A mortgage lender hates the idea that the borrower might file bankruptcy. Thus, even if the loan is otherwise nonrecourse, the lender will often require the owner of the borrower to sign a “carveout guaranty.” Such a guaranty won’t activate unless, in part, the owner ever decides to put the borrower into bankruptcy. It gives the owner every incentive to keep the borrower out of bankruptcy. It should solve the lender’s concern and prevent voluntary bankruptcies, right?

That dynamic works fine as long as no third parties enter the picture. If the owner owns 100 percent of the borrower and doesn’t have to answer to any other investors in the borrower, the owner can do as he or she pleases. The owner can make sure the borrower never files bankruptcy, even if failure to file will let the mortgage lender foreclose on the borrower, take the borrower’s only meaningful asset, and put the borrower out of business—a form of corporate suicide.

If the borrower has other investors, though, the situation becomes more complicated. If the borrower faces a foreclosure sale, then those other investors will want to see the borrower file bankruptcy, as a matter of self-preservation. This also almost means that for any company with any degree of complexity, if bankruptcy is available the company should always choose bankruptcy. Ordinary state-court foreclosure proceedings almost don’t matter.

If the controlling owner signed a carveout guaranty, though, the controlling owner may deliberately not pursue a borrower bankruptcy filing. By preventing such a filing, the controlling owner prevents guaranty exposure. The other investors might then claim the controlling investor didn’t live up to his obligations as a steward of their company—he let the company commit corporate suicide just to prevent guaranty exposure.

Controlling owners of borrowers and their counsel know how to prevent those claims from investors. They simply require the investors to waive any such claims in advance. If the investors don’t want to sign that waiver, then the controlling owner will find other investors.

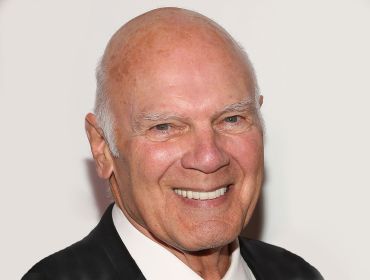

A case decided in April of this year shows that carveout guarantors may have more to fear than claims from co-investors. The case involved another layer of fallout from the Lightstone Group’s doomed purchase, in 2007, of Extended Stay Hotels, using mortgage debt and ten layers of mezzanine debt—each layer backed by a pledge of the equity ownership of the next entity down the ladder, finally reaching a pledge of the equity ownership of the mortgage borrower. David Lichtenstein, the principal of Lightstone, signed guaranties by which he personally agreed to pay $100 million if a voluntary bankruptcy filing occurred.