex Crossing and includes 83 for-sale residential condominiums, 175,000 square feet of office space and 37,000 square feet of retail.

“[Square Mile] invests across the [capital] stack in debt and equity, and it allows us to be selective, choosing to focus our time in areas where the opportunities are,” Reimer said. “If we think we’re late [in the cycle] and valuations are at the higher end, we can focus time on the debt side, which gives you downside protection and a lower basis. And then if there’s a big opportunity on the equity side then we can shift our strategy.”

Reimer received a bachelor’s in industrial and operations engineering from the University of Michigan in 2008 and busted into the commercial real estate world not long after, becoming a financial analyst for leasing and sales at CBRE. He left the brokerage house as a senior financial analyst in January 2011 and joined Cantor Commercial Real Estate, where he remained for nearly six years, departing as a vice president for originations before joining Square Mile as a vice president in August 2016.—M.B.

Dan Sacks, 34

Managing Director, Greystone

It’s interesting talking to Greystone’s Dan Sacks about multifamily and, specifically, the affordable housing sector.

“It’s, for lack of a better term, a niche,” Sacks said. “Tax credits and bond financing can come into play, but that component of the housing industry is very small in relation to the whole multifamily sector. Promoting affordable measures within the conventional market rate sector is an area where creativity can shine.”

Sacks has strong opinions on multifamily; he said he supports a free-market solution to the affordable housing crisis, incentivizing major real estate owners and developers to reserve chunks of their residential products for affordable use. And his view is that new rent-control laws have softened developer interest in affordable use and have somewhat handcuffed multifamily originators like him.

But maybe strong views about policy are to be expected. Sacks is originally from Indianapolis, Ind., and moved to Maryland for high school after his father got a job with the Federal Communications Commission. In high school, in 2002, he interned for Democratic Senator Evan Bayh, who was a member of the Committee on Banking, Housing, and Urban Affairs, where Sacks got a taste for housing finance and the banking system.

“What intrigued me was, given how demographics change, housing is at the core of it all,” Sacks said. “That turned me on to real estate and specifically the finance side of it.”

Sacks went on to earn a bachelor’s in entrepreneurship from the University of Maryland College Park, at the Smith School of Business. In his senior year in 2009, just after the crisis, he nabbed an internship with Freddie Mac that eventually turned into a full-time gig. He said, “It was definitely an interesting time to get in [to the multifamily sector.]”

“Multifamily was a big enough component of commercial real estate and was one that was growing, and it continues to grow,” Sacks said. “We continue to see positive demographics trends that promote growth [in the sector]. I’ve dedicated myself to becoming an expert on multifamily, and that extends to seniors and affordable housing.”

Sacks spent two years in sales and investments at Freddie Mac before moving on to commercial loan origination at Wells Fargo in 2011. In 2013, he joined Greystone, a seemingly natural fit given his passion for the multifamily sector. He’s since logged six years at Stephen Rosenberg’s firm.

In August, Sacks’ team originated a $198 million Fannie Mae-backed financing package to refinance a portfolio of multifamily properties for multifamily and retail single-family office investor Besyata Investment Group. The loan covered the refinance of three properties, totaling 1,782 units.

Sacks and his team of eight finance professionals expect to originate around $2.25 billion this year.—M.B.

Josh Sasouness, 31

Managing Principal, Dwight Capital

For Josh Sasouness, Manhattan-based Dwight Capital is a family affair: He cofounded the commercial real estate and investment house with his brother Adam Sasouness in 2014, and the pair serve as the company’s co-chief executives. Such familial ties are probably why the firm bills itself as providing “institutional-quality finance without the bureaucracy.”

As an individual dealmaker, Sasouness’ biggest transaction was also one of the largest in the history of the federal Department of Housing and Urban Development: a $128 million loan in July 2016 for City Market, an apartment complex on Washington, D.C.’s O Street. At the time it was the largest HUD loan under its 223(a)(7) section, which insures lenders against losses on mortgage defaults.

More recently, Sasouness, an Alpine, N.J., native who now lives in the West Village, closed on a $40 million HUD loan for a Bradenton, Fla., project with 262 apartments on 23.8 acres. Sasouness and his team were able to get the owner a reduced mortgage insurance premium through a federal energy-efficiency program.

