Advantage, Landlords: Bell Tolls for Prospective Tenants in Midtown Trophies

By Tom Acitelli July 5, 2011 2:35 pm

reprintsFor a while there, the cost of Class A office space in New York was tumbling amid thousands of layoffs, the Great Recession, cats and dogs living together, etc. Landlords were having to concede incentives like free rent and comped upgrades; and tenants were jumping at deals in addresses that in frothier times had higher barriers of entry.

That appears to have changed. Landlords now can command higher rents with fewer tenant incentives, evincing a serious pivot in New York’s economy.

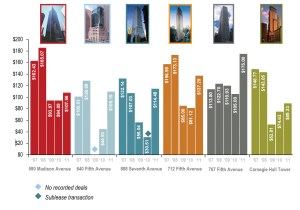

A new report from Jones Lang LaSalle shows the highest recorded terms on leases and subleases at six trophy buildings in midtown from 2007 through the beginning of 2011: 590 Madison Avenue, 640 Fifth Avenue, 888 Seventh Avenue, 712 Fifth Avenue, the GM Building at 767 Fifth Avenue and the Carnegie Hill Tower at 152 West 57th Street. The net effective rents—the base rent minus the cost of tenant incentives—have rebounded in the favor of landlords.

A new report from Jones Lang LaSalle shows the highest recorded terms on leases and subleases at six trophy buildings in midtown from 2007 through the beginning of 2011: 590 Madison Avenue, 640 Fifth Avenue, 888 Seventh Avenue, 712 Fifth Avenue, the GM Building at 767 Fifth Avenue and the Carnegie Hill Tower at 152 West 57th Street. The net effective rents—the base rent minus the cost of tenant incentives—have rebounded in the favor of landlords.

They’re not at 2007 or 2008 levels, the loudest years of the real estate boom. But they are not at 2009 and 2010 levels, either.

At Boston Properties’ GM Building, for instance, the highest net effective rent on a new lease was $113.80 a square foot in 2007, and dropped to $105 in 2010. It has climbed to $175 this year.

The biggest turnaround has been at Vornado’s 888 Seventh. The highest net effective rent tumbled from $132.13 in 2007 to $30.51 in 2010; and has jumped to $114.48 now. (The $30.51, it should be noted, was for a discounted sublease.)

This is not to say that tenant concessions are dead as a trend at the high-end. As the Jones Lang LaSalle report notes, while asking rents in midtown trophies were up 16 percent annually in May, the per-square-foot average for tenant incentives for each year of a lease was $5.34 in 2011 so far, roughly the same as in all of 2009, and actually up slightly from 2010.

Still: “When the market improves and demand for high-end space increases, historical data shows that asking rents rise before concessions are significantly reduced.” Emphasis ours.