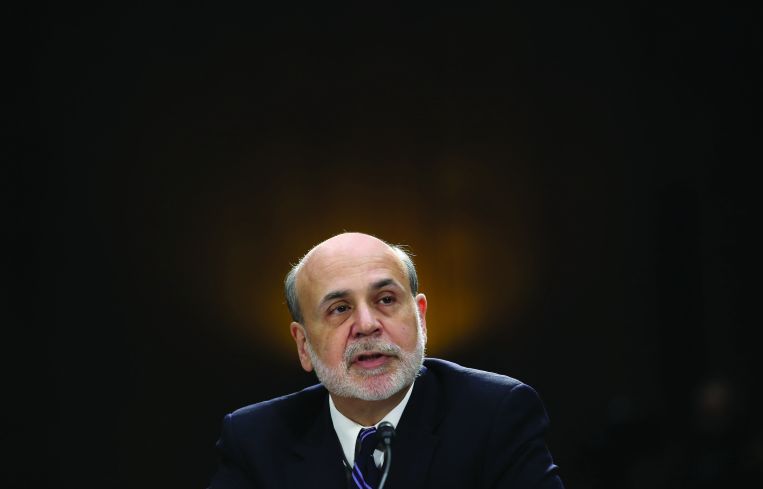

So They Say: Ben Bernanke Talks Refinancing Troubles, AIG and Other Hard Times

By Damian Ghigliotty October 31, 2014 2:35 pm

reprints

Ben Shalom Bernanke, who ended his tenure as chairman of the Federal Reserve in February, recently told a conference moderator in Chicago that he is unable to refinance his home mortgage due to the fact that most of his income comes from 1099 contracts rather than W-2s.

The remarks, made on Oct. 2 and first reported by Bloomberg News, evoked criticism from other media outlets, which quickly pointed to Mr. Bernanke’s latest endeavors, including a speech in Abu Dhabi in March that earned him an estimated $250,000.

The 60-year-old registered Republican, now an economist at the Washington, D.C.-based think tank the Brookings Institution, purchased his home in the nation’s capital for $839,000 in 2004 and last refinanced with a $672,000 loan in 2011. Mr. Bernanke’s home is now valued at $906,490.

Mortgage Observer looks at some recent quotes from the retired Fed chairman and former Princeton University professor.

“The housing area is one area where regulation has not yet got it right. I think the tightness of mortgage credit … is still probably excessive.”

—Remarks at a conference hosted by the National Investment Center for Seniors Housing and Care in Chicago (October, 2014)

“It was evident from the fact that the board took the Fed’s offer that [American International Group] didn’t have a better offer.

“I think the company did worse than I anticipated.”

—Legal testimony defending the U.S. government’s 2008 rescue of AIG (October 2014)

“September and October of 2008 was the worst financial crisis in global history, including the Great Depression.

“AIG’s demise would be a catastrophe [and] could have resulted in a 1930s-style global financial and economic meltdown, with catastrophic implications for production, income and jobs. It was our assessment that they had plenty of collateral to repay our loan.”

—Remarks quoted in court documents with the U.S. Court of Federal Claims (August 2014)

“You called me a dove. Well, maybe in some respects I am, but on the other hand, my inflation record is the best of any Federal Reserve chairman in the postwar period, or at least one of the best.”

—Testimony before the Senate Banking Committee (February 2013)

“We have tried very, very hard—and I think we’ve been successful at the Federal Reserve—to be nonpartisan and apolitical, to make our decisions based entirely on the state of the economy and the needs of the economy for policy accommodation.”

—Comments to the press following a Federal Reserve policy announcement (September 2012)