Fortress Prepping $4.7B Bid for Stuy Town

By Al Barbarino May 14, 2014 11:58 am

reprints

After word broke yesterday that Stuyvesant Town-Peter Cooper Village may be up for sale, New York-based private equity firm Fortress Investment Group is reportedly seeking financing to make a bid.

The New York-based private equity firm is seeking equity partners for a deal valued around $4.7 billion, Bloomberg reported today.

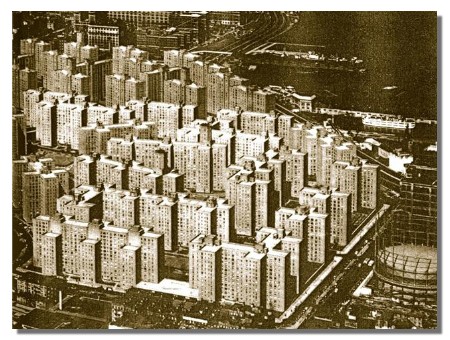

CW Capital, which runs the 11,200-apartment, 80-acre complex between 14th and 23rd Streets, said yesterday that it would foreclose on a secondary loan in order to take ownership of the complex in June, leading to speculation that they would sell.

Though the firm reportedly said that the foreclosure would have “no impact on our residents or on property operations,” tenants concerned that a sale could force their eviction are working with Brookfield Asset Management on a plan to convert apartments into condos in order to pay off bondholders.

Stuy Town’s value rose to $3.4 billion in September from about $2.8 billion when CWCapital took it over in 2010, but Barclays estimated on May 2nd that the property could pull between $4 billion to $4.3 billion in a sale, Bloomberg noted.

Tishman Speyer Properties and BlackRock bought the property for a record-setting $5.4 billion in November 2006 but lost the complex to lenders in 2010.

Stuy Town was built by The Metropolitan Life Insurance Company in 1947 as a response to a city-wide postwar housing crisis, according to GSAPP.