CapitalSource, Atalaya Capital Provide $315M in Financing for NoMad Ritz-Carlton

By Cathy Cunningham July 20, 2018 6:00 pm

reprints

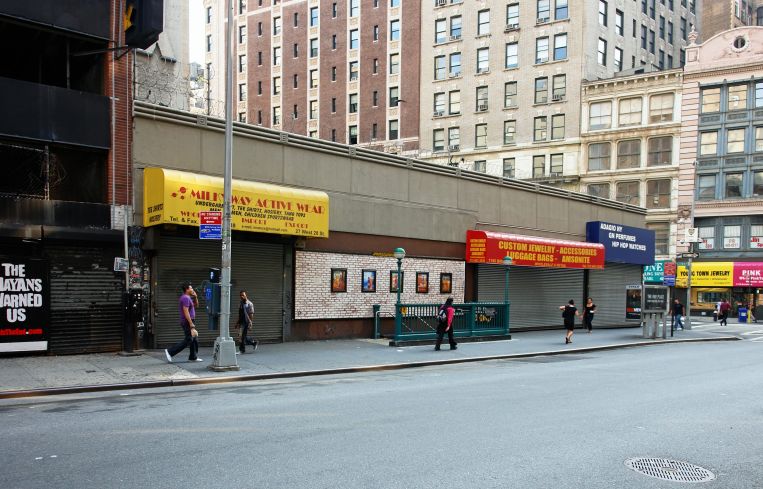

Flag Luxury Properties has nabbed $315 million in financing for the construction of its Ritz-Carlton hotel at 1185 Broadway, according to property records filed today and sources familiar with the deal.

CapitalSource—a division of Pacific Western Bank—and Atalaya Capital joined forces to provide $250 million in construction financing. Atalaya also provided $65 million in preferred equity in the deal, sources told Commercial Observer.

The $250 million in construction financing comprises a $108 million building loan and $92 million project loan and also replaces $50 million in acquisition debt on the property that was provided by United Overseas Bank in 2016.

Both the building and project loans are split in an A/B-note structure with CapitalSource as the A-note holder and Atalya Fund VI REIT as the B-note holder.

The building loan’s A-note has a maximum principal balance of $64.6 million and the B-note a balance of $43.3 million. The project loan’s A-note has a maximum principal balance of $55 million and the B-note weighs in at $37 million.

Flag Luxury picked up the NoMad site from Clark Wile and Mayer for $100 million in 2015.

The 40-story building,153,199-square-foot building is being designed by architect Rafael Vinoly and will include 11,200 square feet of commercial space, according to New York YIMBY.

Paul Kanavos’ Flag Luxury empire also includes Ritz-Carlton South Beach, Ritz Carlton Bal Harbor Resort, Ritz-Carlton Coconut Grove and Ritz-Carlton Golf Club & Spa Jupiter.

Officials at CapitalSource declined to comment, officials at Atalaya did not immediately return a request for comment.