In Their Own Words: Real Estate’s Top Dogs Sum Up 2015 and 2016

By Terence Cullen December 16, 2015 12:00 pm

reprints

There’s plenty in store for 2016, and we’re not just talking about the Olympics, the new Ghostbusters movie or the presidential election. We polled some of the top real estate industry officials—developers, brokers and business groups alike—to get their take on the last year (see story on page 32) and what we can look forward to in 2016 (below). There was consensus that 2015 was a pretty strong year. But there’s a lot of disagreement on how the market will perform, whether the turmoil in Syria and the Ukraine will shake the foundation of the market here and how the technology, advertising, media and information services, or TAMI, sector will fare.

Larry Silverstein

Chairman, Silverstein Properties

“I have a very positive feeling in my gut that says 2015 was a great year and 2016 will be an even better one. I can’t see good reason for that to stop. You’ve got this continued flow of capital and tremendous growth creation around the globe. It’s got to go somewhere, and the bulk of it is coming right here. It makes you feel pretty good.”

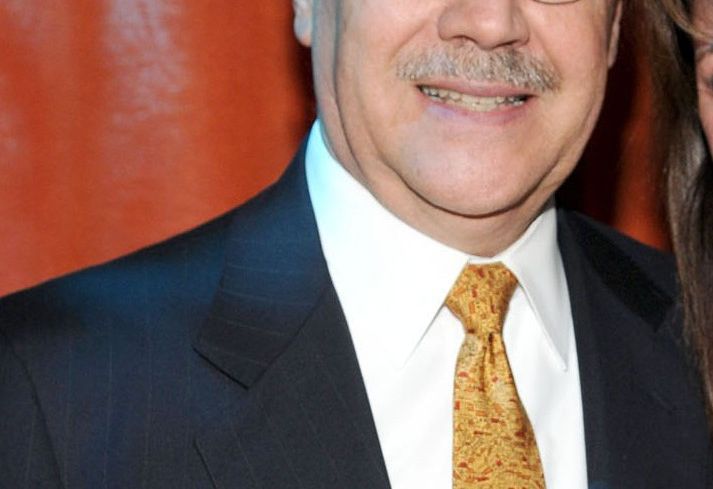

John Banks

President, Real Estate Board of New York“The [421a] negotiations are underway, ongoing, and they mark a great opportunity to engage in frank and honest discussions about how we can build much more affordable housing. There’s an opportunity to ensure construction workers are treated fairly and create job opportunities for residents of the city.” (Photo: Adam Jones/for Commercial Observer).

Anthony Malkin

Chairman and Chief Executive Officer, Empire State Realty Trust“2016 will see more downward adjustment in the private market values of more TAMI businesses, the distinction of real businesses from unjustified enthusia sm and increased focus of real businesses on buildings in great locations with financially solid landlords. Watch for Ping-Pong tables and foosball to be replaced by cubicles and tech workers dropping off and picking up their dry cleaning themselves.”

Joseph Harbert

President of Eastern Region, Colliers International“I think we’re going to see another strong year next year. I don’t know if prices will continue to escalate at the rate that they have. You have a flow of capital into New York that would mitigate any concerns about the local, or national or global economy slowing down any way. Retail may be a little softer than it has been.” (Photo: Clint Spaulding/PatrickMcMullan.com).

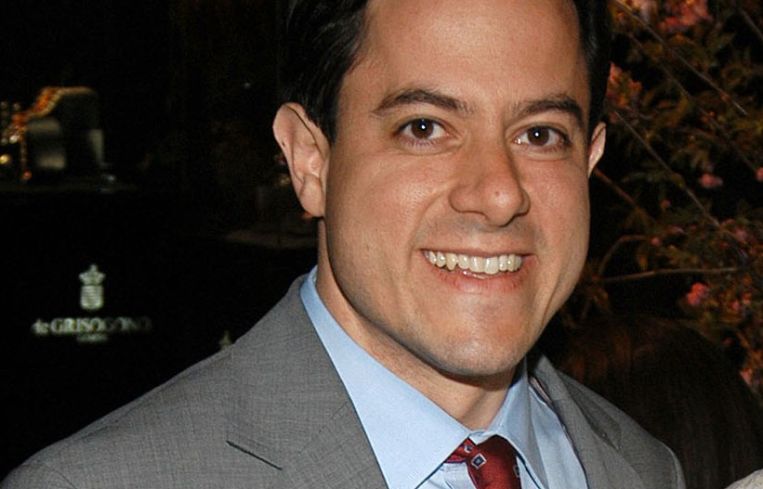

Robert Knakal

Chairman of New York Investment Sales, Cushman & Wakefield“The number of properties sold will likely be down by 25 percent to 35 percent given the elevated levels seen in the last two years. The dollar volume should not be down by quite as much, but we expect a 20 percent reduction in this metric. Values have started to soften in some sectors, which will continue into 2016 and will affect all sectors as we proceed further into the year.” (Photo: Mireya Acierto/PatrickMcMullan.com)

