When Is a Prepayment Premium Not a Prepayment Premium?

By Joshua Stein March 10, 2015 12:00 pm

reprints

Boilerplate language, familiar and old, sometimes doesn’t play out in the real world exactly as planned.

As a major bankruptcy case recently demonstrated, huge economic surprises can lurk in standard language—even when the facts of the case are quite ordinary.

This particular case involved the simple issue of a prepayment premium, which states that if a borrower repays a loan earlier than intended, then it must compensate the lender for some or all of the interest the lender would have earned had the loan stayed in place for the agreed term.

The borrower was Momentive Performance Materials, Inc., a business that Apollo Management LLC acquired from GE in 2006 for $3.8 billion. According to Bloomberg, the company never once made an annual profit since that acquisition. Nevertheless, a group of lenders was happy to provide a package of multiple corporate loans evidenced by a complex stack of bond documents. The documents—which were essentially loan documents—provided for the possibility that the borrower might prepay, and gave the lender the right to collect a prepayment premium if that happened. So far, so good.

Instead of voluntarily prepaying, though, the borrower decided to file bankruptcy. The language in the loan documents—“standard boilerplate”—said the bankruptcy triggered an acceleration, i.e., an obligation to immediately repay the loan. The lender wanted to treat the acceleration as an optional or voluntary prepayment so as to collect the premium. Any need to pay that premium would have added significant complexity to the borrower’s plans to reorganize through bankruptcy.

The bankruptcy court parsed the loan documents to determine exactly how the various prepayment provisions fit together. The documents contemplated the general possibility of prepayment, requiring a premium only in the case of a voluntary optional prepayment before a certain date.

The court decided an acceleration triggered by bankruptcy did not in fact qualify as a voluntary optional prepayment. The loan documents didn’t express with “sufficient clarity” that such a prepayment triggered the premium. Instead, the court interpreted the language of the loan documents only to mean that if the borrower files bankruptcy, then the loan must be repaid early—nothing about a prepayment premium in that particular case.

It may seem “obvious” that an acceleration in bankruptcy was just as voluntary as any other optional prepayment, and hence “should have” triggered a prepayment premium. After all, the lender suffered the exact same loss of interest income as if the borrower had voluntarily prepaid.

The court didn’t agree. The documents just weren’t explicit enough in requiring the premium in the particular case of an acceleration through bankruptcy. It was a big loan and a big loss: The missing language reduced the lender’s claim by around $200 million and vastly enhanced the borrower’s ability to confirm its plan of reorganization.

When not examined under the microscope of the bankruptcy process, the prepayment language in the Momentive bond documents sounded utterly ordinary. The documents gave the borrower a prepayment option and provided for an “applicable premium” if a voluntary prepayment occurred. Anything “applicable” must be very serious!

The documents referred repeatedly to possible prepayment. The formula to calculate the premium was thorough and quite burdensome to the borrower. But when the bankruptcy judge examined the document closely, a piece was missing: A tight and unambiguous link between all that great prepayment language and the one factual circumstance that actually occurred. For a leveraged corporate borrower like this one, of course, an acceleration through bankruptcy hardly amounted to a left-field possibility. Indeed, a borrower of this type may be more likely to file bankruptcy as a financial management technique than voluntarily prepay a loan. Both possibilities are very much part of the territory.

In hindsight, the lender and its counsel should have made sure the bond documents triggered a prepayment premium if the borrower paid the loan early for any reason—bankruptcy, a whim, mandatory amortization, whatever—at any time before the original scheduled maturity date. It would have been a simple fix. But because the documents failed to capture a possible prepayment triggered by a bankruptcy acceleration, they essentially let the borrower off the hook.

In cases like these, the legal language often sounds quite fierce. But if one parses through its complexities and inclusions and exclusions, it doesn’t actually create the intended result in a particular set of not-too-far-fetched circumstances. The Momentive case is actually one of a significant number of cases where boilerplate language didn’t quite give the lender the rights it expected. Lenders and their counsel may want to revisit their “standard” documents and run through how those documents actually treat some of the problems most likely to arise. Instead of (or in addition to) focusing on unlikely hypothetical eventualities and the details of representations and warranties, they might want to double-check the stuff that’s particularly likely to become relevant—no matter how dumb, “standard” and fierce it may sound.

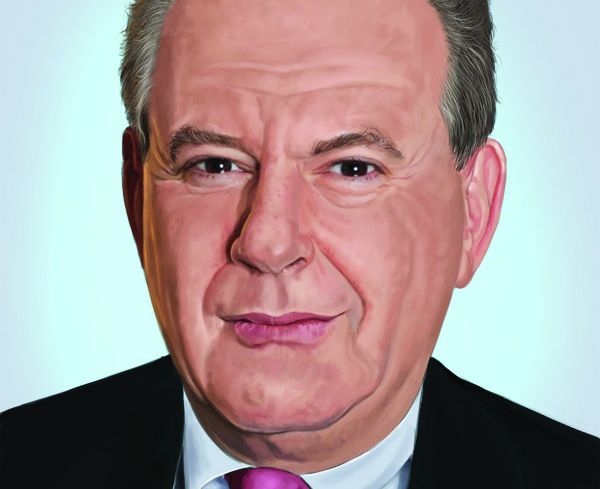

Joshua Stein is the sole principal of Joshua Stein PLLC. The views expressed here are his own. He can be reached at joshua@joshuastein.com.