In general, Josh Sasouness has had an especially good track record with federal loan programs. He has originated more Federal Housing Authority-HUD transactions than any other individual in the country, according to the firm, with a network of owners, developers and operators nationwide.

The firm is growing: The Sasouness brothers have expanded Dwight Capital’s Manhattan headquarters since 2014, and have added office locations in Washington, Cleveland, and St. Petersburg, Fla.

It was while at George Washington University that the real estate bug bit Sasouness: A professor taught him the nuances of the mortgage banking industry. He worked as a broker renting apartments during college summers and after graduation landed a position at Greystone & Co., where he led a top nationwide multifamily loan origination group before striking out with his brother.—T.A.

Pinchas Vogel, 31

Director of Bank Relationships & Loan Placement, Eastern Union Funding

Given the plethora of our young honorees this year who got a head start in real estate through college or even high-school internships, Pinchas Vogel’s early achievements in real estate finance are all the more impressive considering it’s not even his first career.

The 31-year-old, who has risen to lead lending relationships for Eastern Union Funding, was an accountant in a former life, helping clients near where he lives in New Jersey prepare their tax returns. But assisting those who had real estate assets or liabilities on their balance sheets soon inspired a career change.

“After working for clients who were involved with real estate, I wanted to use my accounting background as a conduit to enter the industry through the back way,” Vogel explained.

Since that humble beginning, there’s been nothing furtive about Vogel’s impact at the New York-area brokerage.

At Eastern Union, the native of Far Rockaway, Queens, currently runs the company’s Quotes and Term Sheets division. His team of 20 is responsible for keeping in touch with about 250 lenders nationwide, so that when a new loan request comes into the Eastern Union office the broker responsible knows exactly whom to pitch it to.

Granted, the energetic company, led by Ira Zlotowitz, rarely works on the sort of marquee properties that make front page news. But few firms come anywhere close to the sheer volume that Eastern Union churns through, as Vogel knows all too well.

“We do crazy, crazy volume,” he said. “We’re seeing 450 new opportunities per month, because we’re everything-agnostic. We don’t care about property type or loan size.”

Vogel likes to spend any free time that’s left with his family in and around their New Jersey home. A finance nut through and through, Vogel can also often be spotted paging through business-minded non-fiction. “Think Like Amazon,” a book by John Rossman about the strategies that have made the e-commerce giant a global powerhouse, is one recent favorite.—M.G.

Andrea Wagonseller, 34

Vice President, M&T Bank

Many real estate superstars grew up in New York or other major metropolises, where a childhood spent in skyscrapers’ shadows can breed an innate familiarity with the rhythms of commercial real estate. That makes the exceptions to the rule all the more intriguing.

Take Andrea Wagonseller, who spent her high-school years in rural Ohio, about 30 miles east of Columbus. Wagonseller’s first job was at Park National Bank as a mortgage data processor at around the same time she was pursuing a degree in economics from the University of Rochester.

“I learned a lot about banking and the residential mortgage market, but to be honest, I got bored pretty quickly with that role,” Wagonseller said. “You’re working with great teammates, but you know, there’s no client interaction.”

Her next job was perhaps just a notch higher on the totem pole, but Wagonseller gained a wealth of experiences of a different kind when she moved on to become a retail teller and eventually, a branch manager.

Today, that kind of work is a distant memory. There’s nothing rote about Wagonseller’s role as a vice president and relationship manager at M&T Bank. Based in New York City, she’s responsible for structuring debt deals commensurate with the size and dynamism of the Big Apple’s world-beating real estate market.

At the moment, for instance, she’s at work finishing up a $400 million financing package for a residential developer who is building a new project with a 70-30 affordable component in the city.

It was too early to talk specifics about that project, except for Wagonseller to divulge that the builder is “one of New York City real estate’s top families.”

Wagonseller, who also picked up a master’s degree in business from New York University along the way, enthusiastically recommends the career to younger aspirants, noting that she’s benefitted from a terrific stretch of upward mobility enabled by hard work.

“It’s imperative that you approach this industry with a healthy curiosity and a desire to learn,” Wagonseller said. “I think you have to be able to roll up your sleeves and work hard, because our industry is anything but stagnant. I could read for days and I still wouldn’t be caught up on everything I’d love to know about what’s going on right now.”—M.G.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)