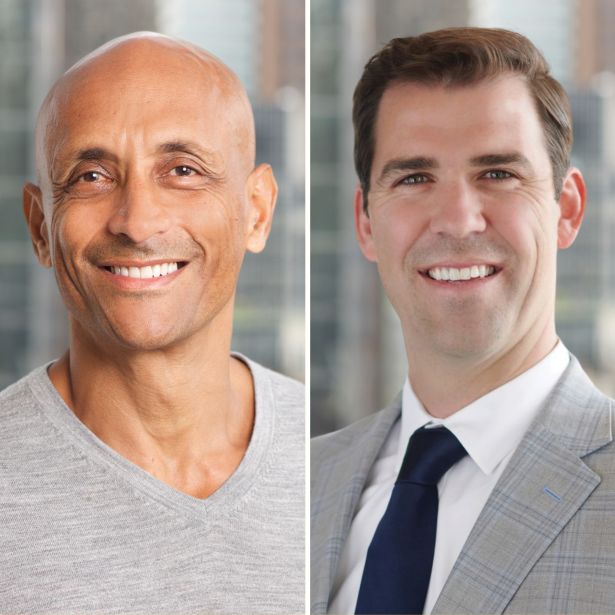

Mathew Wambua (left) and Mike Dury.

Mathew Wambua and Mike Dury

Vice chair and head of agency lending; president and CEO at Merchants Capital

Last year's rank: 33

Merchants Capital continued to play an active role in the debt and equity markets in 2024, financing affordable housing projects around the country.

The affordable housing lender executed more than $7 billion of debt and equity deals last year to top its $6.89 billion total achieved in 2023. It ended the year with over $26 billion in assets under management.

Merchants has been able to persevere through the higher interest rate environment thanks to continued demand for affordable housing coupled with an ability to tap other capital sources to bring down borrowing costs, according to Mathew Wambua.

“So much of what we do tends to be in conjunction with public benefit institutions and counterparties — HFAs, governments, GSEs and FHA — so there tend to be a lot of other sources that fill gaps that otherwise are increased with higher interest rates,” Wambua said. “In many respects, the involvement of so many other counterparts that we collaborate with is one of the things that allows us to continue producing every single year, even when interest rates tend to fluctuate up and down.”

One of the wins Merchants achieved in the past year was closing $316 million of construction, permanent and equity financing for the second phase of Alafia, a project in Brooklyn’s East New York neighborhood that will have 634 affordable and supportive housing units. The layered capital stack transaction was led by a $192.7 million construction loan Merchants provided in conjunction with Bank of America.

Merchants, a top-ranked agency lender with Fannie Mae, Freddie Mac and Housing and Urban Development/Federal Housing Administration, also remained active on the balance sheet lending side in 2024 through its parent, Merchants Bank, with $1.5 billion of securitizations facilitated last year.

For the year ahead, Merchants is eyeing another origination uptick, especially if the acquisition market picks up momentum from more stable, long-term interest rate levels dictated by the 10-year Treasury. Bond yields that settled down to the mid- to low 4 percent range would drive more deals too, CEO Mike Dury said.

“If you see that for an extended amount of time, I think you could see transactions pick up and therefore originations pick up,” Dury said. “In general I think we’re steady and things could pick up.”