As the members of REBNY gather together this week, many will congratulate themselves on a fine year for leasing activity, despite the difficult global economy and the Beltway disaster otherwise known as the U.S. Congress.

All things considered, it was a decent year “leasing-wise” with activity from a wide variety of industries—even financial services, which seemed to always be teetering on the edge due to new regulations (still awaited) and mass layoffs (just beginning).

The saving grace really seemed to be media/tech, or what I’ve dubbed “techmunications”—a hard-to-describe new subset of the economy that crosses into the new media/computer/advertising frontier. Now all this leasing activity is wonderful—it puts money into the pockets of brokers and landlords as well as moving companies, construction workers (buildouts) and the like.

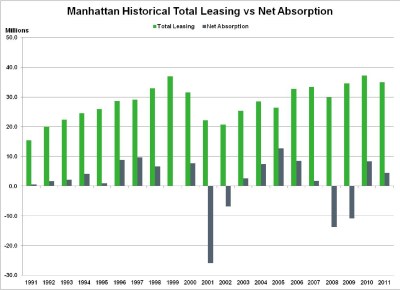

But if we look at net absorption (net change in occupied space), well, that tells a different tale. It was positive in 2011 at 4.4 million square feet (and even a bit better in 2010 at 8.3 million square feet) though nowhere near the record of the past 21 years—12.7 million square feet, or 48.1 percent of total leasing—back in 2005 (red-hot financial services, anyone?).

To really make a difference in getting our NYC/Manhattan economy moving forward, that net absorption must rise and that will take (yes, I know, it has become my mantra) jobs. That will really get the market moving again and allow for all that fancy new (potential) office construction coming down the pipeline. Most important, it will spread the wealth a bit more substantially than where it is centered today.

Robert Sammons, Cassidy Turley

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)