Meredith Marshall

Co-founder and Managing Partner at BRP Companies

Where is BRP Companies going to be in 2026?

By 2026, BRP Companies is anticipated to have doubled in size when compared to the firm’s 2021 stature. This growth is being driven by our active involvement in a substantial volume of transactions across New York, New Jersey, the mid-Atlantic and the Southeast.

Where is BRP Companies going to be in 2028?

By 2028, BRP Companies will have evolved into a truly national development company with a firmly established portfolio and a more prominent widespread national presence.

Where is BRP Companies going to be in 2033?

By 2033, I anticipate that BRP Companies will have undergone a transformative phase in which the firm has ushered in new members of executive leadership and has continued to explore new markets across the country, further expanding our national footprint.

When will we know the market has stabilized? (Be specific!)

To achieve market stability in light of the uncertainties surrounding short- and long-term interest rates, we must address the current high rent levels. Achieving this stability requires a decrease in both short- and long-term interest rates.

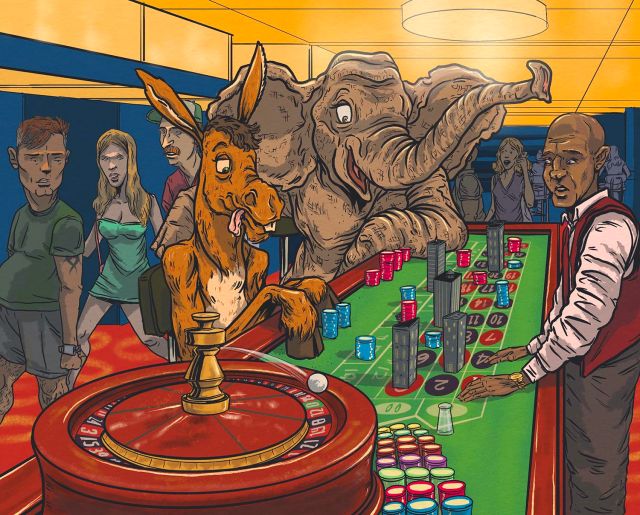

How do you think the 2024 presidential campaign will impact the commercial real estate market?

I maintain the view that the upcoming presidential election is unlikely to significantly affect the commercial real estate market. It is essential to adopt a holistic perspective, considering the greater influence of global inflationary triggers and the high interest rate environment in which we are presently operating within — both of which are poised to play the most pivotal role in the domestic commercial real estate landscape.

If you were to invest your own money in someone else’s real estate, who do you like and why?

I love our deals so much that investing our money in someone else’s real estate isn’t on the radar!

What business advice are you most tired of hearing?

That real estate development projects are risky. All projects carry inherent risks, but I believe that ground-up development presents a comparatively lower risk profile than acquiring assets with potential unknown factors.

What’s the biggest market opportunity as we round out 2023?

The biggest opportunity is in the workforce and mixed-income development market.

Who do you like for POTUS in 2024?

Whoever wins.

Do you feel personally safe moving through NYC? Yes.

Jerome Powell: Are you a fan or critic? Neither.

Can’t-live-without technology now? Smartphone.

Elon Musk is…? Very rich.

Taylor Swift or Beyoncé? Beyoncé.

Artificial intelligence — good or bad? It depends.

Mischa’s or Nathan’s for a hot dog? Nathan’s.

Netflix or Hulu? Netflix.