Stat of the Week: 80 Basis Points

By Richard Persichetti March 11, 2015 3:19 pm

reprints

The avalanche of available space rolling onto the market continued in February. After the month of January had 11 buildings each dump 45,000 square feet or more of available space throughout Manhattan, February followed up with another 10 such buildings. This time the market was ready for the storm, and the availability rate dipped 10 basis points to 9.8 percent. This was due to leasing activity thawing out from January’s frozen state, as five transactions signed greater than 100,000 square feet were completed.

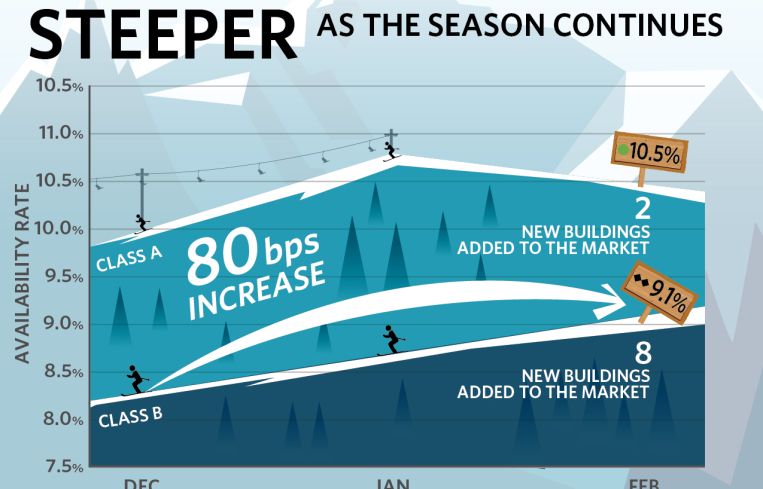

Most of the positive momentum occurred in Class A buildings, as the availability rate for Manhattan Class A dropped 30 basis points to 10.5 percent. All three major markets contributed to this decline in the available supply, as only two of the significant blocks of available space to hit the market in February were Class A spaces (one in Midtown and one Downtown). Class B space, however, was not so lucky.

The availability rate for Class B buildings shot up 80 basis points this year to 9.1 percent, after reaching an eight-year low of 8.3 percent at the end of 2014. Class B buildings accounted for eight of the 10 significant spaces added to the market in February, and brought the total Class B buildings with significant spaces to 10 for the year. These 10 buildings contributed to back-to-back months of negative absorption, the first time this has happened in almost two years. Midtown led Manhattan with eight Class B buildings placing large amounts of space on the market this year, which pushed the Class B availability up to 10 percent. The other two Class B buildings to bring significant space to the market were located in Midtown South, which still has the lowest availability rate at 7.7 percent.

Despite the change in the Class B available supply, expect the additional Class B space to create more value opportunities for tenants. The 10 Class B spaces added to the market average an asking rent of $58.03 per square foot, substantially discounted to the 11 Class A spaces added to the market with an average of $71.03 per square foot.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)