Manhattan’s Sublease Pricing Gap Widens

In January the average Manhattan sublease asking rent was 26.2 percent smaller than the direct average

By Richard Persichetti February 22, 2018 3:09 pm

reprints

While watching the Winter Olympics over the past two weeks, I realized how cool some of these events are, especially snowboarding and speed skating. Watching the speed skaters in a mass-start event while the lead skater breaks away from the rest of the pack, made me think of how the distance between Manhattan direct and sublease asking rents is growing.

Despite Manhattan overall asking rents dropping year-over-year for both direct and sublease space, the depreciation for sublease was greater. The increase in the sublease supply, 1.4 million square feet, was added to the market over the past 12 months and placed a downward pressure on asking rents. In January, the average Manhattan sublease asking rent at $55.11 per square foot was 26.6 percent below the direct average of $75.12 per square foot. This pricing gap has widened compared with one year ago, when the difference was 430 basis points lower at 22.3 percent.

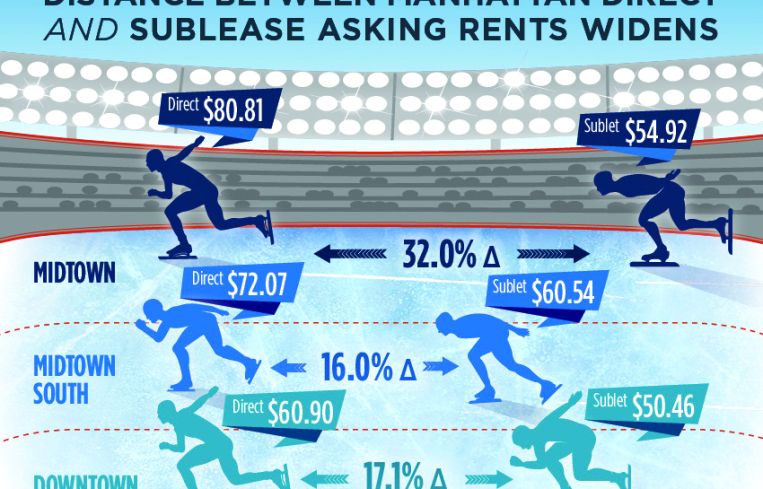

The pricing differential for Midtown is the largest of the three major markets. Midtown sublease pricing is 32 percent lower than direct space with direct asking rents averaging $80.81 per square foot, compared with sublease asking rents at $54.92 per square foot. The price disparity for Midtown Class A is even larger with subleases priced 33.8 percent below direct space. The pricing gap widened the most for Midtown overall and Class A asking rents over the past year, up 520 basis points and 670 basis points, respectively.

Midtown South has the smallest gap between direct and sublease space, and the amount between them narrowed year-over-year. At $60.54 per square foot, sublease space averages 16 percent below the direct average asking rent of $72.07 per square foot. In January of 2017, that difference was greater at 18.9 percent.

Downtown sublease asking rents averaged $50.46 per square foot in January, a 17.1 percent discount to a direct average asking rent of $60.90 per square foot. The pricing differential slightly increased from one year ago, up 270 basis points from a 14.4 percent difference.

Looking forward, expect the price difference to continue to widen between direct and sublease asking rents throughout the year, as new construction completions drive direct rents up, while sublease rents remain flat.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)