Stat of the Week: 156,212 Square Feet

By Richard Persichetti January 25, 2017 5:17 pm

reprints

It’s three-plus weeks into 2017, and by now most people who made a New Year’s resolution broke it. Only around 9.2 percent of people feel they are successful in keeping with their resolutions, according to online statistics company Statistic Brain, but I intend to stick to my resolution of shedding some pounds. So, even though I get looks around the office for carrying my giant 48-ounce water bottle everywhere, I know it will be worth it come March.

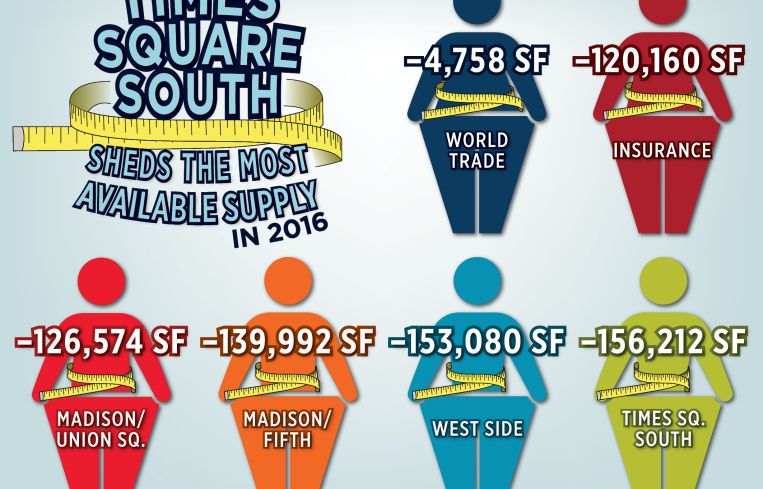

In 2016, only six of the 19 Manhattan office submarkets actually shed available supply, while unfortunately, the other 13 added to their waistlines. So, let’s examine the six submarkets that stuck to their resolutions in 2016.

World Trade—One of two Downtown submarkets squeezed onto the list, as its available supply dropped 4,758 square feet to 3 million square feet from 3.01 million square feet. This decline was buoyed by two new leases signed greater than 100,000 square feet during 2016.

Insurance—Downtown’s second submarket to shed available supply, with a drop of 120,160 square feet, to 1.17 million square feet from 1.29 million square feet. Despite no large new leases, this submarket benefitted from a year-over-year increase in new leasing activity as it was only one of six submarkets throughout Manhattan with a rise in demand.

Madison/Union Square—Surprisingly, Midtown South only had one submarket where the available supply dropped year-over-year, as Madison/Union Square shed 126,574 square feet to 1.92 million square feet from 2.04 square feet. Similarly to the World Trade submarket, two new leases greater than 100,000 square feet were signed, which helped with the decrease in available supply.

Madison/Fifth—Midtown’s first of three submarkets to make the list, as it shed 139,992 square feet of available supply in 2016, down to 2.68 million square feet from 2.82 million square feet. After starting 2016 with five consecutive months of increases in available supply, a 159,306-square-foot lease by WeWork at 12 East 49th Street helped the available space drop consecutively for the last five months of the year.

West Side—The West Side dropped 153,080 square feet of available supply, to 2.77 million square feet from 2.92 million square feet. Although the submarket did not benefit from any new leases greater than 100,000 square feet signed, there were six midsized tenants that signed deals between 50,000 and 100,000 square feet, the most of any submarket on this list.

Times Square South—The submarket where the New Year truly starts had the largest decline in available supply, shedding 156,212 square feet. The decline to 2.83 million square feet from 2.99 square feet was mostly due to a whittling away of the availability of Class B space, which dropped by 119,161 square feet.