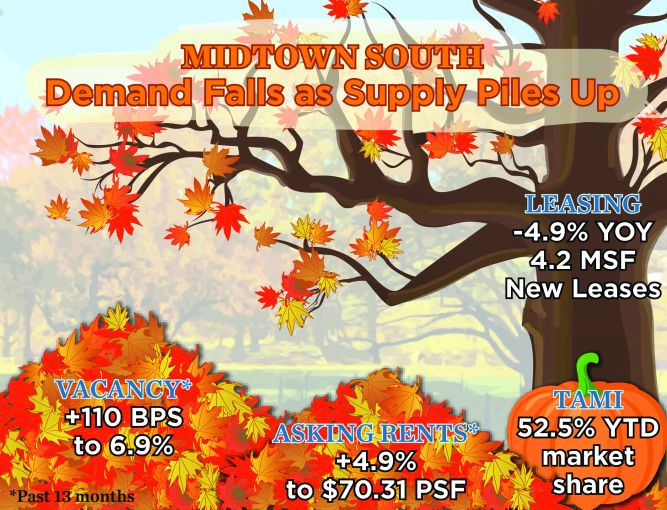

Stat of the Week: 6.9 Percent

By Richard Persichetti November 16, 2016 9:40 am

reprints

Living in the suburbs has its advantages and its disadvantages, and despite a beautiful fall and Thanksgiving season, cleaning up a leaf-covered yard is irritating. The thought of leaves piling up made me think about Midtown South’s vacancy, which has also been on the rise. In September 2015, vacancy hit an expansion cycle-low of 5.8 percent but has steadily increased over the past 13 months to 6.9 percent. During this time, more than 620,000 square feet of direct space was added to the market, while the available sublease supply increased by 96,095 square feet.

The bulk of this increase is in Class B and Class C space, as Class A vacancy declined 30 basis points over this period to 4.2 percent. Class B vacancy is up 80 basis points to 6.8 percent since it bottomed, as 67,666 square feet at 75 Varick Street and 55,025 square feet at 95 Madison Avenue was added earlier this year. Class C vacancy has soared during this time to 9.7 percent, a 290-basis-point increase, with most of the space added in Hudson Square/West Village.

Demand slowed this year compared with one year ago, down 4.9 percent with only 4.2 million square feet of new leases signed, yet still remains 3.6 percent above this expansion cycle average. The technology, advertising, media and information sector remains strong in Midtown South, with over 1.2 million square feet leased this year, on pace to surpass last year’s total of 1.4 million square feet. This sector accounts for 52.5 percent of new leasing activity this year, up from 45.7 percent in 2015.

The increase in market share for the TAMI sector can be partially attributed to other industries being priced out of the area as asking rents continue to soar to historical highs.

A tenant that signed a 10-year lease in Midtown South in 2006 could be faced with a 73.5 percent increase in rent, as overall asking rents average $70.31 compared with only $40.52 per square foot a decade ago. Over the past 13 months, asking rents added to the historical high average and are up 4.9 percent due in part to the first time that three of the five submarkets average north of $70 per square foot.

Despite the rise in vacancy, tenants now have the opportunity to jump into a pile of spaces that were missing from the market for the last 13 months.