Where Are the Big Tenants? CBRE Data Shows Lack of Large Deals in Manhattan

By Daniel Geiger October 16, 2012 4:20 pm

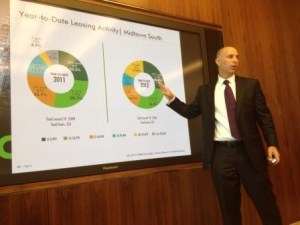

reprintsThe leasing market in Midtown and Lower Manhattan is down due to a paucity of big office deals, the real estate services company CBRE announced this morning, releasing its data for the third quarter of the year.

“In 2011 we had five deals over 250,000 square,” Peter Turchin, a leasing executive at CBRE who delivered a presentation to the media at the company’s headquarters, said, referring to Midtown. “In 2012 we haven’t had any. In 2011 we had 10 units leased above 100,000 square feet totaling 1.3 million square feet of deals. So far we’ve had two this year. So the real drop-off has been in the large tenant market.”

Downtown also has tallied fewer big deals. Last year, Conde Nast signed an over one million square foot lease at One World Trade Center. So far this year, only one deal larger than 250,000 square feet has been done, a 273,000 square foot transaction far smaller than the blockbuster Conde lease. Three leases above 100,000 square feet were signed in Lower Manhattan compared to seven last year.

The lack of big transactions has had an impact.

According to CBRE’s leasing figures, 9.6 million square feet of space was leased in Midtown through the first three quarters of the year, a total that would appear to put the neighborhood on track for about 13 million square feet of deals – well below last year’s total. Downtown has seen 3.3 million square feet of leasing this year compared to 4.8 million square feet during the same period last year.

In Midtown, 16.5 and 16.8 million square feet were taken respectively in 2010 and 2011, and the current year’s tally would equate to the most anemic period of leasing in the neighborhood since the depths of the recession in 2009 when there was about 11.6 million square feet of deals. Downtown’s projected leasing total would be higher than the last downturn but likely 25 percent less than last year’s roughly six million square feet of leases in that area.

In Midtown, where the dip in activity has been most pronounced, mid-sized deals, between 50,000 and 100,000 square feet, have also fallen from last year. Tenants of this size took about 1.5 million square feet during the first three quarters of 2011 in Midtown, more than the roughly 1.1 million square feet of activity they accounted for this year.

With the lack of sizable deals, the amount of big block spaces in Midtown has risen over the past year, from 30 options last October to 42 now.

Smaller deals, which have less of an impact on the health of the market, have tracked more consistently with last year’s numbers. About 2.2 million square feet of space was leased by tenants 25,000 to 50,000 square feet in size this year in Midtown compared with 2.6 million square feet last year. About three million square feet was leased both this year and last in Midtown by tenants 10,000 to 25,000 square feet in size. And 3.1 million square feet was leased by small tenants under 10,000 square feet in size so far this year in Midtown, compared to just slightly less during the same period last year.

“The decrease hasn’t been in the small tenant market,” Mr. Turchin said. “It’s just as active as it was a year ago. So if you’re an owner or you’re a tenant in the small-tenant market under 10,000 square feet, it’s been just as busy as it was in 2011.”

The sluggish activity has left rents and vacancy levels flat or weakening. Midtown vacancy was 12 percent, up from 11.3 percent at the start of the year. Average rental rates there are around $65 per square foot, only slightly above the $62 average at the beginning of the year. Downtown’s vacancy at the end of the third quarter was 10.6 percent, nearly identical to the 10.5 percent rate at the beginning of the year and average rents there have been hovering around $40 for the past three years.

Mr. Turchin indicated that landlords have been encouraged to break up big spaces in order to cater to the more active smaller-deal segment of the market. Such a strategy, he said, was employed at 399 Park Avenue, a building owned by Boston Properties where Mr. Turchin is a leasing agent. Earlier this year, about 150,000 square feet of space came available at the Midtown tower that Mr. Turchin helped fill with a collection of smaller tenants rather than one big user.