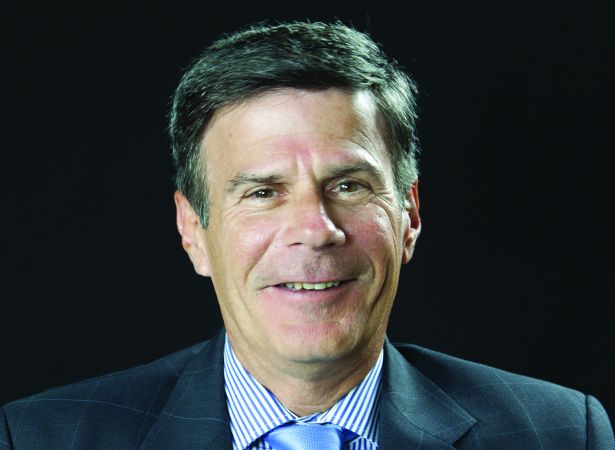

PHOTO: Courtesy John Adams

John Adams

Executive Vice President and Chief Lending Officer at New York Community Bank

Last year's rank: 42

New York Community Bank enjoys a reputation as a big-time, commercial real estate lender, as well as one that lives by its name as a community lender with a block-by-block understanding of its New York-area turf.

COVID could have gotten in the way of all that, but it did not, said John Adams. Despite the pandemic’s tumult for lending and for society in general, the Westbury, N.Y.-based bank made around $12 billion in commercial mortgage originations in 2020, which Adams called one of NYCB’s best annual performances.

“We never pulled back,” Adams said. “I can take you back 20 or so years, after 9/11. We never stopped. When we had the Great Recession of ‘08, ‘09, ‘10, we never pulled back. That doesn’t mean we went in with our eyes closed. We made sure our underwriting was appropriate for the situation, but we never closed our doors.”

Among the loans it financed was the refinancing of The Shoppes at 82nd Street, a retail property in the Jackson Heights section of Queens, where NYCB provided $59 million out of $79 million of construction take-out financing to developers Sun Equity Partners and The Heskel Group. It also funded a $105 million loan to Cardone Capital on luxury rental project Altis Boca Raton in Boca Raton, Fla.

Financing of commercial real estate was among the areas least affected by the lockdown, as executives learned to work from home and made an extra effort to be there for their clients, many of whom suffered revenue shortfalls as some tenants — especially those in retail, hotels and some workforce rental housing — had trouble paying their rent.

NYCB describes itself in regulatory filings as “a leading producer of multifamily loans on non-luxury, rent-regulated apartment buildings in New York City.” It also lends in the city’s suburbs as well as outside the tri-state area, including Florida.

In November, it declared a quarterly cash dividend of $15.94 per preferred share. That’s the same that it paid in 2019, a year not affected by the pandemic.—D.L.