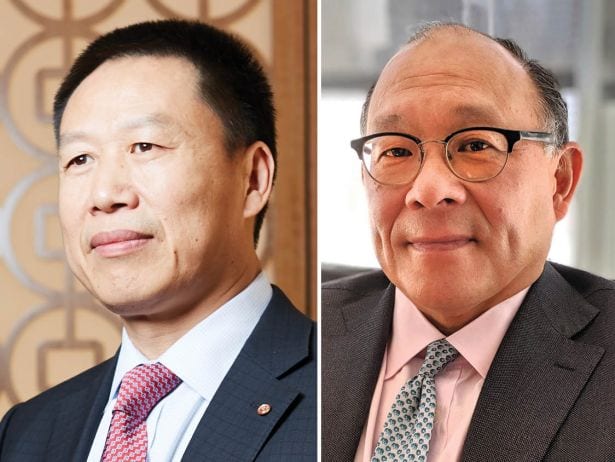

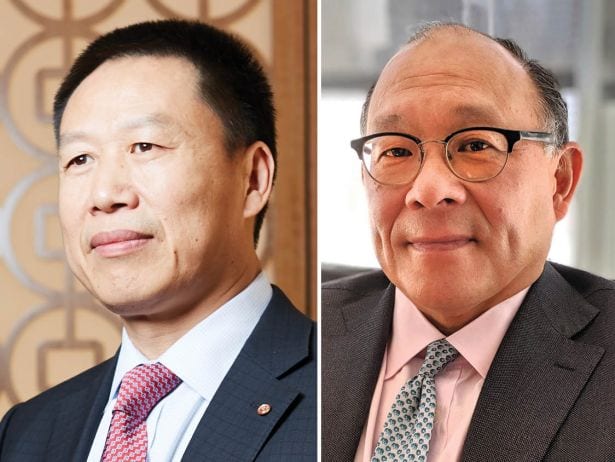

Raymond Qiao and Anthony Wong

Chief Lending Officer; Head of U.S. Commercial Real Estate Lending at Bank of China

Last year's rank: 38

Bank of China’s origination figures year-to-date for the start of April 2021 only came in around $606 million as a result of it pausing, and taking a slow and methodical approach to the whims of the market, allocating capital “cautiously in line with our balance sheet lending peers,” Anthony Wong said.

But, in just the first three months of 2020, leading up to the pandemic really hitting the economy, the bank came off a strong end to 2019, deploying $1.3 billion in debt, which had put them on pace to surpass $4 billion in lending in 2020.

By last summer, the bank was back at it. In June, it contributed half of the balance of a $171 million construction loan originated by Bank of America for Brookfield Properties’ 1100 Avenue of the Americas in Manhattan’s Bryant Park area, which it is planning to conjoin with the Grace Building. A month later, it closed on a $125 million loan to SL Green Realty Corp. on its development of Pace University’s 27-story, 215,000-square-foot outpost at 126 Nassau Street in Manhattan’s Financial District.

“Consistent with our culture, we support valued sponsors that are seasoned developers and owners,” Wong said. “We’re very relationship-centric and support our sponsors on good deals — well-leased, well-occupied and well-located, where we can structure with a margin of safety.

“We evaluated situations carefully, [those] in which not only the margin of safety for our loans would be wider, but also where cash flows and credit quality were strong,” he added.

Bank of China’s continued focus on major metros last year was a key, as Wong said the operation maintains a belief “in the viability of cities.” The bank also went out of its way in some cases — while honoring safety protocols and privacy concerns — to visit the homes of folks they were working with to get signatures executed, and make document drop-offs and pick-ups from various parties.

“We add value by being present, accessible and communicative,” Wong said. “Sponsors value our transparency, industry expertise and execution, which are also key factors in expanding our existing relationships.”—M.B.