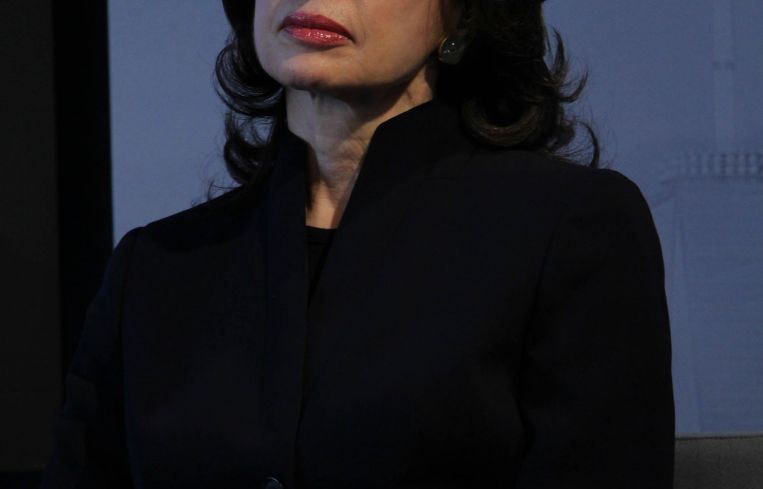

Mary Ann Tighe

CEO of New York Tristate Region, CBRE“You are going to see, I believe, increasing [commercial] rents. I would say that there is a high probability that by the end of 2016, you will see Midtown close to its record rents in 2008 and you will see rents continue to rise in Midtown South and Downtown.” (Photo: RONALD RIQUEROS/PatrickMcMullan.com)

Ron Lo Russo

President of the New York Tristate Region, Cushman & Wakefield“There’s been a lot of activity [Downtown]. We’ll continue to see that in 2016, as people have a desire to see new product. From the real estate world, we’re still going to have a strong market going into 2016.”

MaryAnne Gilmartin

CEO, Forest City Ratner Companies“The city is in a strong place from the job creation point of view. You’re starting to see a spike in rents in Downtown Brooklyn, which is a sign it could be ready for a world-class office building. We’re starting to see that that is now possible.” (Photo: Sasha Maslov/for Commercial Observer)

Peter Hauspurg

Chairman and CEO, Eastern Consolidated“In 2016, we will have some competing factors—the strong dollar that might reduce foreign interest in U.S. real estate, balanced against uncertainty with the instability in many parts of the world. Therefore we will see flight money continue to park here, from investors who are far less concerned with current yield than they are with the preservation of capital and the ability to liquefy when they need to.” (Photo: CHANCE YEH/PatrickMcMullan.com)

David Falk

President of New York Tristate Region, Newmark Grubb Knight Frank“People who are moving in the years, say, 2018 to 2020, will be moving [out] of older buildings in Midtown, and moving to brand new buildings in Hudson Yards. My prediction is most of those owners will probably look at their assets and try to really reimagine them. They’re going to do everything they can to add youth to those buildings.” (Photo: Sean Zanni/PatrickMcMullen.com)

Norman Sturner

President and CEO, MHP Real Estate Services“We’re not near saturated [with office space]. We’re still in the fifth inning.” (Photo: Sasha Maslov/for Commercial Observer)

Scott Galin

Principal and CEO, Handler Real Estate Organization“Looking ahead, assuming there are no major geopolitical events beyond our control to disrupt the U.S. economy, we are cautiously optimistic that 2016 will prove to be a relatively strong year with a few soft pockets, such as super high-end residential.”

Daniel Garodnick

New York City Councilman“2016 stands to be a very big year for East Side transportation. The Second Avenue subway is marked for opening in December of 2016 barring any further delays. It is a long-needed and much anticipated improvement that will make a real difference.” (Photo: A SCOTT/PatrickMcMullan.com)

William Rudin

Vice Chairman and CEO, Rudin Management Company“I think continued strong leasing activity. The economy is strong enough where the Fed will likely be raising interest rates. Young people want to be here. Companies are following them to be in the city.” (Photo: Presley Ann/PatrickMcMullan.com)

Richard Anderson

President, New York Building Congress“We’re in a boom time, particularly in the private sector. The strongest component at the moment is resid`ential, and this in some ways is almost astounding with what’s going on.” (Photo: JONATHON ZIEGLER/PatrickMcMullan.com)

Jason Muss

Principal, Muss Development“You’re going to see slow but steady population growth. You’re not going to see the booms and busts we’ve seen in the past.”

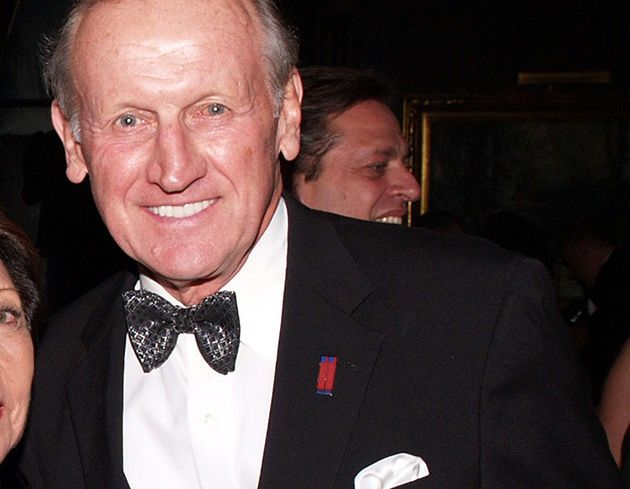

Douglas Durst

Chairman, Durst Organization“In 2016, residential rental demand will continue to outstrip supply with risk of a destructive interruption in the rental pipeline due to the uncertainty of 421a. This will push residential rents up.” (Photo: A. De VOS/PatrickMcMullan.com)