Tawan Davis

Founding Partner and CEO at Steinbridge Group

Where is Steinbridge Group going to be in 2026?

$1 billion to $2 billion of operational, impact-

focused real estate portfolio in major U.S. markets. Another $1 billion to $2 billion of active developments in similar markets. Both will represent several thousand rental and ownership opportunities.

Where is Steinbridge going to be in 2028?

Activate multiple adjacent, impact-focus investment strategies, including potentially lending, co-investment, venture capital and securities.

Where is Steinbridge going to be in 2033?

Positioned, recognized, and affirmed as the industry’s leading impact-focused investment firm.

Tell us about a successful financing in the last 12 months. Or tell us about an unsuccessful one.

Successful: Refinanced a portfolio of stabilized, value-added single-family homes in late 2022 right before rates skyrocketed. Unsuccessful: We were set to close a large credit facility the very week that certain regional bank failures destabilized the lending markets.

When will we know the market has stabilized? (Be specific!)

For the single-family and multifamily residential space, there will be stability when there is at least a 50- to 100-basis -point positive spread of prevailing cap rates above commercial mortgage interest rates for at least one to three consecutive months.

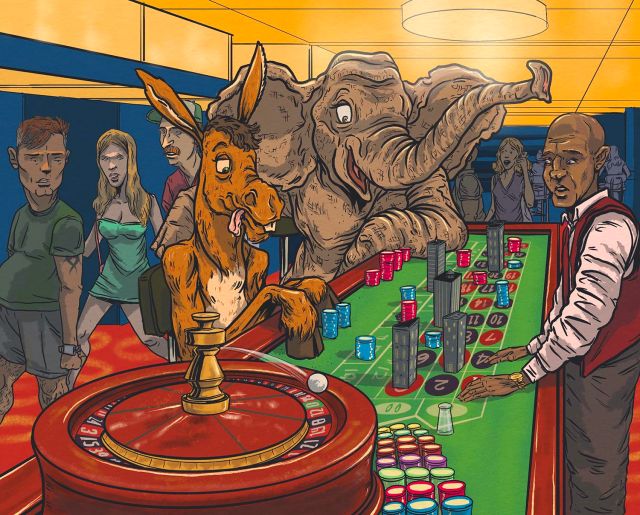

How do you think the 2024 presidential campaign will impact the commercial real estate market?

Commercial real estate thrives when there is stability and predictability in the economy and in our politics. Another year of continued instability and uncertainty will only make things harder on an industry already struggling with high interest rates and anemic economic growth.

If you were to invest your own money in someone else’s real estate, who do you like and why?

Peter Woo. A leading property holder and developer in Hong Kong and other parts of Asia with several sizable projects on the horizon.

What business advice are you most tired of hearing?

A lot of investors debar New York City and other major markets in exchange for the growth of secondary cities and the Sun Belt region. We believe in and have meaningful developments in the Sun Belt, but I never count out New York City and the great American metropolises.

What’s the biggest market opportunity today?

There is a massive opportunity in single-

family rentals. SFR represents nearly half of all rentals in the U.S. but fewer than 2 percent of those are institutionally owned. It’s a massive growth opportunity.

Have you had a lot of staff turnover?

No. Our team believes in the mission and has largely stuck together. In fact, we are now growing tremendously.

Do you feel personally safe moving through NYC? Absolutely.

Jerome Powell: Are you a fan or critic? Critic.

Can’t-live-without technology now? Cellphone.

Elon Musk is …? Complicated contribution.

Taylor Swift or Beyoncé? Beyoncé.

Artificial intelligence – good or bad? Yes.

Mischa’s or Nathan’s for a hot dog? Nathan’s.

Netflix or Hulu? Netflix.

What character are you in “Succession”? Logan Roy — building something from scratch.