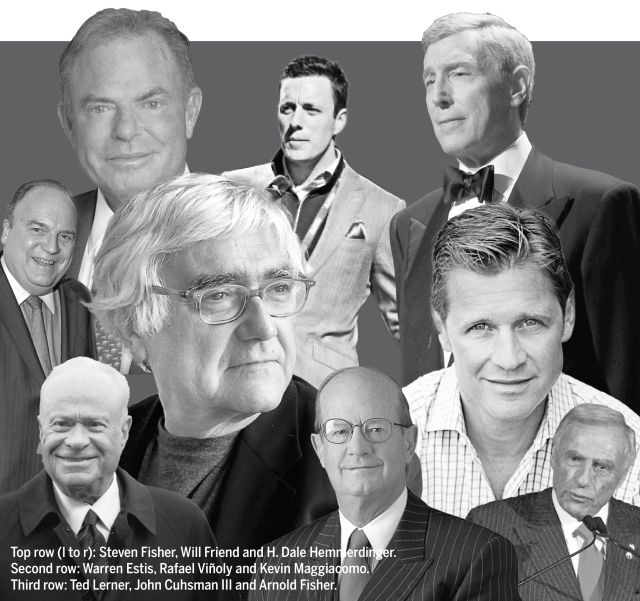

Clockwise from top left: Michael Rudin, Samantha Rudin Earls, Eric Rudin, and Bill Rudin.

Michael Rudin, Samantha Rudin Earls, Bill Rudin and Eric Rudin

Co-CEO; co-CEO; co-executive chairman; co-executive chairman at Rudin

Last year's rank: 30

In October of last year, Bill Rudin thought the timing was right.

It was time to usher the fourth generation of Rudins into positions of authority at owner and developer Rudin. So Michael Rudin and Samantha Rudin Earls, Bill’s son and daughter, became the company’s co-CEOs with Bill staying on as co-executive chairman alongside his cousin Eric.

“My father and Eric haven’t gone anywhere,” Michael Rudin explained. “They’re not off on a beach somewhere sipping mai tais. They’re very much here and active. They didn’t retire. They are still going to have a hands-on approach and involvement in the business. The major decisions are going to get made as a family, whether it’s an investment, a divestment, a partnership, whatever it may be.”

The changeover comes at a challenging time, not just for Rudin but also for the entire New York commercial real estate industry. But, given the company’s scope and experience, Rudin is better positioned than most to weather the uncertainty.

The 99-year-old company now has more than 600 employees, with a residential portfolio consisting of 17 buildings spanning 4.7 million square feet, and an office portfolio of 15 buildings and 10.1 million feet. Challenges the Rudins face include leasing up 3 Times Square and Dock 72, a building on the Brooklyn waterfront that Rudin co-developed with BXP as both companies’ first foray into the outer boroughs.

At 3 Times Square, Reuters, the building’s co-owner, has less use of it now. The Rudins find themselves then re-renting it in an age that takes for granted the renewal of Times Square — which the building helped herald.

“Could it be doing better? Sure,” Michael Rudin said. “Could it be doing worse? Also sure. We got Touro [University] in there in the bottom portion of the building. That was a really great deal to get done in the depths of the pandemic. They’ve grown their original footprint.” (Indeed, the school’s footprint is now nearly 310,000 square feet, helping bring the building to 58.6 percent leased, per Rudin.)

Regarding Dock 72, anchored by the bankrupt WeWork, Michael Rudin said, “We’re proceeding as it was designed. We’ll see where [WeWork’s bankruptcy] takes their space and their position in the building.”

But Rudin could also boast one of the most sought- after office development deals in a city that had a scarcity of them in 2023: With Vornado Realty Trust and hedge fund manager Ken Griffin, Rudin is partnering on a new 62-story tower for Griffin’s Citadel Securities at 350 Park Avenue, the plans of which the developers revealed in April 2024.