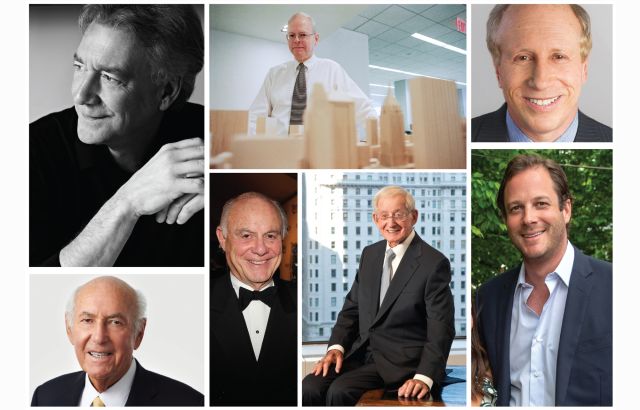

David Amsterdam (clockwise from top left), Peter Nicoletti, Zach Redding and Dylan Kane.

David Amsterdam, Peter Nicoletti, Dylan Kane and Zach Redding

President of U.S. capital markets; managing directors at Colliers

Last year's rank: 67

The Colliers capital markets team that David Amsterdam leads was at the forefront of a number of multilayered transactions last year in the New York region and beyond. Colliers facilitated deals utilizing multiple parts of the capital stack in a continued higher interest rate environment with a versatile team featuring Peter Nicoletti, Dylan Kane and Zach Redding.

“We’ve demonstrated success across multiple asset classes and we’ve been able to leverage our really deep expertise in both the debt and equity structure,” Amsterdam said. “We operate as a unified, collaborative team, which I think is unique in what we do, and that’s across all asset classes, and I just think that positions us to capture the opportunities across all the sectors.”

One of Colliers’ beefiest transactions in 2024 involved a $91 million capitalization for an office-to-self-storage conversion of 152 West 26th Street on behalf of Falcon Properties, which sold the property to Flatiron Equities and Mequity Companies for $23.8 million. The complex deal also involved the transfer of air rights from 150 West 36th Street, $17 million in limited partner equity from a foreign billionaire family office, and $50 million of construction financing from Elsee Partners.

Nicoletti, Kane and Redding also brokered a $210 million construction loan from Benefit Street Partners for WHK Development’s 1800 Avenue at Port Imperial condominium development in Weehawken, N.J., last July.

On the investment sales front, Colliers arranged the $175 million sale of 576 Fifth Avenue, with Gary Barnett’s Extell Development acquiring the development site this March from Korean investors. Amsterdam’s team was also tapped to market the sale of the Wolff Building at 508-534 West 26th Street along the High Line, representing the estate of Gloria Naftali and marking the first time the 400,000-square-foot property has been for sale in five decades. Colliers expects it to fetch up to $170 million.

Colliers finished the first quarter in second place in New York City investment sales across all asset classes, which Amsterdam said is a testament to the team’s ability to work on a variety of deals.

“The Swiss Army knife of the team allows us to be extraordinarily effective with our clients because we’re looking at it from sort of all spokes of the wheel,” Amsterdam said. “We have top-tier team members covering all levels of expertise.”