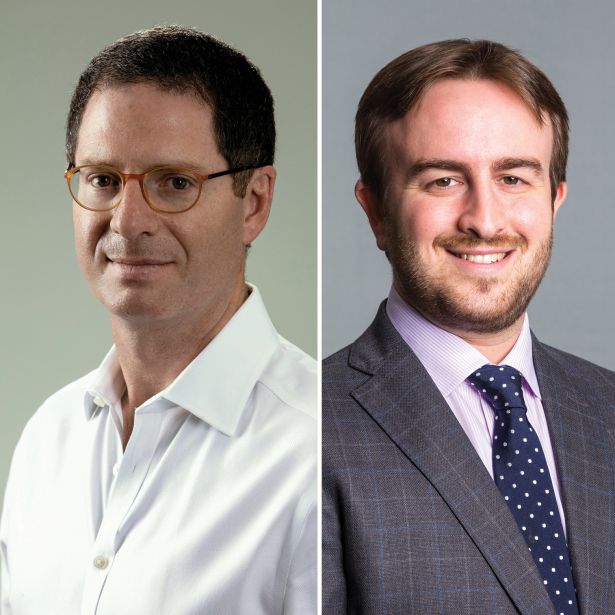

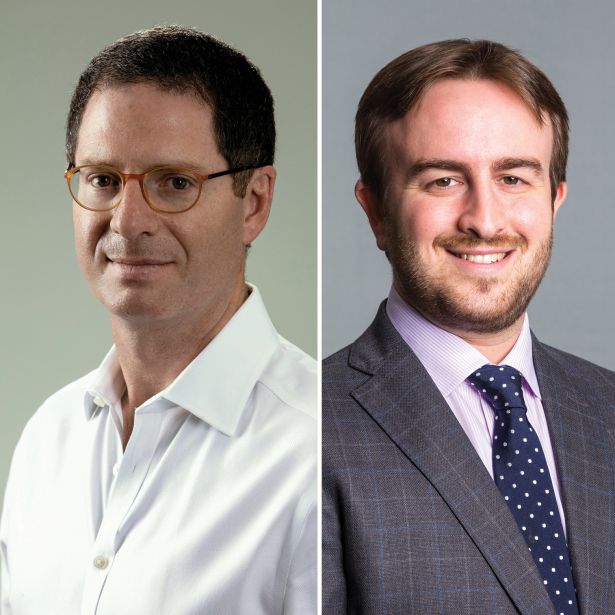

Brian Brooks (left) and Yoni Goodman.

Brian Brooks and Yoni Goodman

Chairman and CEO; president at Meridian Capital Group

Last year's rank: 21

Despite a difficult year that saw several banks collapse and his mortgage brokerage find itself in the crosshairs of negative headlines, Yoni Goodman steered Meridian Capital Group across the finish line to end the year with $24.1 billion in originations on more than 1,500 loans in 43 states.

Goodman’s firm brokered an additional $1.5 billion in investment sales transactions and deals that exceeded 2.8 million square feet of commercial property. Meridian’s president told Commercial Observer that 2023 was the first year in more than a decade that truly challenged him as a professional.

“2023 was the first year in this long bull run we’ve been on where you had to really navigate, use your head, and be creative,” he said.

The firm made changes at the top: Brian Brooks, a former acting comptroller of the currency and lawyer who also worked at Fannie Mae, was appointed as chairman and CEO in March 2024, replacing Ralph Herzka.

Among Meridian’s biggest deals were a $405 million CMBS financing for an industrial portfolio across the Northeast, a $260 million refinancing for a 12-property portfolio of national nursing facilities, and a $242 million construction loan to build a mixed-use project in Brooklyn’s Coney Island.

Goodman said his brokerage’s success came from finding new sources of capital by closing deals with more than 300 unique lenders. “The key was being able to adapt and, specifically, finding a breadth of lenders instead of just a depth within the ones we’re used to,” he said. “It’s about doing more, and pivoting like gears on a bike, to the different capital sources.”

But Meridian’s pivot to new lenders came out of necessity.

In November, the firm was barred from placing deals through Freddie Mac seller-servicers due to an investigation into loans originated by a Meridian broker. Moreover, in January, one of the brokerage’s closest multifamily lenders, New York Community Bancorp., nearly collapsed after the shuffling of several CEOs combined with a cratering stock price. Through it all, however, Meridian persevered by discovering new lenders and tailoring their deals around data and analytics like maturity dates and recent lender activity.

“Most brokerages get a deal and they try to broker that deal,” Goodman explained. “Meridian is trying to look at it almost in reverse [by first asking] which lenders have appetite for which products, and let me then use that to go acquire deals that I can place in a differentiated way.”