Part 2! Dealing with a Financially Challenged Landlord (or Sublandlord)

In Part 1 of this column in September, we highlighted tenant protections against a landlord in distress, in particular use of the Subordination, Non-Disturbance and Attornment Agreement, or SNDA. Essentially, in return for subordinating the lien of the lease to the lien of the mortgage, the lender agrees not to “disturb” the tenant in the event of a landlord default and a subsequent foreclosure. We also highlighted that the typical SNDA represents a sharp trade-off for many important tenant concessions and protections as were obtained during hard-fought negotiations.

In Part 1 of this column in September, we highlighted tenant protections against a landlord in distress, in particular use of the Subordination, Non-Disturbance and Attornment Agreement, or SNDA. Essentially, in return for subordinating the lien of the lease to the lien of the mortgage, the lender agrees not to “disturb” the tenant in the event of a landlord default and a subsequent foreclosure. We also highlighted that the typical SNDA represents a sharp trade-off for many important tenant concessions and protections as were obtained during hard-fought negotiations.

Now, we discuss protecting subtenants and brokers from sublandlords and landlords in distress. Where we last covered tenant protections, now we look at some peculiar issues to be dealt with in the sublease context, and then revert to the issue of how brokers can protect their commissions, whether in a direct lease or a sublease scenario.

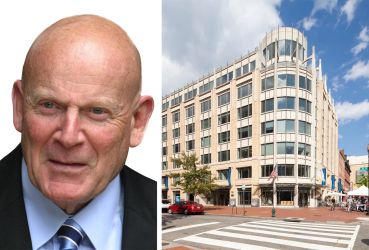

The scene: midtown office of a midsize ad agency.

The dramatis personae: the agency COO, its lawyer and its broker.

The discussions to this point: On the table is a draft term sheet for a seven-year 18,000-rsf sublease from a fairly well-known communications company in a Class A building at a substantially below-market rent. The space is pretty much in move-in condition. Broker will be getting its standard commission rates, but payable in two installments, half at signing and half six months later.

(We now listen in on the conversation. …)

Tenant: That rent is so appealing, but I have to be concerned about the finances of Telcomm. The street says they may not be around through the end of the year, let alone until 2017, when our sublease term ends. You know I’m a bit gun shy here. Back in the ’60s, when we first opened Cooper Sterling, we had taken a few rooms from one of our marginal clients–of course, that’s the only kinda client we had back then [chuckles]— and the guy left town owing mucho rent and we got booted by the landlord. It was not a pretty scene. [Tenant pauses to light a cigarette, his ninth of the day, and reaches for the bottle of Jack Daniels he keeps on his desk. It’s 10 a.m.]

Lawyer [declining the proffered bottle]: Well, a Recognition Agreement from the building owner should go a long way in terms of making sure you don’t have to live through that again, but the big bargain rent may be in jeopardy; that rent concession in years two and four will also take a bullet.

Broker [to himself, while debating the pros and cons of the proffered bottle]: Hmmm. I better figure out how I’m gonna make sure my commission gets paid … especially as half is due six months after signing. Gotta find that memo to all brokers on this from the company’s new international HQ office in Saigon. Try for an escrow? Commission in lieu of rent? Nah, that will never fly. Broker’s Entitlement Affidavit? (Does that apply to commercial leases?) Well there’s always a lien action … but who’s gonna pay for the litigation?

Oh, before we move off tenant protections, I wanted to share with you a letter I received after Part 1 of this column appeared:

Dear Jeff,

You have said that SNDA equals bargaining power. I represent a space-challenged small tenant. I was laughed at when I requested that SNDA. What should I do?

(Signed)

R.S.F. Small

Dear R.S.F.

If unable to get an SNDA, at least get a representation from landlord that it has not received notice of default from lender. While not protecting tenant from future default, at least tenant will know it is not signing on with a landlord in trouble.

Hope this helps.

JAM

O.K., NOW ON to protecting the subtenant.

We emphasized the importance of the SNDA in terms of protecting the tenant from a foreclosing landlord’s lender in the direct lease context; well, a document called the Recognition Agreement (“RA”) is its counterpart in the sublease context.

Simply put, under a Recognition Agreement, if the prime tenant-sublandlord defaults and the prime lease is terminated, the landlord will recognize the subtenant as its new, direct tenant. For the sake of completeness, we’ll add: provided the subtenant did not precipitate the tenant’s default and provided, too, that the subtenant is not then in default of its sublease obligations.

Like the SNDA, a tenant with clout will try to negotiate for this agreement up front, so it can be offered to suitable prospective subtenants. It is far more important than a mere subleasing checklist item.

With a sublease, potential pitfalls are magnified. Sure, a tenant may seek to sublease in connection with a consolidation of its operations or simply to lay off excess space for future expansion, but often the context is more dire: The space is on the market because the sublandlord is weak.

Again, major tenants are able to extract some agreement from the landlord to provide the RA when the initial lease is executed, usually with parameters as to the financial qualifications of the subtenant. More frequently, the request for the recognition agreement comes at the time the sublease consent is requested. The issue for the subtenant negotiating team is how to make the sublease equal a viable, market-worthy lease (and the subtenant an attractive direct tenant) in the landlord’s eyes.

As with the SNDA, if there is to be a “takeover,” the landlord does not want unwelcome baggage to go along with the deal. More on this later.

Leaving aside glamorous legal concepts as to privity of land and contract (stifle that disappointment) the landlord-lender-tenant relationship is different than that of landlord-tenant-subtenant.

All relations between landlord and subtenant flow through–are subordinate to–the main or prime lease. When we discussed the SNDA, it was in the context of protection from a foreclosing lender–that “S” was for subordination, getting the lien of the lease subordinate to the lien of the mortgage.

Not so in the sublease context. In fact, by definition, there is no such thing as a nonsubordinate sublease. If the prime tenant is forced out of the picture, the sublease ipso facto (O.K., you got some Latin) disappears and the subtenant must surrender and vacate or, if fortunate to have a Recognition Agreement, then a new legal relationship is formed, a direct relationship (tenancy) between the prime landlord and (former) subtenant.