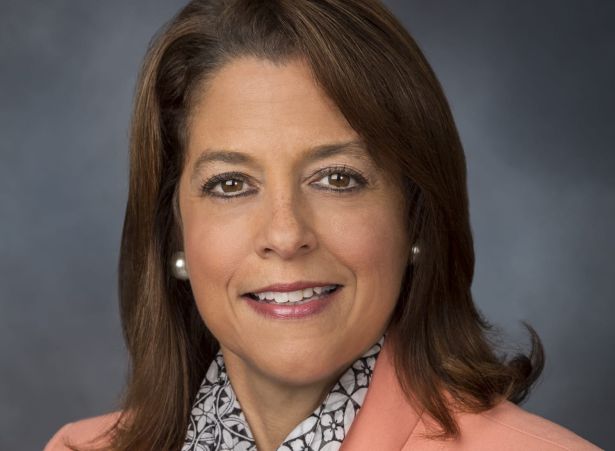

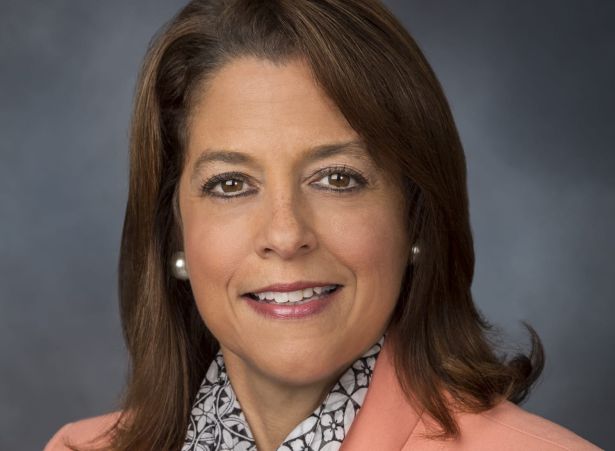

Honorable Mention: Lisa Pendergast

Executive Director at CREFC (Commercial Real Estate Finance Council)

In the early days of the pandemic, it was hard to keep up with what was materializing within the federal government as it related to support for the commercial property sector — its many segments and its lenders, investors, borrowers and renters.

But, one thing that was abundantly clear was CREFC’s role on the front lines, regularly advocating for the sector and advising public officials on the steps that needed to be taken to remediate the stress.

It was a stern voice for the $4.7 trillion commercial real estate finance sector, acting quickly in calling for support of the hotel sector and liquidity support for the commercial mortgage-backed securities (CMBS) arena, for instance.

“[We have] been laser-focused on ensuring that relief is provided to the overall industry, including, in particular, hotel and retail borrowers in distress,” Lisa Pendergast said. “CREFC has, and continues to be, a strong voice in advocating the U.S. government to recognize the industry’s importance to the U.S. economy and its contribution of some 18 percent of gross domestic product.”

She added that the task has been to simply provide “a vital bridge to the other side of the COVID crisis.”

In a matter of days, after the pandemic seeped into the sector, CREFC put teams together to communicate with borrowers, to assist them in working with their debt servicers and to guide them through the CMBS realm. Its work also included extensive outreach to educate the industry and its observers about the possible impacts on the sector and its participants, including weekly updates on developments on Capitol Hill.

The organization regularly lobbied influential lawmakers for action on behalf of the industry, including the White House, the U.S. Treasury Department and Congress — the Senate Banking Committee in particular. It also provided career services geared for the disruption, attempting to help guide CREFC members — some 15,000 individuals — on how to work remotely.

As early as March 2020, the Fed, as part of its sweeping and swift action, added new-issue CMBS as eligible collateral to the renewed Term Asset-Backed Security Loan Facility (TALF) program, which helped keep bond yields low and allowed lenders to continue offering competitive mortgage rates to borrowers, while preventing mass mark-to-market losses for CMBS bond investors.—M.B.