Runyon Group Nabs $38M Construction Loan for LA Office Project

By Matt Grossman February 16, 2018 3:39 pm

reprints

Los Angeles-based developer Runyon Group has secured a $38 million construction loan to build out the latest stage of Platform, a mixed-use development in Culver City, Calif., according to an announcement from Quantum Capital, which arranged the financing.

The four-and-a-half-year, floating-rate loan from Cathay Bank comes with an extension option, Quantum said. Runyon will use the proceeds to fund construction at 8888 Washington Boulevard, where it plans to finish a four-story mixed-use commercial building to go along with its thriving high-end shopping center on the site.

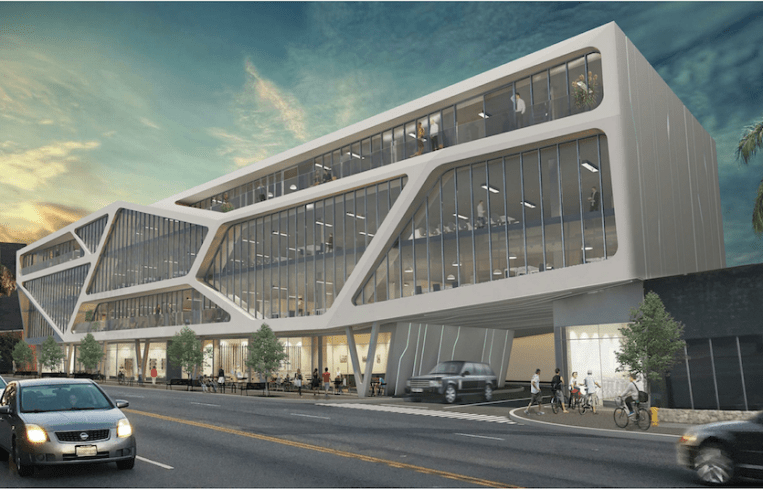

When complete, the sleek new structure—designed by Abramson Teiger Architects—will host 66,000 square feet of office space and a 6,000-square-foot ground-floor retail box. Completion is scheduled for summer 2019.

The project’s location, a block and a half from the nearest metro stop, promises to keep Platform’s neighborhood—about half a mile from downtown Culver City—an attractive destination for office tenants, according to Quantum managing director Jonathan Hakakha.

“Culver City was an emerging market, but with the development of Platform, it’s become the new ‘it city’ in Los Angeles, due to its location between Downtown L.A. and Santa Monica,” Hakakha said.

Cranes on site to support construction of new office project, which Runyon is building with an eye towards media, entertainment and tech tenants, will be in good company in the neighborhood.

Last year, ground was broken at Ivy Station, a 500,000-square-foot multi-use project with apartments, shopping, offices and a hotel on a site a couple blocks from Platform.

And HSH Management Group has plans for a new 712-apartment multifamily project at 6221 Bristol Parkway, although a neighborhood group’s opposition over fears of increased congestion could yet derail that initiative.

Representatives from Runyon and Cathay Bank did not respond to requests for comment.

Quantum Capital has been especially active on the California construction scene lately, closing a concurrent $16.5 million loan to build a multifamily complex in Walnut Creek—a Bay Area suburb northeast of Oakland.

“We’ve seen an increase … in lenders’ appetite for construction debt between the first half of 2017 and the beginning of 2018,” Hakakha said in a statement. “Based on our conversations with multiple lenders and the amount of construction loans we have under application, we expect an ample supply of construction debt in 2018.”