Leasehold Financing and the Mortgage Priority Conundrum

By Joshua Stein January 27, 2014 2:55 pm

reprints

When you structure a ground lease, the tenant’s mortgage needs to be ahead of the landlord’s mortgage, doesn’t it? Otherwise, maybe it’s not a first mortgage—or something like that. But what about the landlord’s mortgage? Isn’t that supposed to be ahead of everyone else? Otherwise, maybe it’s not a first mortgage. Who comes first?

These questions arise again and again in ground leases and leasehold loans. Usually, they start when someone announces the tenant’s mortgage must be prior to the landlord’s mortgage or the landlord’s mortgage must be ahead of everyone, though the lender will graciously give the tenant nondisturbance protection. Often, these discussions lead to tail-chasing driven by nonnegotiable edicts, coupled with a misunderstanding of the logic of ground leases.

These issues matter. If the parties get them wrong, then the landlord or the tenant—in the worst case, maybe even both—may find themselves seriously constrained in their ability to obtain mortgage financing or a favorable exit. And these issues arise again and again, because leasehold financing plays a huge role in major development and investment transactions in New York City and, to a lesser degree, elsewhere in the United States.

There is a right way to resolve these issues.

It starts by recognizing that, when the parties create a ground lease, they fundamentally convert a single piece of real property into two pieces of real property. First, there is the tenant’s long-term right of possession on hopefully attractive terms—a “leasehold.” Second, there is the property owner’s right to receive a hopefully attractive long-term stream of rental income, followed eventually by full possession of everything, including the tenant’s building, when the ground lease ends. That’s a “leased fee.” Each of those positions should have its own value and constitute a reasonable investment asset and reasonable collateral for a loan.

When a mortgage lender finances either the leasehold or the leased fee, the lender’s collateral consists of only the leasehold or the leased fee—nothing more. If the landlord defaults on its loan, the landlord’s lender or a foreclosure purchaser should end up acquiring the leased fee without in any way affecting the leasehold. After the foreclosure against the landlord, the tenant will just keep paying rent to a different landlord. Conversely, if the tenant defaults, the lender or purchaser should get just the leasehold without affecting the leased fee. A different tenant will just keep paying rent to the same landlord. Each lender must be comfortable with that result—i.e., comfortable with its collateral—or else not make its loan.

That means the tenant’s lender should receive a mortgage that attaches only to the leasehold. And the landlord’s mortgage should attach only to the leased fee, in a way that cannot possibly hurt the leasehold. That means the landlord’s mortgage needs to be “subordinate” to the ground lease, which in turn means that a foreclosure under the landlord’s mortgage will not affect the ground lease in any way. This is exactly the desired result. If such a foreclosure occurs, it should have no impact on the ground lease at all, because the ground lease should be “prior” to the landlord’s mortgage.

But when the landlord’s lender accepts the landlord’s leased fee as collateral, doesn’t that lender need to have a first priority mortgage, ahead of everyone else, including the ground lease?

No. When a mortgage lender finances a leased fee, the mortgage lender needs to understand and accept that its collateral consists of only the leased fee—the incoming rent stream and the possible windfall at the end of the lease—but not the entire interest in the property, i.e., both the landlord’s and the tenant’s positions. So when a lender accepts a mortgage on the leased fee, the lender needs to accept that, when it forecloses, it will acquire only the leased fee, subject to the lease. Thus, the lender’s mortgage needs to be subordinate to the leasehold. If the lender can’t live with that, it should not finance a leased fee.

What if the landlord’s lender gets a first priority mortgage but gives the tenant nondisturbance protection, i.e., an agreement not to terminate the lease if the lender ever forecloses? Yes, major national retailers do accept that arrangement, but careful tenants under ground leases, and their lenders, do not like it at all. Too much can go wrong. Why should they have to worry about it?

As the last piece of the puzzle, should a mortgage on a leased fee be prior to a mortgage on the leasehold? Or the reverse? Answer: neither. Each mortgage has different collateral, and never the twain shall meet. As long as the leasehold stays prior to the landlord’s mortgages, it all works. But what about condemnation clauses? That will have to wait for a future issue.

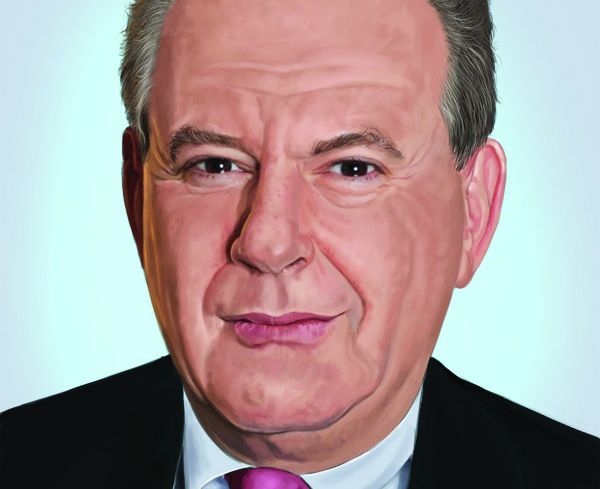

Joshua Stein is the sole principal of Joshua Stein PLLC. The views expressed here are his own. He can be reached at joshua@joshuastein.com.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)