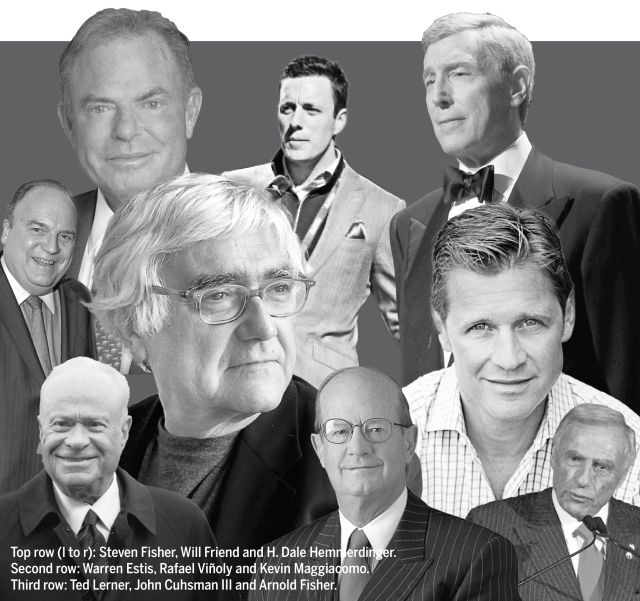

Mike Sales, Carly Tripp and Nadir Settles

CEO; global chief investment officer and head of investments; and global head of real estate impact at Nuveen Real Estate

Last year's rank: 24

It’s a nice time to have little investment exposure to traditional office space.

TIAA subsidiary Nuveen Real Estate has been active nationally in all different asset classes, except old-school office space. The firm had already shifted before COVID-19 and the decline in office values. That helped it stay active during the past year “at a moderated level,” Carly Tripp said.

“We have not been net investors in office. None of our strategies include traditional office, and so we hadn’t been investing there,” she said. “We’ve been focused for the last five years-plus on industrial, housing and alternatives. And those continue to be our bread and butter.”

Indeed, Nuveen’s activity spreads far and wide. For example, the firm owns 3.2 million square feet of life sciences space, and is building a 200,000-square-foot research lab called Iron Horse Labs on Manhattan’s Upper East Side with Taconic Partners and Flatiron Equities. This May, Nuveen announced it acquired more than 1,200 affordable housing units in what is one of the largest multifamily sales so far this year. The company didn’t share the value of the deal but said it was part of the $3 billion it has in new acquisitions in its pipeline.

For the office Nuveen does have in New York, Nuveen recently spent $40 million creating The Gardens at 780 with outdoor spaces, a lobby and basements at 780 Third Avenue in Midtown. Thanks to the flight to quality on the office side, Nuveen has maintained leasing activity at 701 Brickell in Miami’s Financial District, and has an impressive 95 percent occupancy rate at the trophy property during a time when landlords are more desperate for tenant demand.

Nuveen also recently made another big bet on industrial real estate in Southern California, and paid $151 million for a fully leased distribution project with 337,125 square feet in Los Angeles County. Southern California is also one of the hottest multifamily markets in the nation and a growing secondary life sciences market. Nuveen recently provided financing for an age-restricted community with 264 units in the Inland Empire, and led a joint venture to acquire a fully leased 56,300-square-foot life sciences building in L.A.

Additionally, Nuveen launched an impact housing sector, as well as a European value-add fund over the past year. In total, the firm has about $1.1 trillion assets under management.

“We’re very large investors in affordable housing, and we’ve just put more intention around that,” Tripp said. “We’re really fortunate, not only to be large — because this is when scale is absolutely a benefit — but part of a parent company that is also AAA-rated as well.”